Excel

EXD Excel Paper 2 Accounting Guide

Introduction to Accounting

Accounting is the process of recording, classifying, and reporting financial information of a business. It provides stakeholders with the information they need to make informed decisions about the company. In this guide, we will explore the key concepts and principles of accounting, including financial statements, accounting equations, and accounting standards.

Financial Statements

Financial statements are the primary means of communicating financial information to stakeholders. The three main financial statements are: * Budgets: A detailed financial plan outlining projected income and expenses over a specific period. * Balance Sheets: A snapshot of a company’s financial position at a given point in time, including its assets, liabilities, and equity. * Income Statements: A summary of a company’s revenues and expenses over a specific period, providing insight into its profitability. These statements are essential for making informed decisions about investments, loans, and other business opportunities.

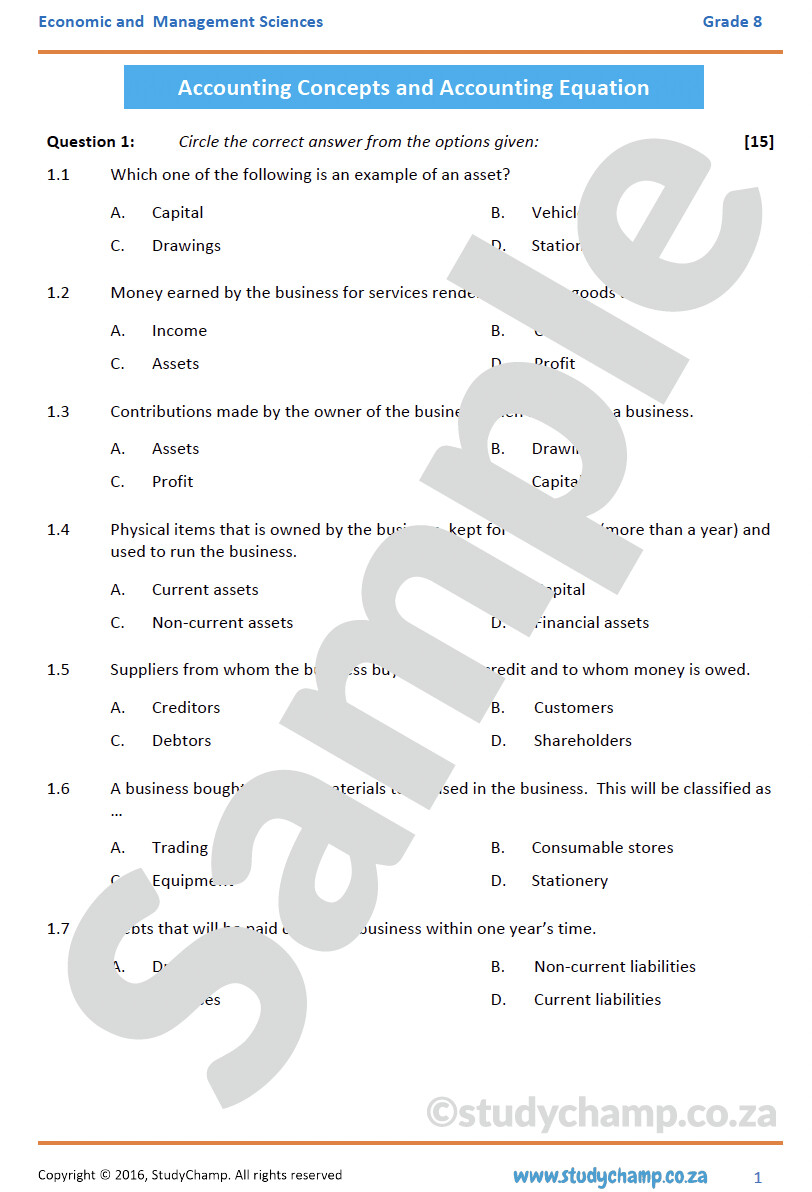

Accounting Equations

The accounting equation is a fundamental concept in accounting, representing the relationship between a company’s assets, liabilities, and equity. The equation is: Assets = Liabilities + Equity This equation is essential for understanding how a company’s financial position changes over time. Assets represent what a company owns, liabilities represent what a company owes, and equity represents the company’s net worth.

Accounting Standards

Accounting standards provide a framework for preparing financial statements, ensuring consistency and comparability across companies. The most widely used accounting standards are: * GAAP (Generally Accepted Accounting Principles): A set of rules and guidelines for accounting and financial reporting in the United States. * IFRS (International Financial Reporting Standards): A set of standards for financial reporting used in over 140 countries worldwide. These standards help ensure that financial statements are presented fairly and consistently, enabling stakeholders to make informed decisions.

