Compute Payback Period In Excel

Introduction to Payback Period

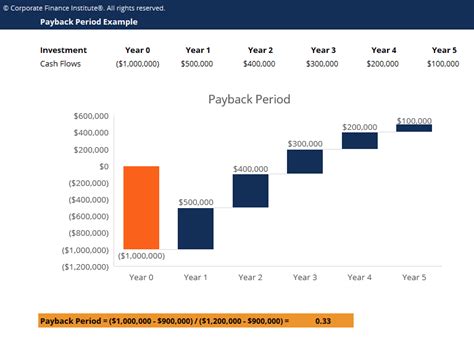

The payback period is a financial metric used to evaluate the feasibility of a project or investment. It represents the time it takes for an investment to generate cash flows that equal the initial cost of the investment, effectively “paying back” the initial outlay. The payback period is a simple and intuitive measure that helps investors and businesses determine whether a project is worth pursuing.

Understanding the Payback Period Formula

The payback period can be calculated using the following formula:

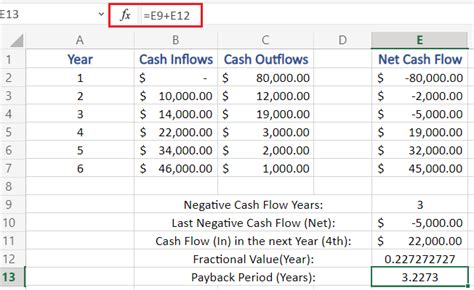

Calculating Payback Period in Excel

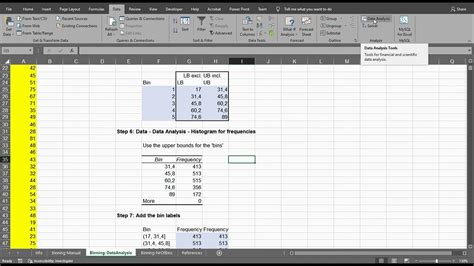

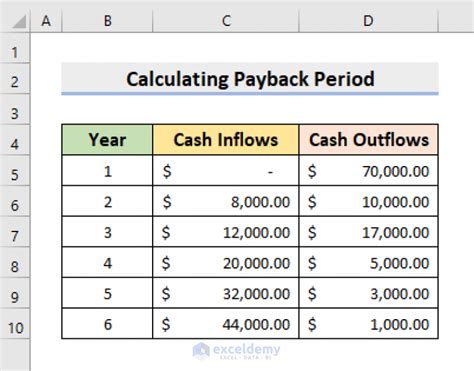

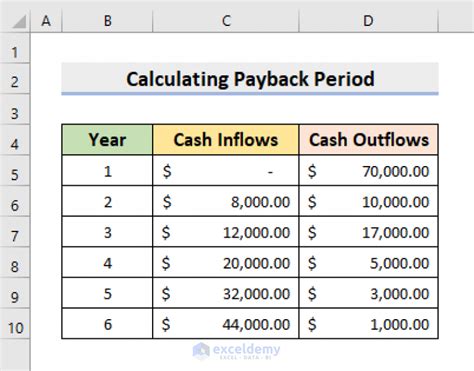

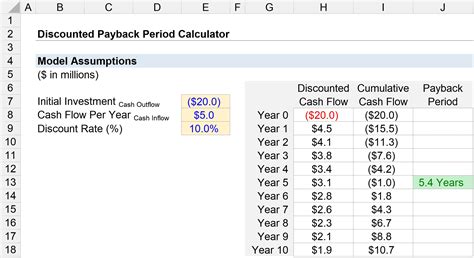

Excel provides a convenient way to calculate the payback period, especially when dealing with complex cash flow scenarios. Here’s a step-by-step guide to calculating the payback period in Excel:

- Set up a table with the initial investment and annual cash flows. Create a table with two columns: one for the year and one for the cash flow.

- Enter the initial investment as a negative value in the first row of the cash flow column.

- Enter the annual cash flows in the subsequent rows of the cash flow column.

