Find Expected Value In Excel Easily

Introduction to Expected Value in Excel

The expected value is a measure of the center of a probability distribution. It is the long-run average of the variable, and it represents the value that the variable would be expected to have on average if the process were repeated many times. In Excel, calculating the expected value is a straightforward process that can be accomplished using various methods, including formulas and functions. In this article, we will explore how to find the expected value in Excel easily.

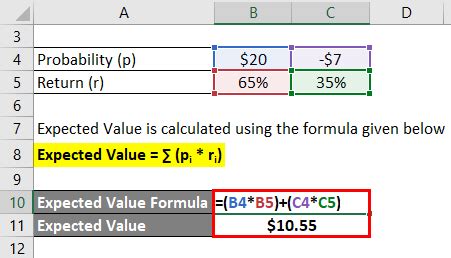

Understanding Expected Value Formula

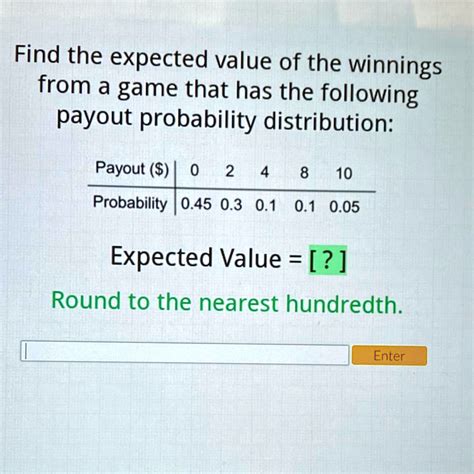

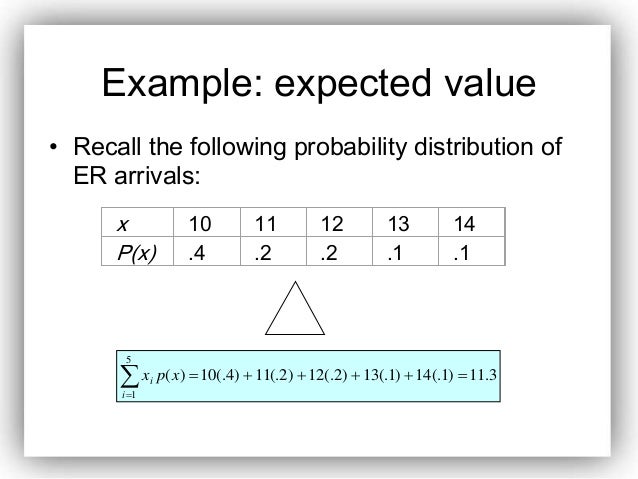

The expected value formula is given by: E(X) = ∑xP(x), where x represents the possible outcomes, and P(x) represents the probability of each outcome. To calculate the expected value in Excel, you need to have a list of possible outcomes and their corresponding probabilities. You can then use the SUMPRODUCT function to calculate the expected value.