Accounting Processes

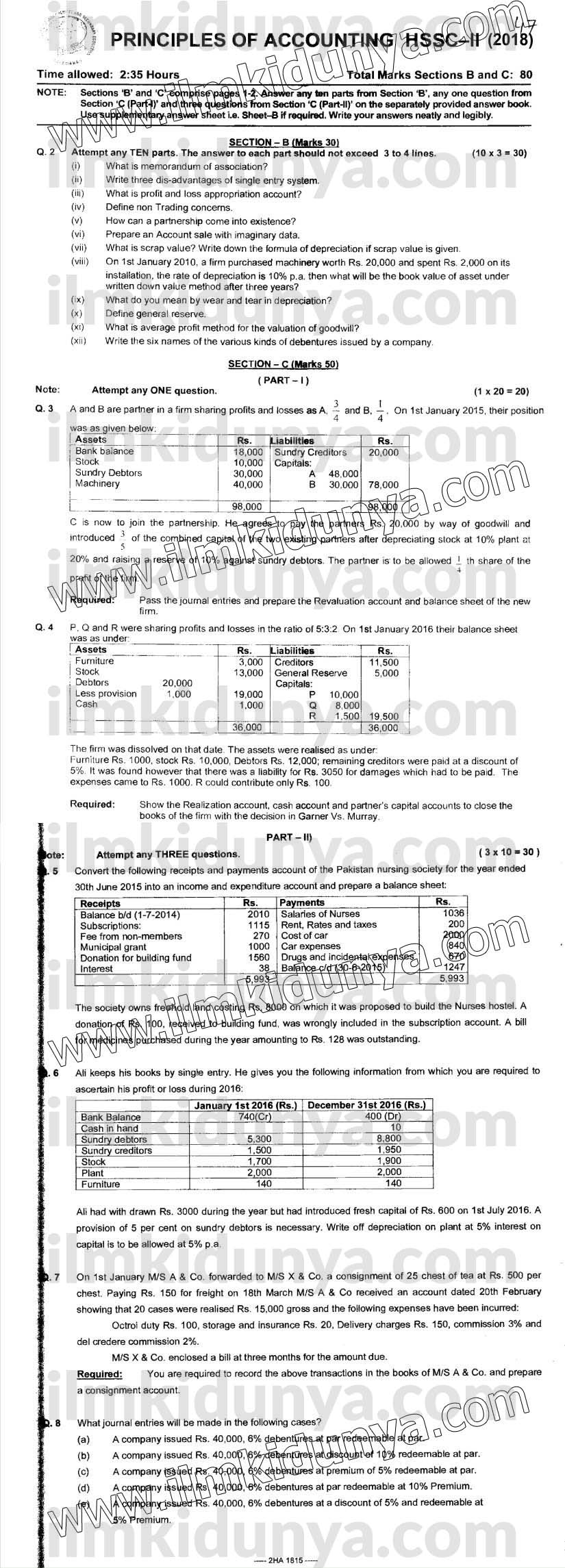

The accounting process involves several steps, including: * Identifying and recording transactions: Recognizing and documenting financial transactions, such as sales, purchases, and expenses. * Classifying and reporting transactions: Organizing and presenting financial information in a clear and concise manner. * Analyzing and interpreting financial information: Examining financial statements to identify trends, risks, and opportunities. These processes are essential for maintaining accurate and reliable financial records.

📝 Note: It is essential to follow established accounting standards and guidelines to ensure the accuracy and reliability of financial information.

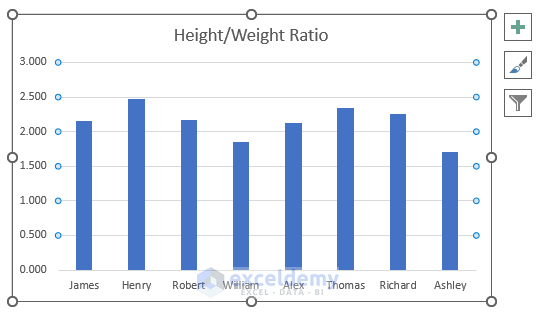

Financial Analysis

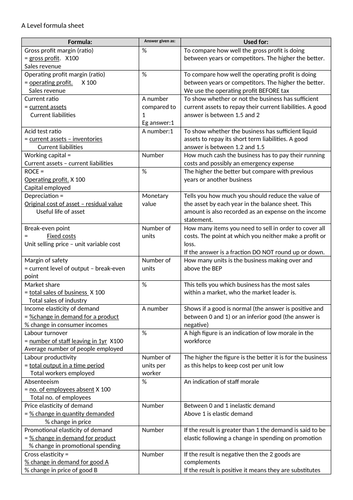

Financial analysis involves examining financial statements to assess a company’s performance, position, and prospects. Common financial analysis techniques include: * Ratio analysis: Calculating financial ratios, such as the current ratio and debt-to-equity ratio, to evaluate a company’s liquidity, solvency, and profitability. * Trend analysis: Examining financial trends over time to identify patterns and anomalies. * Comparative analysis: Comparing a company’s financial performance to that of its competitors or industry averages. These techniques help stakeholders make informed decisions about investments, loans, and other business opportunities.

Accounting Software

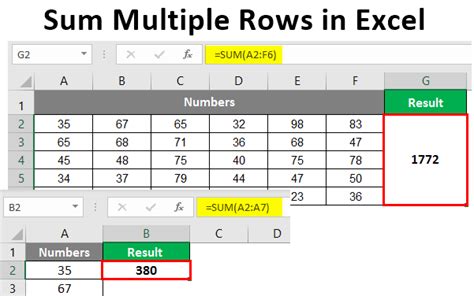

Accounting software is used to automate and streamline accounting processes, including: * Financial statement preparation: Generating financial statements, such as balance sheets and income statements. * Transaction recording and classification: Recording and organizing financial transactions. * Financial analysis and reporting: Analyzing financial data and generating reports. Popular accounting software includes QuickBooks, Xero, and SAP.

Conclusion

In conclusion, accounting is a critical function in business, providing stakeholders with the information they need to make informed decisions. By understanding key concepts and principles, such as financial statements, accounting equations, and accounting standards, individuals can better navigate the world of accounting. Whether you are a business owner, investor, or simply interested in learning more about accounting, this guide has provided a comprehensive overview of the subject.

What is the primary purpose of accounting?

+

The primary purpose of accounting is to provide stakeholders with the information they need to make informed decisions about a company.

What are the three main financial statements?

+

The three main financial statements are the balance sheet, income statement, and cash flow statement.

What is the accounting equation?

+

The accounting equation is Assets = Liabilities + Equity, representing the relationship between a company’s assets, liabilities, and equity.