Find Payback Period In Excel

Introduction to Payback Period in Excel

The payback period is a financial metric used to determine the amount of time it takes for an investment to generate returns equal to its initial cost. It’s a crucial tool for businesses and individuals to evaluate the viability of a project or investment. In this article, we will explore how to calculate the payback period in Excel, using various methods and formulas.

Understanding the Payback Period Formula

The payback period formula is relatively simple: it’s the initial investment divided by the annual cash inflow. However, in Excel, we can use various functions and formulas to calculate the payback period, depending on the data and the scenario. The basic formula is:

Payback Period = Initial Investment / Annual Cash Inflow

Calculating Payback Period using a Simple Formula

To calculate the payback period in Excel, follow these steps:

- Enter the initial investment in a cell, for example, cell A1.

- Enter the annual cash inflow in another cell, for example, cell B1.

- Use the formula: =A1/B1 to calculate the payback period.

- Format the result as a number or a date, depending on your preference.

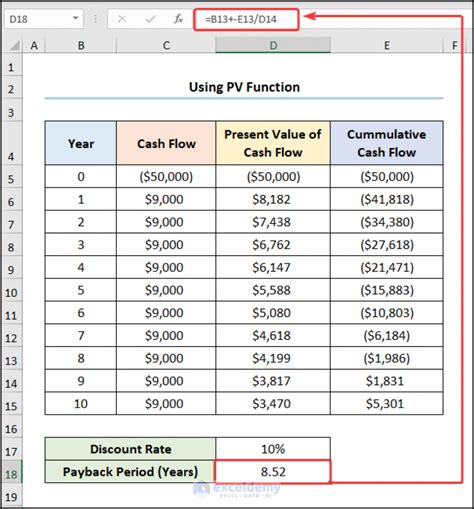

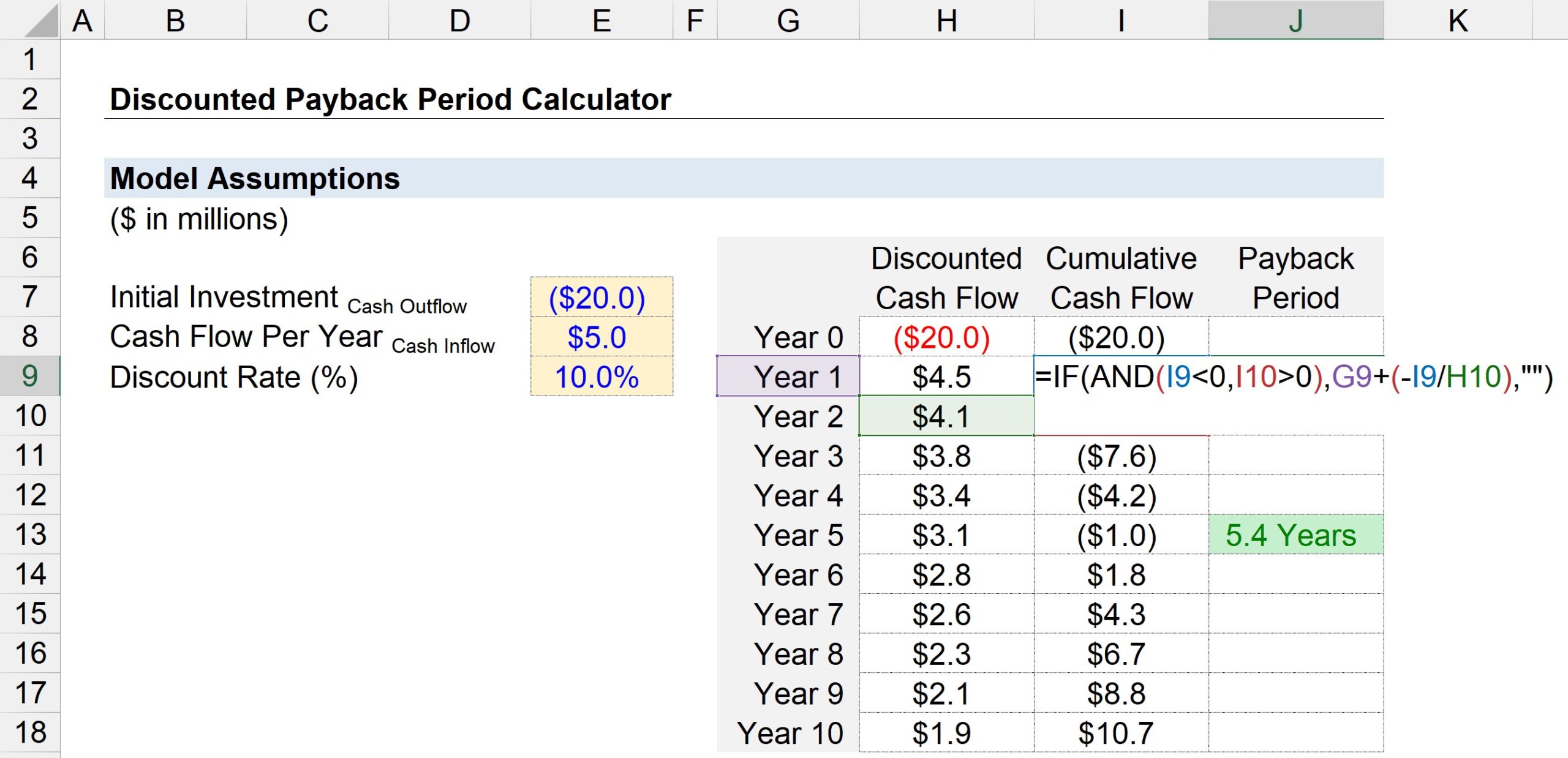

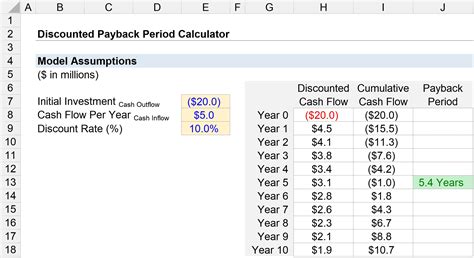

Using the XNPV Function to Calculate Payback Period

The XNPV function in Excel is a more advanced function that can be used to calculate the payback period. The XNPV function calculates the present value of a series of cash flows, and we can use it to calculate the payback period by setting the present value to zero.

The syntax of the XNPV function is:

XNPV(rate, cash flow dates, cash flows)

Where:

- rate is the discount rate.

- cash flow dates are the dates of the cash flows.

- cash flows are the amounts of the cash flows.

- Enter the cash flow dates in a column, for example, column A.

- Enter the cash flows in another column, for example, column B.

- Enter the initial investment as a negative cash flow at the beginning of the period.

- Use the XNPV function to calculate the present value of the cash flows, setting the present value to zero.

- Solve for the payback period by finding the date when the cumulative cash flow equals the initial investment.

