5 Ways To Calculate Payback

Introduction to Payback Calculation

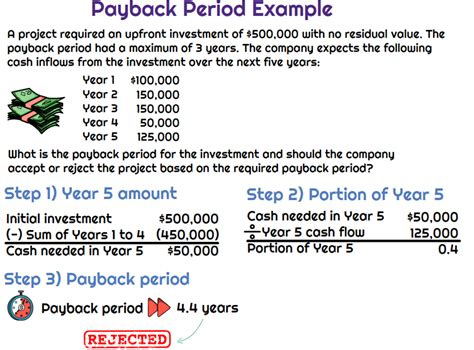

Calculating payback is a crucial step in evaluating the feasibility and potential return on investment (ROI) of a project or investment. Payback period refers to the amount of time it takes for an investment to generate cash flows that equal its initial cost. In this article, we will explore five different methods to calculate payback, each with its own set of assumptions and applications.

Understanding Payback Period

Before diving into the calculation methods, it’s essential to understand the concept of payback period. The payback period is a simple, yet effective way to evaluate the risk and potential return of an investment. A shorter payback period indicates a lower risk and higher potential return, while a longer payback period suggests a higher risk and lower potential return. Investors and project managers often use the payback period as a key criterion in deciding whether to pursue an investment opportunity.