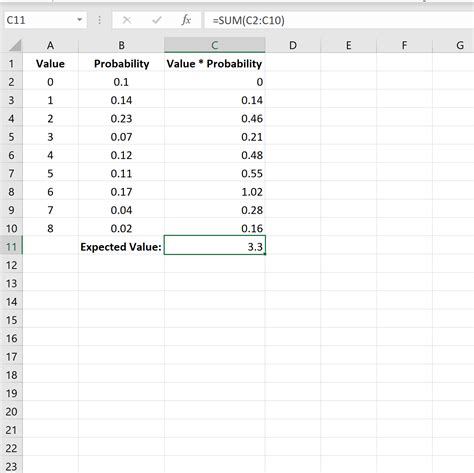

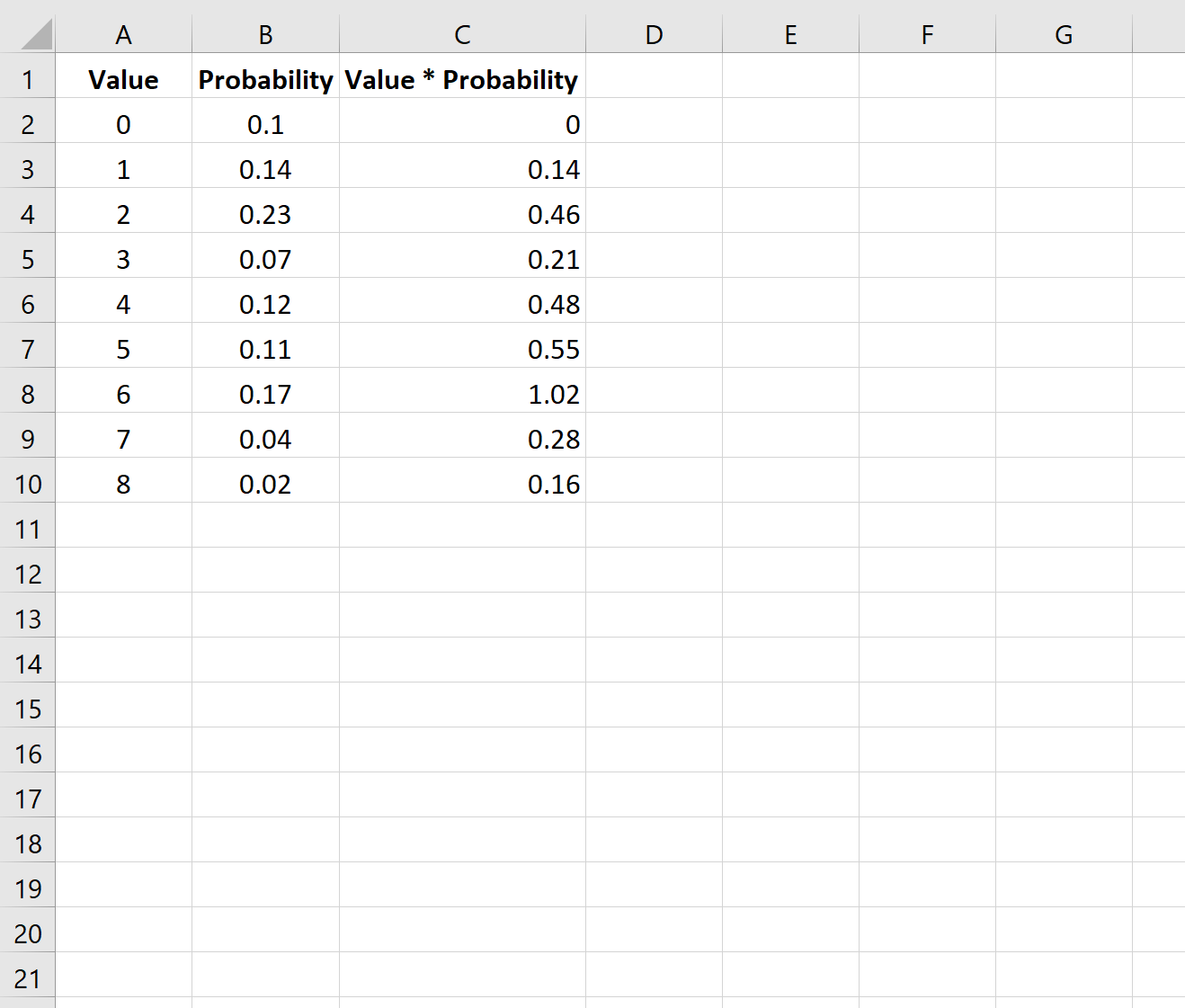

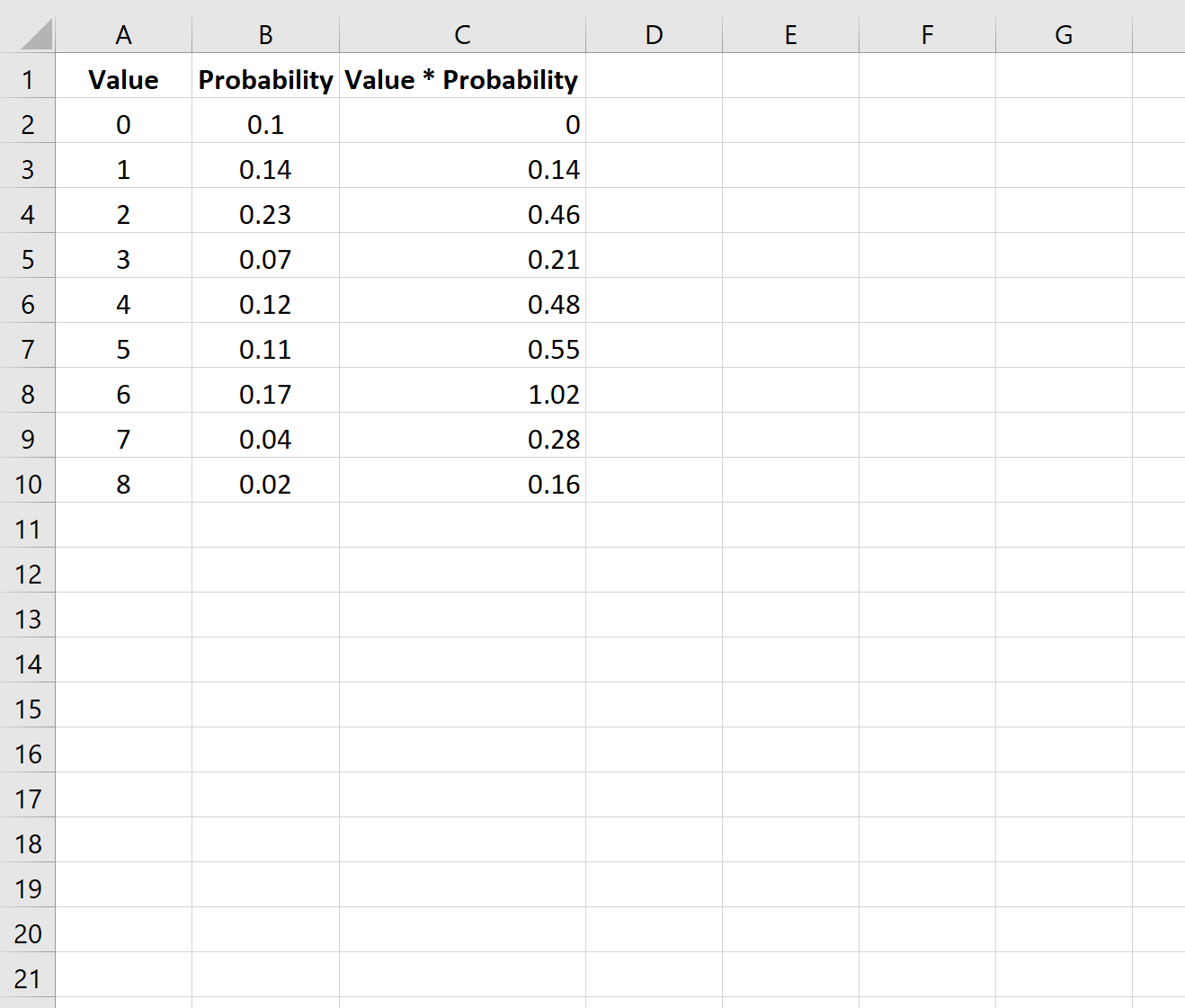

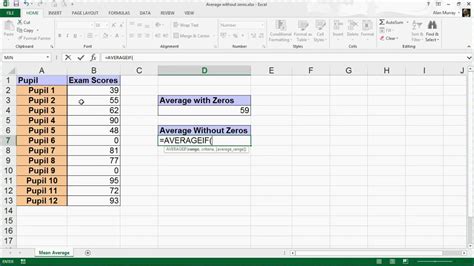

Calculating Expected Value Using SUMPRODUCT Function

To calculate the expected value using the SUMPRODUCT function, follow these steps: * List the possible outcomes in one column (e.g., column A). * List the corresponding probabilities in another column (e.g., column B). * Use the SUMPRODUCT function to calculate the expected value: =SUMPRODUCT(A:A, B:B). * Press Enter to get the result.