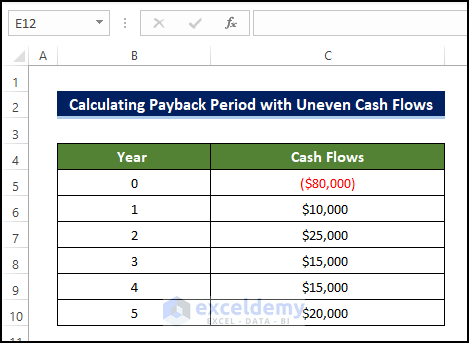

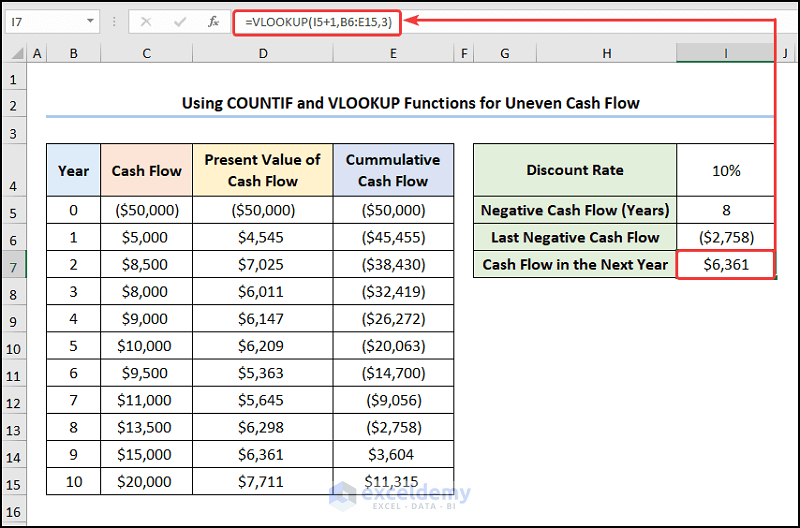

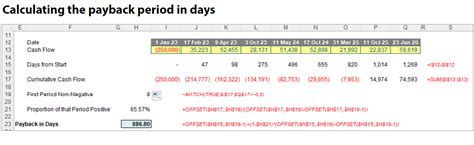

Calculating Payback Period with Uneven Cash Flows

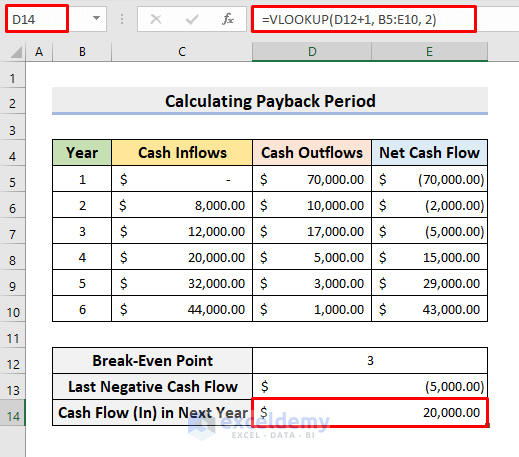

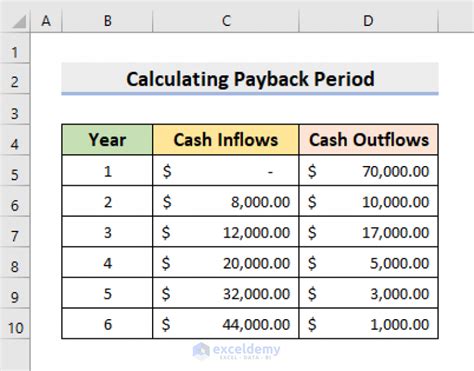

In some cases, the cash flows may not be even, and we need to calculate the payback period based on uneven cash flows. To do this, we can use the following steps:

- Enter the cash flow dates in a column, for example, column A.

- Enter the cash flows in another column, for example, column B.

- Enter the initial investment as a negative cash flow at the beginning of the period.

- Calculate the cumulative cash flow by adding the cash flows to the previous cumulative cash flow.

- Find the date when the cumulative cash flow equals the initial investment.

=CUMIPMT(rate, nper, pv, fv, type)

Where:

- rate is the discount rate.

- nper is the number of periods.

- pv is the present value (initial investment).

- fv is the future value (zero).

- type is the type of cash flow (0 for end of period, 1 for beginning of period).