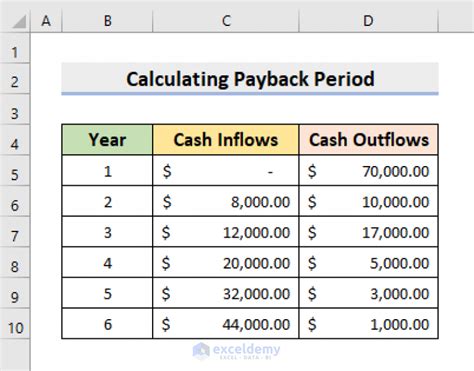

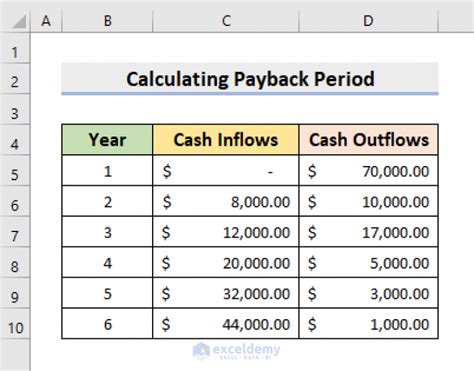

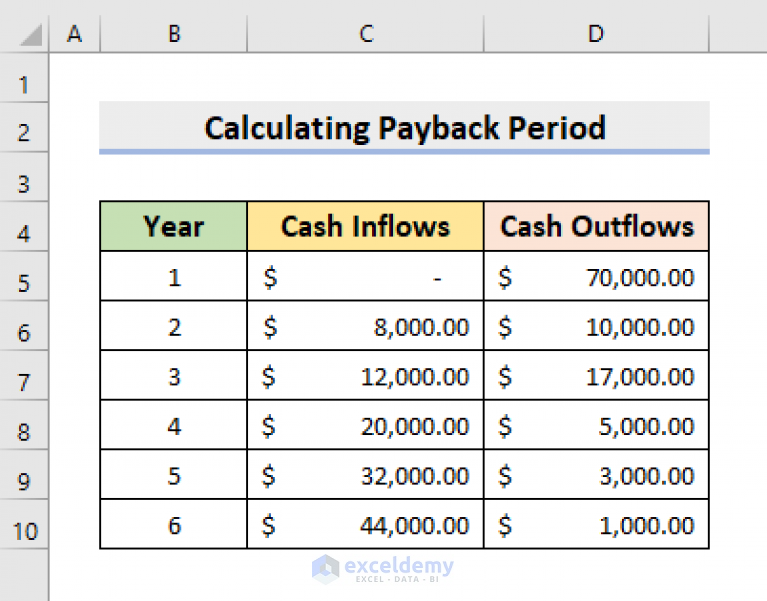

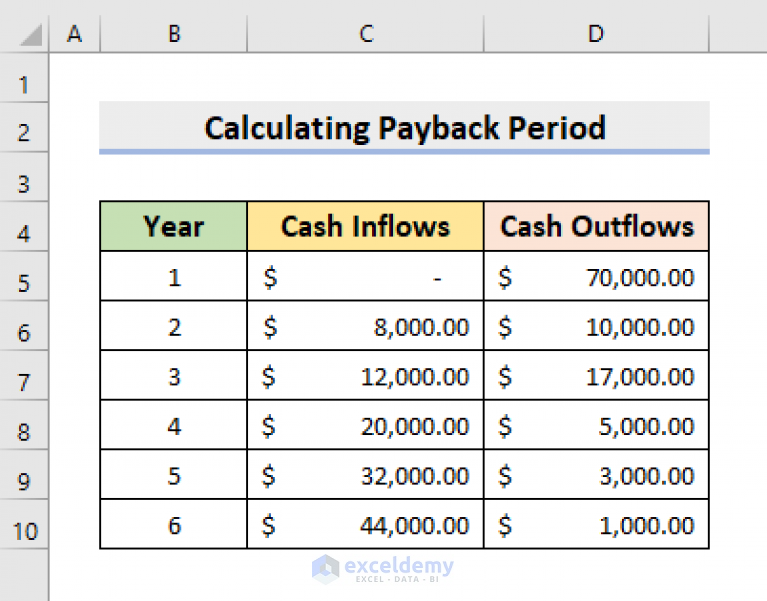

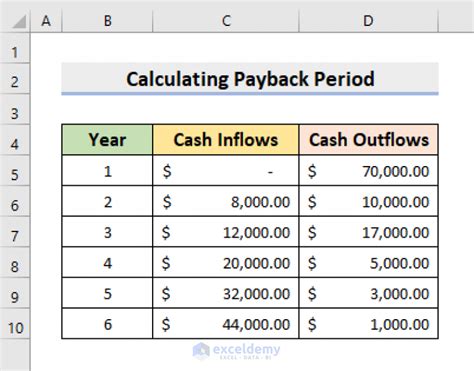

Method 1: Simple Payback Calculation

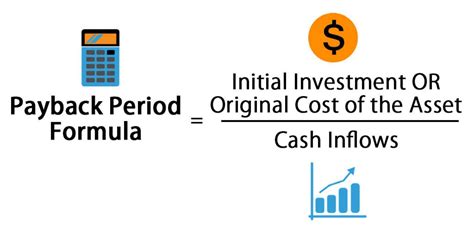

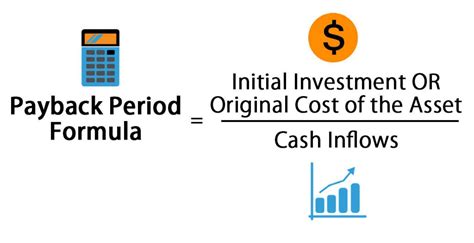

The simple payback calculation is the most basic method of calculating payback. It involves dividing the initial investment by the annual cash flows generated by the investment.

| Initial Investment | Annual Cash Flows | Payback Period |

|---|---|---|

| 100,000</td> <td>20,000 | 5 years |

In this example, the initial investment is 100,000, and the annual cash flows are 20,000. The payback period is calculated as 5 years (100,000 ÷ 20,000).

