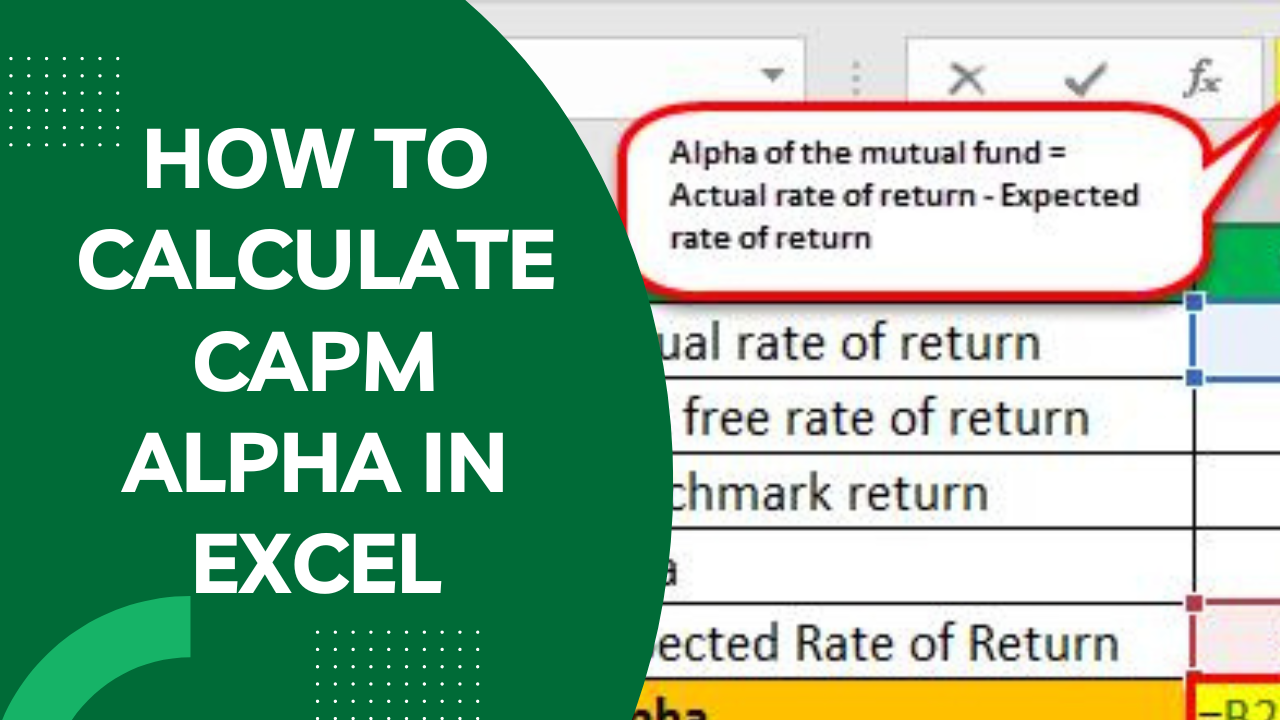

Calculate CAPM Alpha in Excel

Introduction to CAPM Alpha

The Capital Asset Pricing Model (CAPM) is a widely used financial model that describes the relationship between the expected return of an investment and its risk. The CAPM Alpha, also known as Jensen’s Alpha, is a measure of the excess return of an investment relative to its expected return, given its beta. In this blog post, we will learn how to calculate CAPM Alpha in Excel.