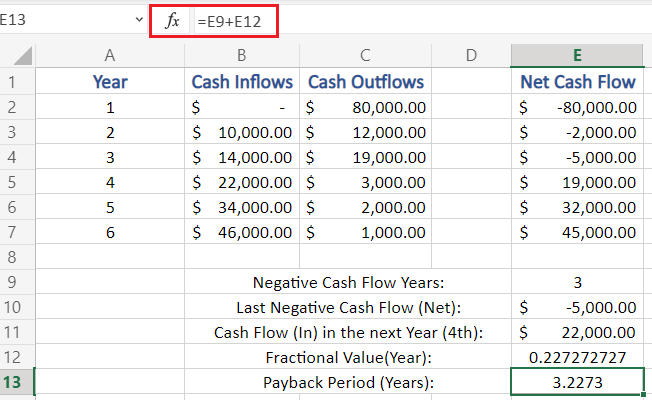

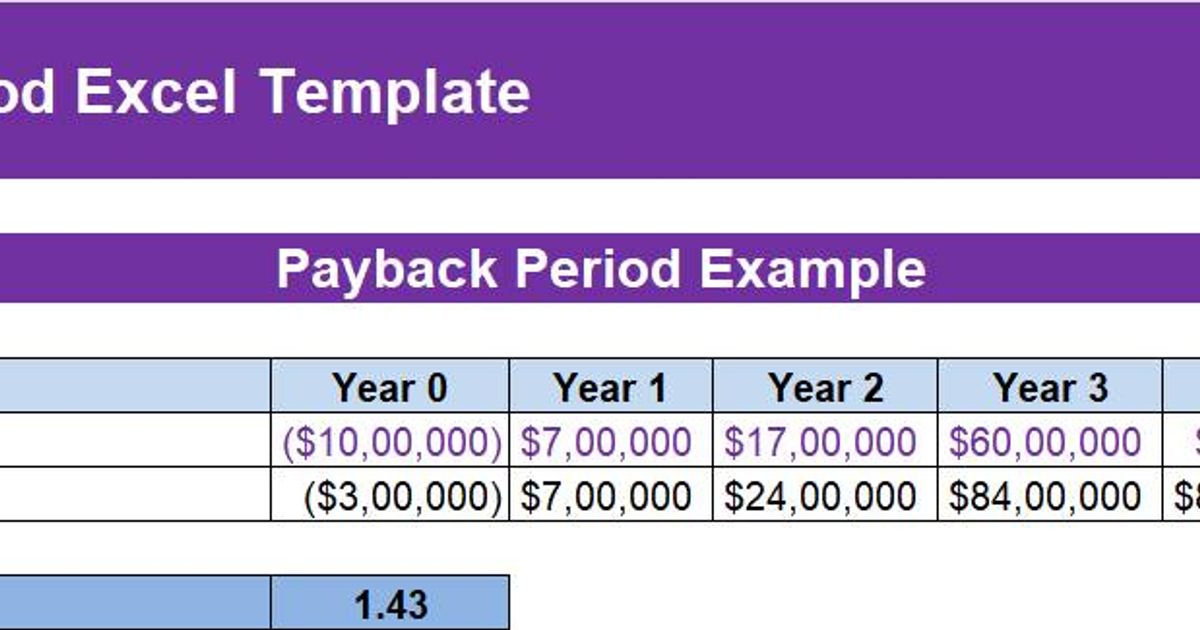

Example of Payback Period Calculation

Let’s consider an example of a company that invests 10,000 in a project with the following cash flows: <table> <tr> <th>Year</th> <th>Cash Flow</th> </tr> <tr> <td>0</td> <td>-10,000 1 2,000</td> </tr> <tr> <td>2</td> <td>3,000 3 4,000</td> </tr> <tr> <td>4</td> <td>5,000 To calculate the payback period, we can use the XNPV function or the cumulative cash flow method. Let’s use the XNPV function:

=XNPV(0.1, A2:A6, B2:B6)

Where:

- A2:A6 are the cash flow dates.

- B2:B6 are the cash flows.

📝 Note: The payback period calculation assumes that the cash flows are evenly distributed throughout the year. If the cash flows are not evenly distributed, we need to adjust the calculation accordingly.

Conclusion and Final Thoughts

In conclusion, calculating the payback period in Excel is a straightforward process that can be done using various formulas and functions. The payback period is a useful metric for evaluating the viability of a project or investment, and it can be used to compare different investment opportunities. By following the steps and examples outlined in this article, you can calculate the payback period in Excel and make informed investment decisions.

What is the payback period, and why is it important?

+

The payback period is the amount of time it takes for an investment to generate returns equal to its initial cost. It’s an important metric for evaluating the viability of a project or investment, as it helps investors determine whether an investment is likely to generate returns in a reasonable amount of time.

How do I calculate the payback period in Excel?

+

To calculate the payback period in Excel, you can use the XNPV function or the cumulative cash flow method. The XNPV function calculates the present value of a series of cash flows, while the cumulative cash flow method involves calculating the cumulative cash flow and finding the date when it equals the initial investment.

What are some common mistakes to avoid when calculating the payback period?

+

Some common mistakes to avoid when calculating the payback period include assuming that cash flows are evenly distributed throughout the year, not accounting for discount rates, and not considering the time value of money. It’s also important to ensure that the cash flows are accurately forecasted and that the initial investment is correctly calculated.

Can I use the payback period to compare different investment opportunities?

+

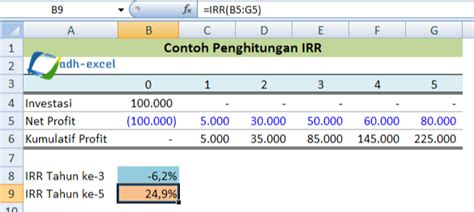

Yes, the payback period can be used to compare different investment opportunities. By calculating the payback period for each investment, you can determine which investment is likely to generate returns in the shortest amount of time. However, it’s also important to consider other metrics, such as the net present value (NPV) and the internal rate of return (IRR), to get a more comprehensive understanding of the investment’s potential.