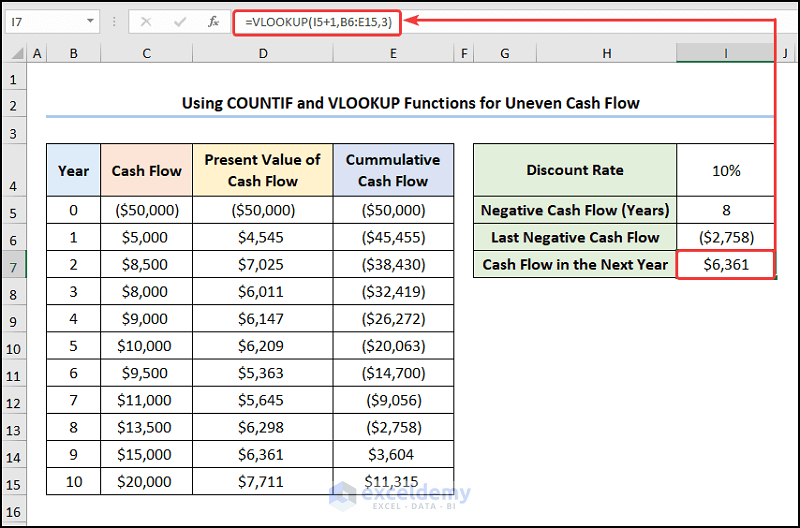

Method 2: Discounted Payback Calculation

The discounted payback calculation takes into account the time value of money by discounting the future cash flows using a discount rate. This method provides a more accurate estimate of the payback period, as it considers the present value of the cash flows.

📝 Note: The discount rate used in the calculation should reflect the cost of capital or the expected return on investment.

The formula for discounted payback calculation is: Payback Period = Initial Investment / (Annual Cash Flows x Discount Factor) where Discount Factor = 1 / (1 + Discount Rate)^nMethod 3: Net Present Value (NPV) Payback Calculation

The NPV payback calculation involves calculating the NPV of the investment and then determining the payback period based on the NPV. This method provides a more comprehensive evaluation of the investment, as it considers the present value of all cash flows, including the initial investment. The formula for NPV payback calculation is: NPV = ∑ (Cash Flows x Discount Factor) Payback Period = Initial Investment / (Annual Cash Flows x Discount Factor)

Method 4: Internal Rate of Return (IRR) Payback Calculation

The IRR payback calculation involves calculating the IRR of the investment and then determining the payback period based on the IRR. This method provides a more accurate estimate of the payback period, as it considers the expected return on investment. The formula for IRR payback calculation is: IRR = Rate at which NPV = 0 Payback Period = Initial Investment / (Annual Cash Flows x (1 + IRR)^n)

Method 5: Modified Internal Rate of Return (MIRR) Payback Calculation

The MIRR payback calculation involves calculating the MIRR of the investment and then determining the payback period based on the MIRR. This method provides a more accurate estimate of the payback period, as it considers the expected return on investment and the reinvestment rate. The formula for MIRR payback calculation is: MIRR = (Initial Investment x (1 + Reinvestment Rate)^n) / (Annual Cash Flows x (1 + Reinvestment Rate)^n) Payback Period = Initial Investment / (Annual Cash Flows x (1 + MIRR)^n)

In conclusion, calculating payback is a critical step in evaluating the feasibility and potential return on investment of a project or investment. The five methods outlined in this article provide different approaches to calculating payback, each with its own set of assumptions and applications. By understanding the strengths and limitations of each method, investors and project managers can make more informed decisions about their investments.

What is the payback period, and why is it important?

+

The payback period is the amount of time it takes for an investment to generate cash flows that equal its initial cost. It’s essential because it helps investors and project managers evaluate the risk and potential return of an investment.

What is the difference between simple payback and discounted payback calculations?

+

The simple payback calculation does not consider the time value of money, while the discounted payback calculation takes into account the present value of future cash flows using a discount rate.

How do I choose the most suitable payback calculation method for my investment?

+

The choice of payback calculation method depends on the specific characteristics of the investment, such as the expected return, risk, and cash flow pattern. It’s essential to consider the strengths and limitations of each method and choose the one that best suits your investment needs.