Find Beta Using Excel

Introduction to Beta

Beta is a measure of the volatility, or systematic risk, of an asset or a portfolio in relation to the overall market. It is used to calculate the expected return of an investment based on its level of risk. The beta of an investment is a measure of how much the investment’s returns deviate from the market’s returns. In this post, we will learn how to find beta using Excel.

Understanding Beta

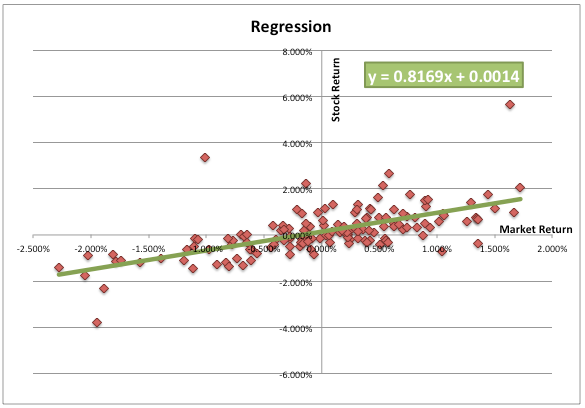

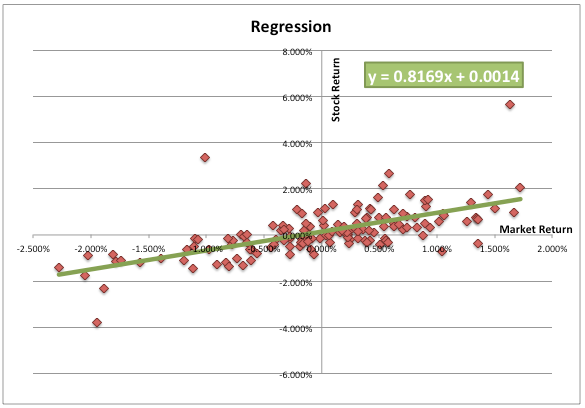

Beta is calculated as the covariance of the investment’s returns with the market’s returns, divided by the variance of the market’s returns. A beta of 1 means that the investment’s returns are perfectly correlated with the market’s returns. A beta greater than 1 means that the investment’s returns are more volatile than the market’s returns, while a beta less than 1 means that the investment’s returns are less volatile.