Understanding CAPM and Alpha

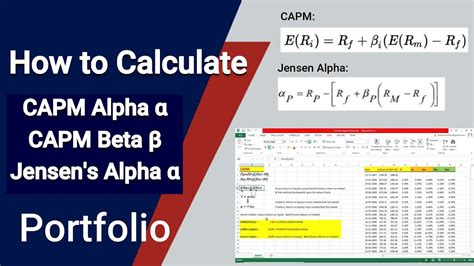

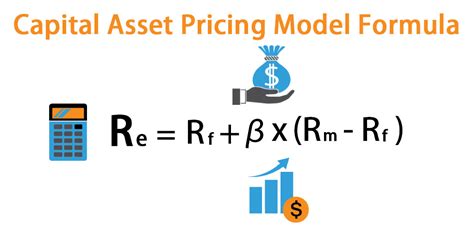

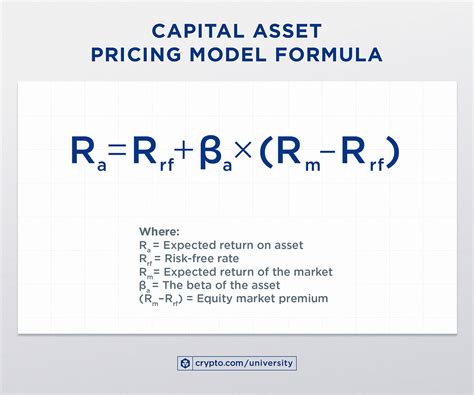

Before we dive into the calculation, let’s understand the concepts of CAPM and Alpha. The CAPM is a linear model that describes the relationship between the expected return of an investment and its beta. The beta of an investment is a measure of its systematic risk, which is the risk that cannot be diversified away. The CAPM equation is as follows:

Expected Return = Risk-Free Rate + Beta x (Market Return - Risk-Free Rate)

The Alpha, on the other hand, is a measure of the excess return of an investment relative to its expected return, given its beta. A positive Alpha indicates that the investment has outperformed the market, while a negative Alpha indicates that it has underperformed.

Calculating CAPM Alpha in Excel

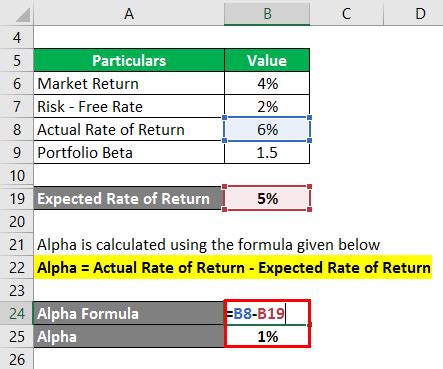

To calculate CAPM Alpha in Excel, we need to follow these steps:

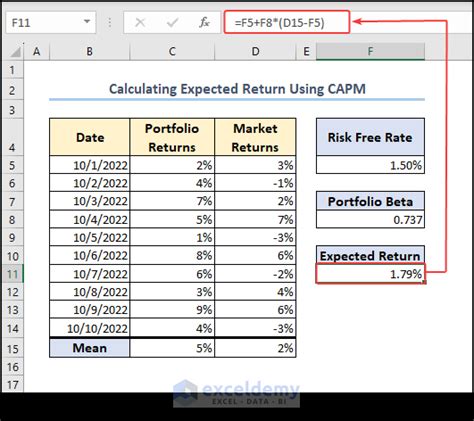

- Step 1: Gather Data: Collect the historical returns of the investment, the market, and the risk-free rate. You can use the average return of the investment and the market over a certain period, such as a year.

