Find Payback Period In Excel

Introduction to Payback Period

The payback period is a financial metric used to determine the amount of time it takes for an investment to generate cash flows that equal the initial investment. In other words, it’s the time it takes for an investment to pay for itself. This metric is often used by businesses and individuals to evaluate the feasibility of a project or investment opportunity.

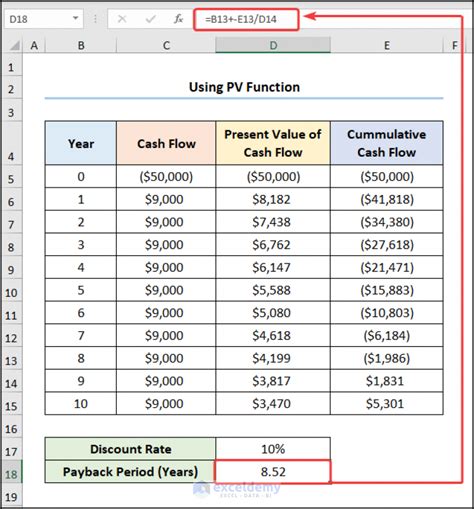

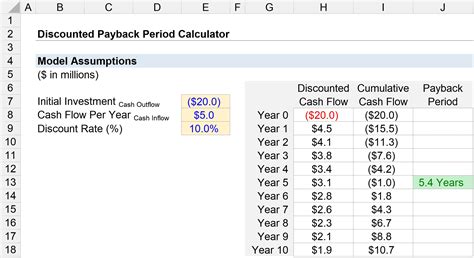

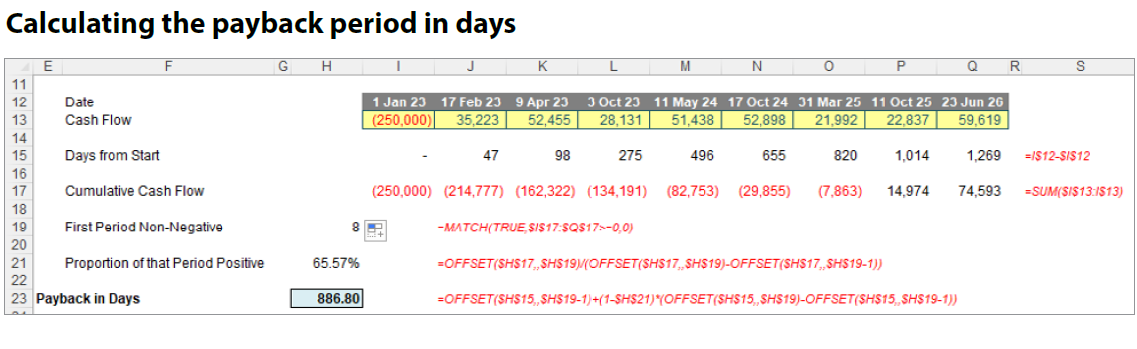

Calculating Payback Period in Excel

To calculate the payback period in Excel, you can use a simple formula or create a more complex model using various functions. Here are the steps to calculate the payback period in Excel:

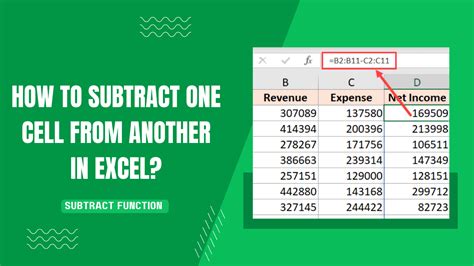

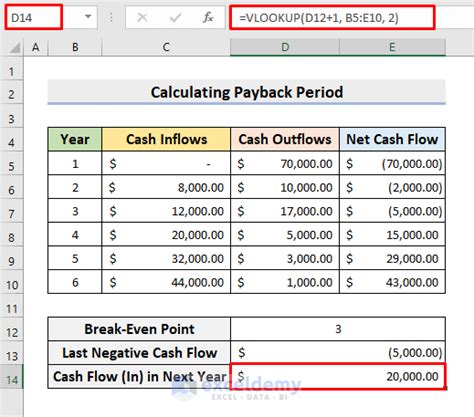

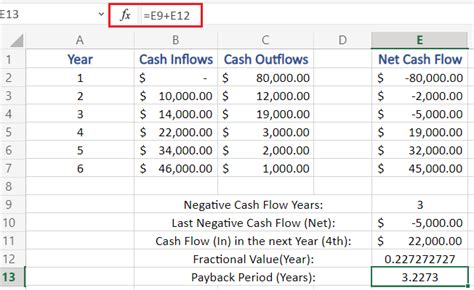

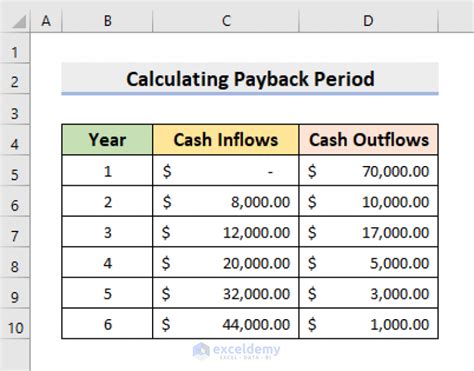

- Step 1: Set up your data: Create a table with the initial investment and the expected annual cash flows. For example:

Year Cash Flow 0 -10000 1 3000 2 4000 3 5000

- Step 2: Calculate the cumulative cash flow: Create a new column to calculate the cumulative cash flow. You can use the formula:

=SUM(B$2:B2), where B2 is the cell containing the cash flow for the current year. - Step 3: Determine the payback period: Use the

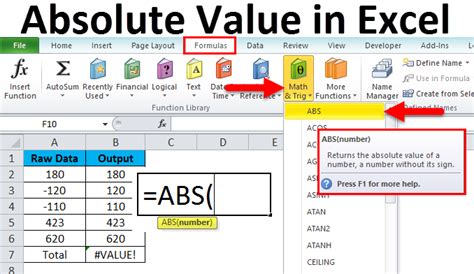

XNPVfunction or theIPMTfunction to calculate the payback period. TheXNPVfunction calculates the present value of a series of cash flows, while theIPMTfunction calculates the interest portion of a fixed payment.

The formula using the XNPV function is: =XNPV(0.1,A2:A5,B2:B5), where:

+ 0.1 is the discount rate

+ A2:A5 is the range containing the years

+ B2:B5 is the range containing the cash flows

The formula using the IPMT function is: =IPMT(0.1,3,0,-10000), where:

+ 0.1 is the discount rate

+ 3 is the number of years

+ 0 is the type (0 for end of period, 1 for beginning of period)

+ -10000 is the present value (initial investment)

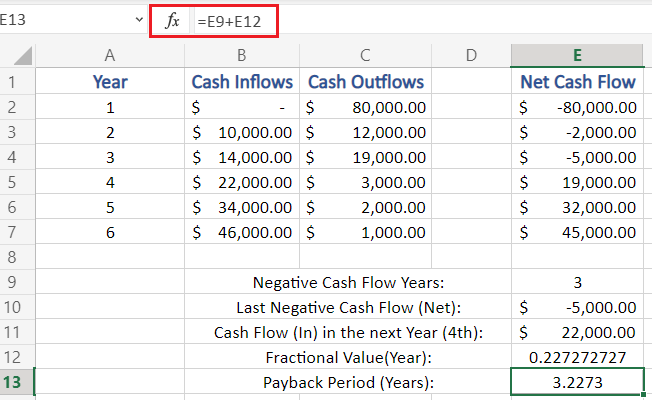

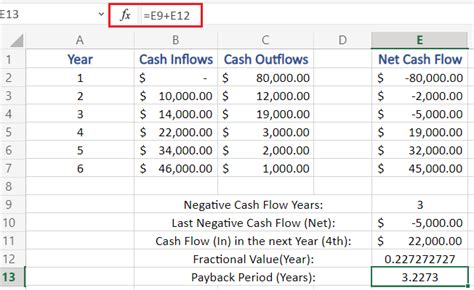

Example Walkthrough

Let’s walk through an example to calculate the payback period using the

XNPV function. Suppose we have an initial investment of 10,000 and expected annual cash flows of 3,000, 4,000, and 5,000 for the next three years.

- Set up the data:

Year Cash Flow 0 -10000 1 3000 2 4000 3 5000 - Calculate the cumulative cash flow:

Year Cash Flow Cumulative Cash Flow 0 -10000 -10000 1 3000 -7000 2 4000 -3000 3 5000 2000 - Calculate the payback period using the

XNPVfunction:=XNPV(0.1,A2:A5,B2:B5)

The result is approximately 2.5 years, which means the investment will pay for itself in approximately 2.5 years.

💡 Note: The payback period calculation assumes that the cash flows occur at the end of each year. If the cash flows occur at the beginning of each year, you need to adjust the calculation accordingly.

Best Practices for Calculating Payback Period in Excel

When calculating the payback period in Excel, keep the following best practices in mind:

- Use a consistent discount rate throughout the calculation.

- Ensure that the cash flows are correctly formatted as positive or negative values.

- Use the

XNPVfunction or theIPMTfunction to calculate the payback period, as they provide more accurate results than simple formulas. - Consider using a sensitivity analysis to test the robustness of the payback period calculation to changes in the input assumptions.

In summary, calculating the payback period in Excel is a straightforward process that involves setting up the data, calculating the cumulative cash flow, and using the XNPV function or the IPMT function to determine the payback period. By following the steps outlined in this article and using best practices, you can accurately calculate the payback period for your investment opportunities.

As we reflect on the key points discussed in this article, it’s clear that calculating the payback period is an essential step in evaluating investment opportunities. By understanding the payback period, you can make more informed decisions about which investments to pursue and how to allocate your resources.

What is the payback period, and why is it important?

+

The payback period is the amount of time it takes for an investment to generate cash flows that equal the initial investment. It’s an important metric because it helps investors evaluate the feasibility of a project or investment opportunity.

How do I calculate the payback period in Excel?

+

To calculate the payback period in Excel, you can use the XNPV function or the IPMT function. The XNPV function calculates the present value of a series of cash flows, while the IPMT function calculates the interest portion of a fixed payment.

What are some common mistakes to avoid when calculating the payback period?

+

Common mistakes to avoid when calculating the payback period include using an incorrect discount rate, failing to format cash flows as positive or negative values, and not using the XNPV function or the IPMT function to calculate the payback period.