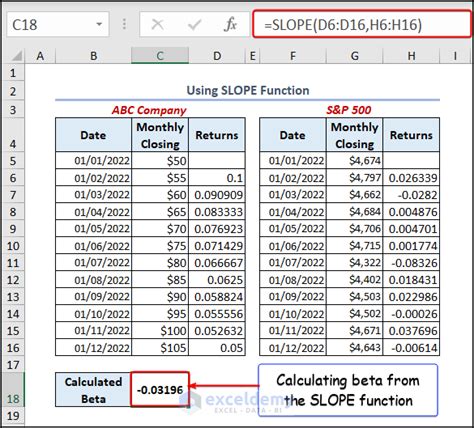

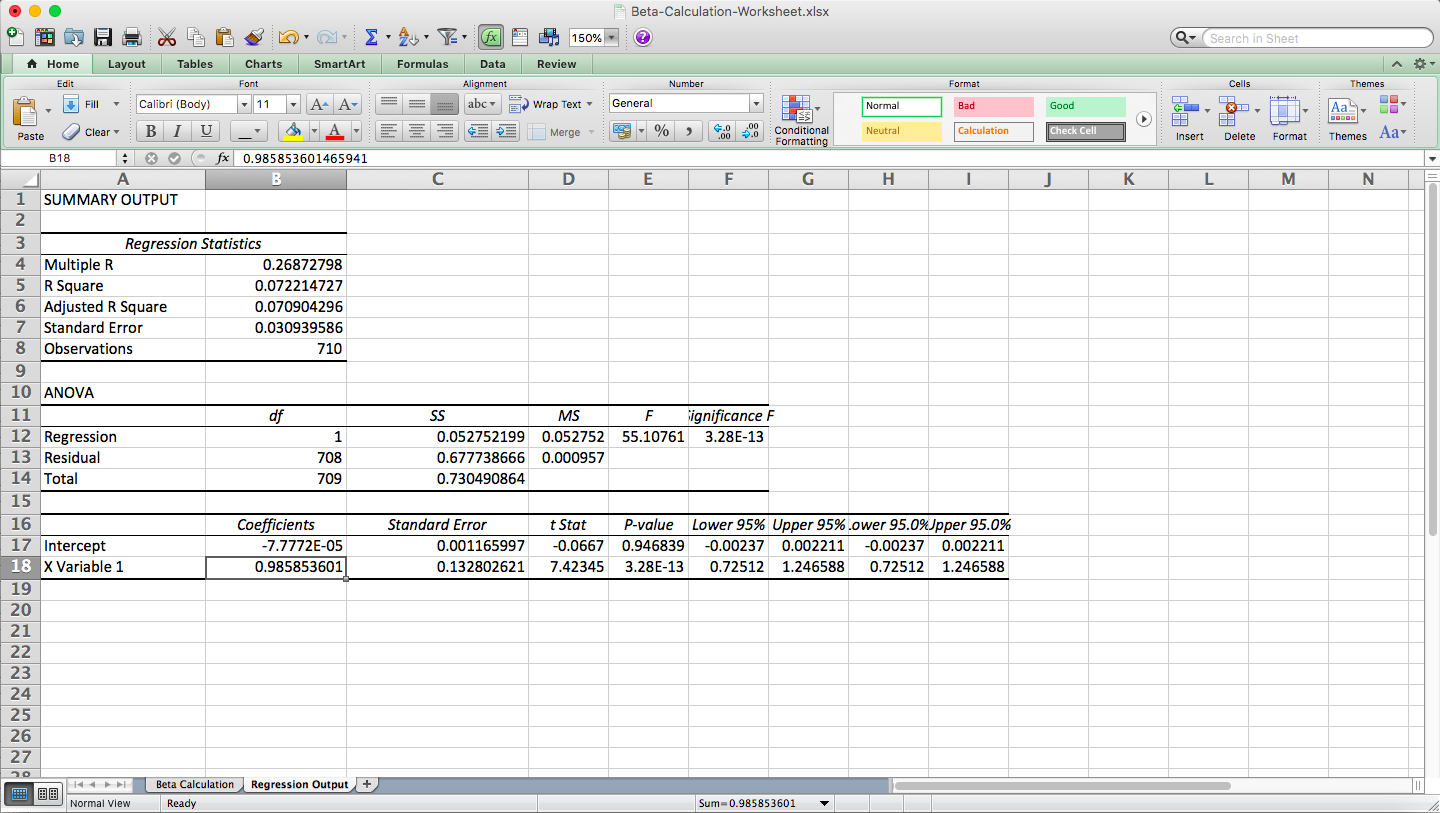

Calculating Beta in Excel

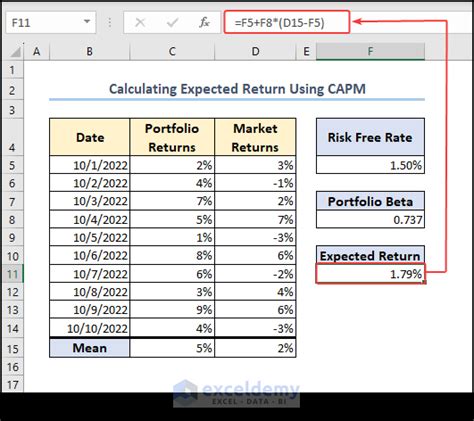

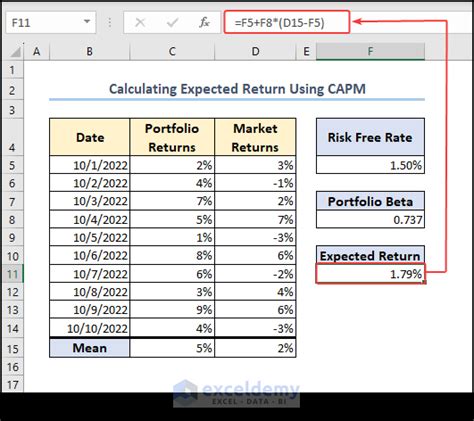

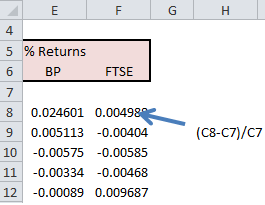

To calculate beta in Excel, we need to have the historical returns of the investment and the market. We can use the following formula to calculate beta:

Beta = COVAR(investment returns, market returns) / VAR(market returns)