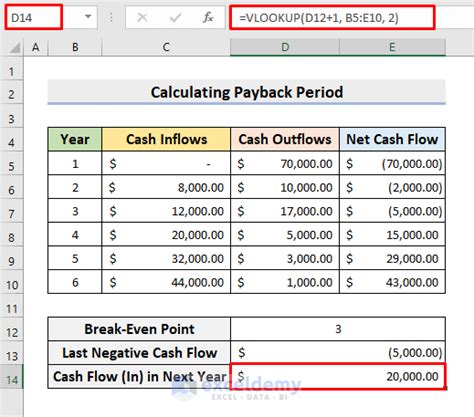

- Calculate the cumulative cash flow by using the formula:

=SUM(B2:B2)</italics>, where B2:B2 refers to the range of cells containing the cash flows. - Determine the payback period by using the formula:

=XLOOKUP(0, C2:C10, A2:A10) , where C2:C10 refers to the range of cells containing the cumulative cash flows, and A2:A10 refers to the range of cells containing the years.

| Year | Cash Flow | Cumulative Cash Flow |

|---|---|---|

| 0 | -10000 | -10000 |

| 1 | 2000 | -8000 |

| 2 | 3000 | -5000 |

| 3 | 4000 | -1000 |

| 4 | 5000 | 4000 |

📝 Note: The payback period calculation assumes that the cash flows occur at the end of each period. If the cash flows occur at the beginning of each period, the calculation will need to be adjusted accordingly.

Interpreting the Payback Period

The payback period is an important metric that helps investors and businesses evaluate the feasibility of a project. A shorter payback period indicates that the investment will generate returns more quickly, while a longer payback period may indicate that the investment is riskier or less attractive. When interpreting the payback period, it’s essential to consider the following factors:

- Cost of capital: The payback period should be compared to the cost of capital to determine whether the investment is generating returns that exceed the cost of capital.

- Risk: The payback period should be evaluated in the context of the investment’s risk profile. A longer payback period may be acceptable for a low-risk investment, while a shorter payback period may be required for a high-risk investment.

- Opportunity cost: The payback period should be compared to the opportunity cost of the investment. If the payback period is longer than the opportunity cost, the investment may not be attractive.

Limitations of the Payback Period

While the payback period is a useful metric, it has several limitations. These include:

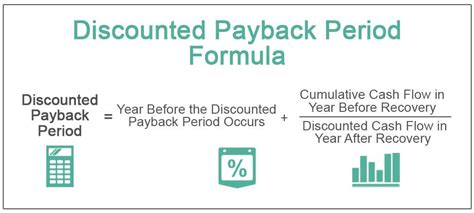

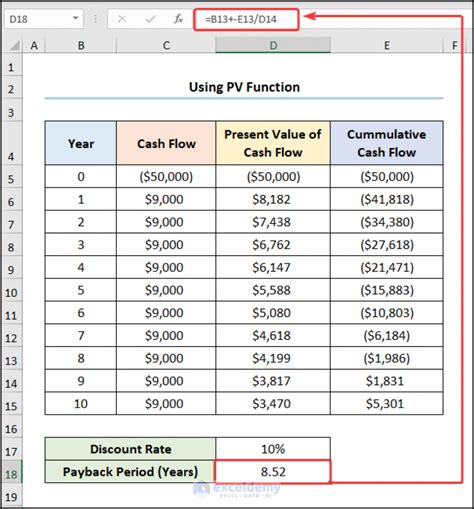

- Ignores time value of money: The payback period calculation ignores the time value of money, which can result in incorrect conclusions about the investment’s viability.

- Does not account for risk: The payback period calculation does not account for the investment’s risk profile, which can result in incorrect conclusions about the investment’s attractiveness.

- Does not consider external factors: The payback period calculation does not consider external factors, such as changes in market conditions or government regulations, which can affect the investment’s viability.

In summary, the payback period is a useful metric for evaluating the feasibility of a project or investment. However, it should be used in conjunction with other metrics, such as the net present value (NPV) and internal rate of return (IRR), to get a more comprehensive understanding of the investment’s viability.

The key points to take away from this discussion are that the payback period is an important metric that can help investors and businesses evaluate the feasibility of a project, but it has several limitations that need to be considered. By using the payback period in conjunction with other metrics and considering the investment’s risk profile, cost of capital, and opportunity cost, investors and businesses can make more informed decisions about their investments.

What is the payback period?

+

The payback period is a financial metric that represents the time it takes for an investment to generate cash flows that equal the initial cost of the investment.

How do I calculate the payback period in Excel?

+

To calculate the payback period in Excel, set up a table with the initial investment and annual cash flows, calculate the cumulative cash flow, and use the XLOOKUP function to determine the payback period.

What are the limitations of the payback period?

+

The payback period has several limitations, including ignoring the time value of money, not accounting for risk, and not considering external factors.