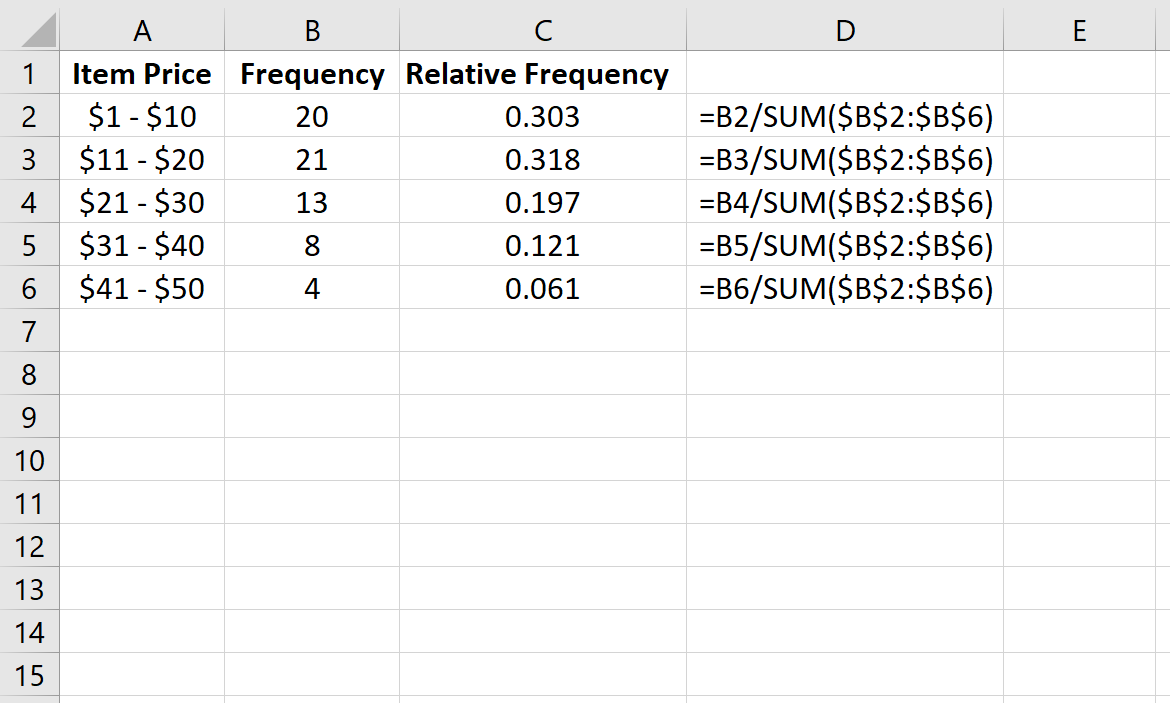

For example, suppose we have the following data:

| Outcome | Probability |

|---|---|

| 10 | 0.2 |

| 20 | 0.3 |

| 30 | 0.5 |

To calculate the expected value, we can use the SUMPRODUCT function: =SUMPRODUCT(A2:A4, B2:B4).

Using Other Functions to Calculate Expected Value

In addition to the SUMPRODUCT function, there are other functions that can be used to calculate the expected value in Excel, including: * NPV function: The NPV function can be used to calculate the expected value of a series of cash flows. * XNPV function: The XNPV function can be used to calculate the expected value of a series of cash flows that are not periodic. * WEIBULL.DIST function: The WEIBULL.DIST function can be used to calculate the expected value of a Weibull distribution.

Benefits of Calculating Expected Value in Excel

Calculating the expected value in Excel has several benefits, including: * Improved decision-making: By calculating the expected value, you can make informed decisions about investments, projects, and other business opportunities. * Reduced risk: By understanding the expected value of a particular outcome, you can reduce your risk and make more informed decisions. * Increased accuracy: Calculating the expected value in Excel can help you to increase the accuracy of your predictions and forecasts.

Common Applications of Expected Value

The expected value has a wide range of applications, including: * Finance: The expected value is used to calculate the expected return on investment, the expected value of a portfolio, and the expected value of a financial instrument. * Insurance: The expected value is used to calculate the expected payout of an insurance policy. * Engineering: The expected value is used to calculate the expected lifetime of a product, the expected failure rate, and the expected maintenance cost. * Economics: The expected value is used to calculate the expected utility of a particular outcome, the expected value of a good or service, and the expected value of a market.

Tips and Tricks for Calculating Expected Value

Here are some tips and tricks for calculating the expected value in Excel: * Use the correct function: Make sure to use the correct function to calculate the expected value, depending on the type of data you have. * Check your data: Make sure to check your data for errors and inconsistencies before calculating the expected value. * Use sensitivity analysis: Use sensitivity analysis to test the robustness of your expected value calculation.

📝 Note: Always check your data and formulas for errors before relying on the results of your expected value calculation.

To summarize, calculating the expected value in Excel is a straightforward process that can be accomplished using various methods, including formulas and functions. By understanding the expected value formula and using the correct function, you can make informed decisions and reduce your risk. The expected value has a wide range of applications, including finance, insurance, engineering, and economics. By following the tips and tricks outlined in this article, you can calculate the expected value in Excel easily and accurately.

What is the expected value formula?

+

The expected value formula is given by: E(X) = ∑xP(x), where x represents the possible outcomes, and P(x) represents the probability of each outcome.

How do I calculate the expected value in Excel?

+

To calculate the expected value in Excel, you can use the SUMPRODUCT function: =SUMPRODUCT(A:A, B:B), where A:A represents the possible outcomes, and B:B represents the corresponding probabilities.

What are the benefits of calculating the expected value?

+

The benefits of calculating the expected value include improved decision-making, reduced risk, and increased accuracy.