Where:

- COVAR(investment returns, market returns) is the covariance of the investment’s returns with the market’s returns

- VAR(market returns) is the variance of the market’s returns

We can use the following steps to calculate beta in Excel:

- Enter the historical returns of the investment and the market in two separate columns

- Use the COVAR function to calculate the covariance of the investment’s returns with the market’s returns

- Use the VAR function to calculate the variance of the market’s returns

- Divide the covariance by the variance to get the beta

For example, let’s say we have the following historical returns:

| Investment Returns | Market Returns |

|---|---|

| 0.05 | 0.03 |

| 0.02 | 0.01 |

| 0.07 | 0.05 |

| 0.01 | 0.02 |

We can use the following formula to calculate the beta:

=COVAR(A2:A5,B2:B5)/VAR(B2:B5)

Where A2:A5 is the range of investment returns and B2:B5 is the range of market returns.

📝 Note: The COVAR and VAR functions are available in Excel 2013 and later versions. In earlier versions, you can use the COVARIANCE.P and VARP functions instead.

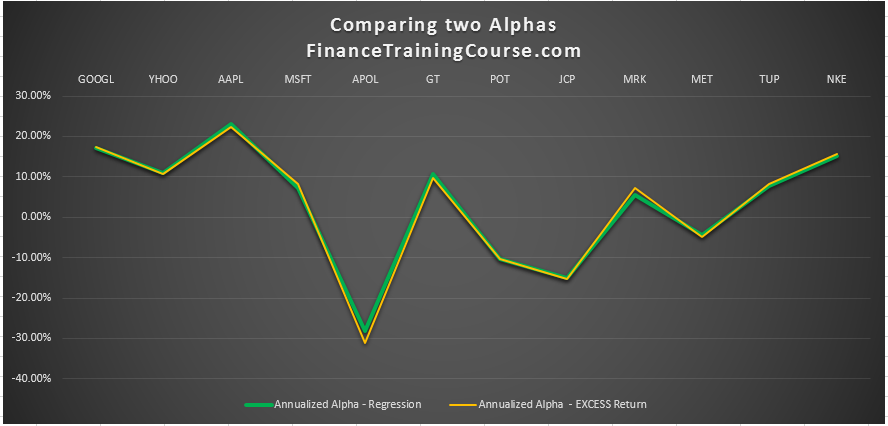

Interpreting Beta

Once we have calculated the beta, we can interpret it as follows:

- A beta of 1 means that the investment’s returns are perfectly correlated with the market’s returns

- A beta greater than 1 means that the investment’s returns are more volatile than the market’s returns

- A beta less than 1 means that the investment’s returns are less volatile than the market’s returns

For example, if the beta is 1.2, it means that the investment’s returns are 20% more volatile than the market’s returns.

Using Beta in Investment Decisions

Beta can be used in investment decisions to measure the level of risk of an investment. A higher beta means a higher level of risk, while a lower beta means a lower level of risk. Investors can use beta to diversify their portfolios and manage their risk.

For example, if an investor has a portfolio with a beta of 1.5, they may want to consider adding investments with a lower beta to reduce the overall risk of the portfolio.

In summary, beta is an important measure of the volatility of an investment, and it can be calculated using Excel. By understanding beta, investors can make more informed investment decisions and manage their risk more effectively.

To recap, the key points are: * Beta is a measure of the volatility of an investment * Beta can be calculated using the COVAR and VAR functions in Excel * A beta of 1 means that the investment’s returns are perfectly correlated with the market’s returns * A beta greater than 1 means that the investment’s returns are more volatile than the market’s returns * A beta less than 1 means that the investment’s returns are less volatile than the market’s returns * Beta can be used in investment decisions to measure the level of risk of an investment

In final thoughts, understanding beta is crucial for investors to make informed decisions and manage their risk effectively. By using Excel to calculate beta, investors can gain valuable insights into the volatility of their investments and make more informed decisions.

What is beta in finance?

+

Beta is a measure of the volatility, or systematic risk, of an asset or a portfolio in relation to the overall market.

How is beta calculated in Excel?

+

Beta is calculated using the COVAR and VAR functions in Excel. The formula is: Beta = COVAR(investment returns, market returns) / VAR(market returns)

What does a beta of 1 mean?

+

A beta of 1 means that the investment’s returns are perfectly correlated with the market’s returns.