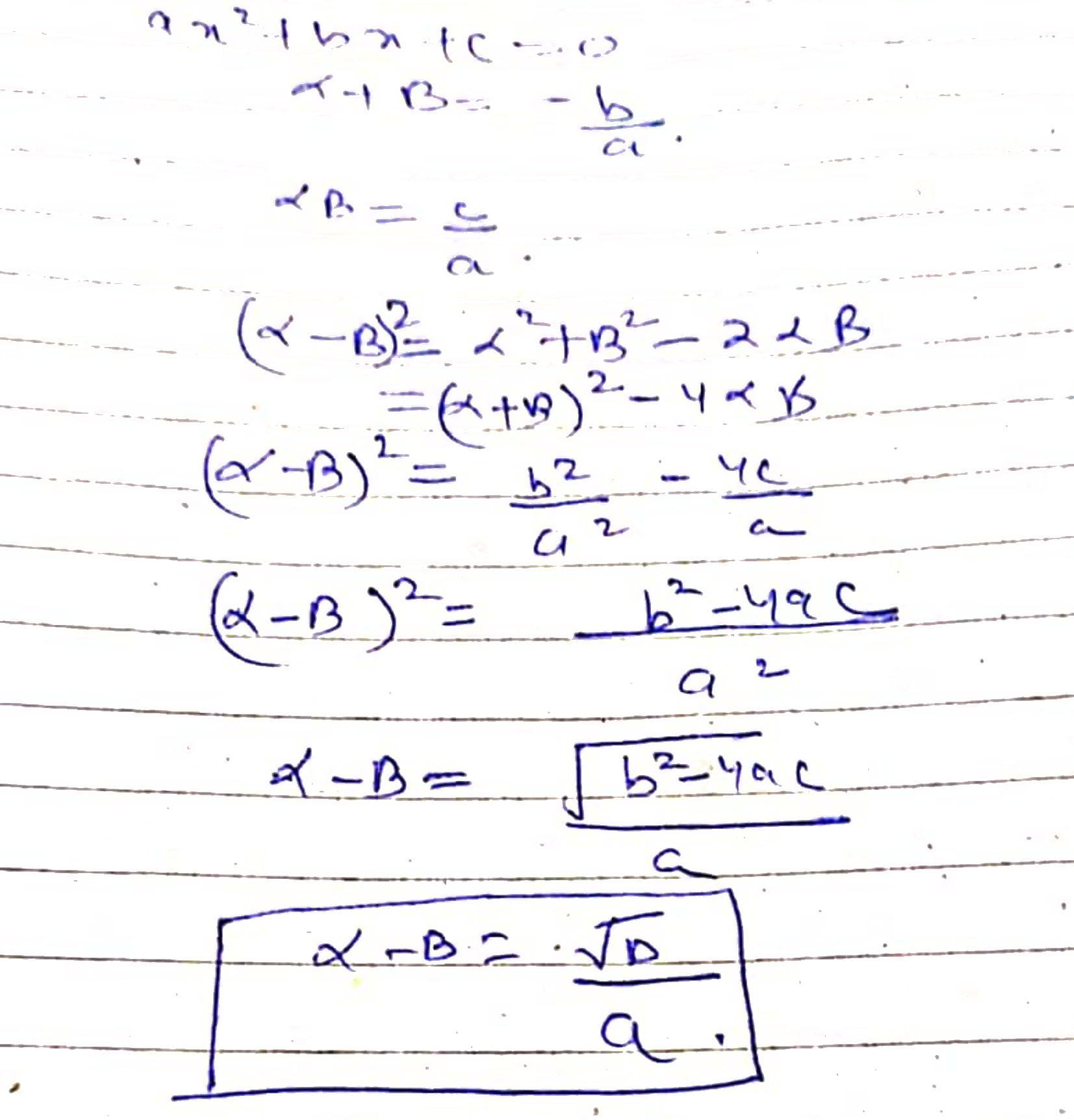

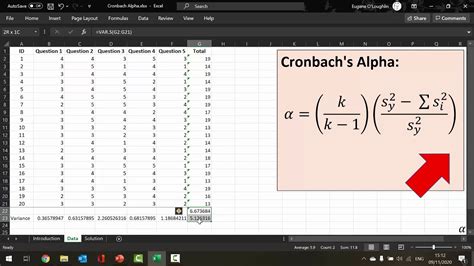

- Step 2: Calculate Beta: Calculate the beta of the investment using the following formula:

Beta = Covariance (Investment Return, Market Return) / Variance (Market Return)

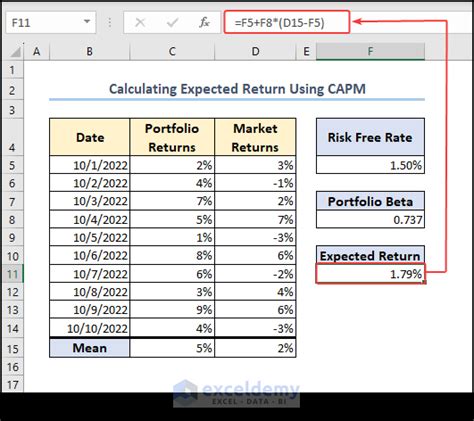

You can use the Covariance and Variance functions in Excel to calculate the beta. * Step 3: Calculate Expected Return: Calculate the expected return of the investment using the CAPM equation:

Expected Return = Risk-Free Rate + Beta x (Market Return - Risk-Free Rate)

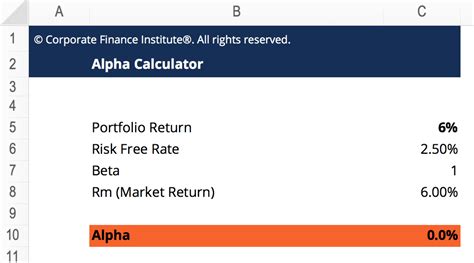

You can use the AVERAGE function in Excel to calculate the expected return. * Step 4: Calculate Alpha: Calculate the Alpha of the investment using the following formula:

Alpha = Actual Return - Expected Return

You can use the AVERAGE function in Excel to calculate the actual return, and then subtract the expected return to get the Alpha.

Here is an example of how to calculate CAPM Alpha in Excel:

| Investment Return | Market Return | Risk-Free Rate |

|---|---|---|

| 10% | 8% | 2% |

| 12% | 10% | 2% |

| 8% | 6% | 2% |

Using the above data, we can calculate the beta, expected return, and Alpha as follows:

Beta = COVARIANCE(Investment Return, Market Return) / VARIANCE(Market Return) = 0.8 Expected Return = Risk-Free Rate + Beta x (Market Return - Risk-Free Rate) = 2% + 0.8 x (8% - 2%) = 6.4% Actual Return = AVERAGE(Investment Return) = 10% Alpha = Actual Return - Expected Return = 10% - 6.4% = 3.6%

Therefore, the CAPM Alpha of the investment is 3.6%, indicating that the investment has outperformed the market by 3.6% per year.

Interpretation of CAPM Alpha

A positive Alpha indicates that the investment has outperformed the market, while a negative Alpha indicates that it has underperformed. The magnitude of the Alpha indicates the degree of outperformance or underperformance. For example, an Alpha of 3.6% indicates that the investment has outperformed the market by 3.6% per year.

📝 Note: The CAPM Alpha is a measure of the excess return of an investment relative to its expected return, given its beta. It is an important metric for evaluating the performance of an investment.

Limitations of CAPM Alpha

While the CAPM Alpha is a useful metric for evaluating the performance of an investment, it has several limitations. For example, it assumes that the investment has a constant beta over time, which may not be the case. Additionally, it does not take into account other factors that may affect the performance of the investment, such as transaction costs and taxes.

Conclusion

In conclusion, calculating CAPM Alpha in Excel is a straightforward process that involves gathering data, calculating beta, expected return, and Alpha. The CAPM Alpha is an important metric for evaluating the performance of an investment, but it has several limitations that should be taken into account. By understanding the concepts of CAPM and Alpha, investors can make more informed decisions about their investments.

What is CAPM Alpha?

+

CAPM Alpha, also known as Jensen’s Alpha, is a measure of the excess return of an investment relative to its expected return, given its beta.

How do I calculate CAPM Alpha in Excel?

+

To calculate CAPM Alpha in Excel, you need to gather data, calculate beta, expected return, and Alpha using the formulas: Beta = COVARIANCE(Investment Return, Market Return) / VARIANCE(Market Return), Expected Return = Risk-Free Rate + Beta x (Market Return - Risk-Free Rate), and Alpha = Actual Return - Expected Return.

What is the interpretation of CAPM Alpha?

+

A positive Alpha indicates that the investment has outperformed the market, while a negative Alpha indicates that it has underperformed. The magnitude of the Alpha indicates the degree of outperformance or underperformance.