Excel Ratios Made Easy

Introduction to Excel Ratios

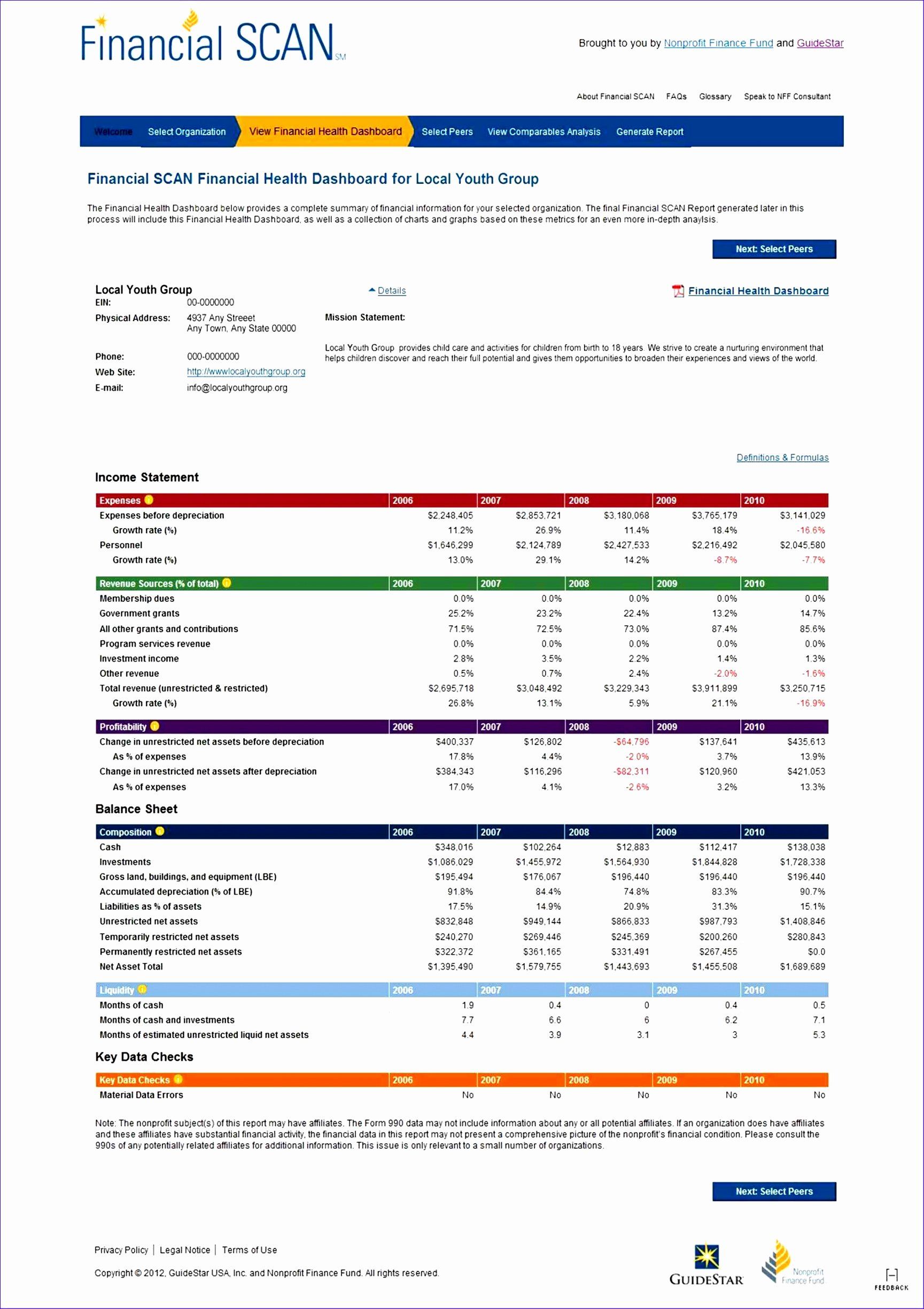

Excel ratios are a powerful tool used in various financial and business applications to analyze and compare data. Ratio analysis is a method of evaluating a company’s performance by calculating various ratios from its financial statements. These ratios help investors, analysts, and business owners make informed decisions about investments, credit, and other business activities. In this article, we will explore the different types of Excel ratios, their formulas, and how to use them effectively.

Types of Excel Ratios

There are several types of Excel ratios, each with its own specific purpose and application. Some of the most common types of ratios include: * Liquidity ratios: These ratios measure a company’s ability to pay its short-term debts. Examples of liquidity ratios include the current ratio and the quick ratio. * Profitability ratios: These ratios measure a company’s ability to generate profits from its sales and investments. Examples of profitability ratios include the gross margin ratio and the return on equity (ROE) ratio. * Efficiency ratios: These ratios measure a company’s ability to use its assets and resources efficiently. Examples of efficiency ratios include the asset turnover ratio and the inventory turnover ratio. * Solvency ratios: These ratios measure a company’s ability to pay its long-term debts. Examples of solvency ratios include the debt-to-equity ratio and the interest coverage ratio.

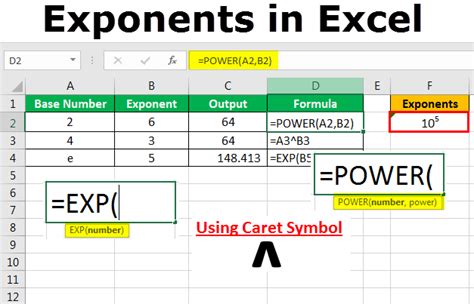

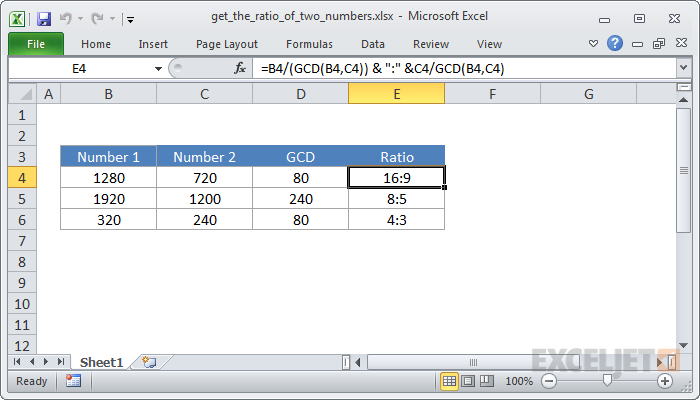

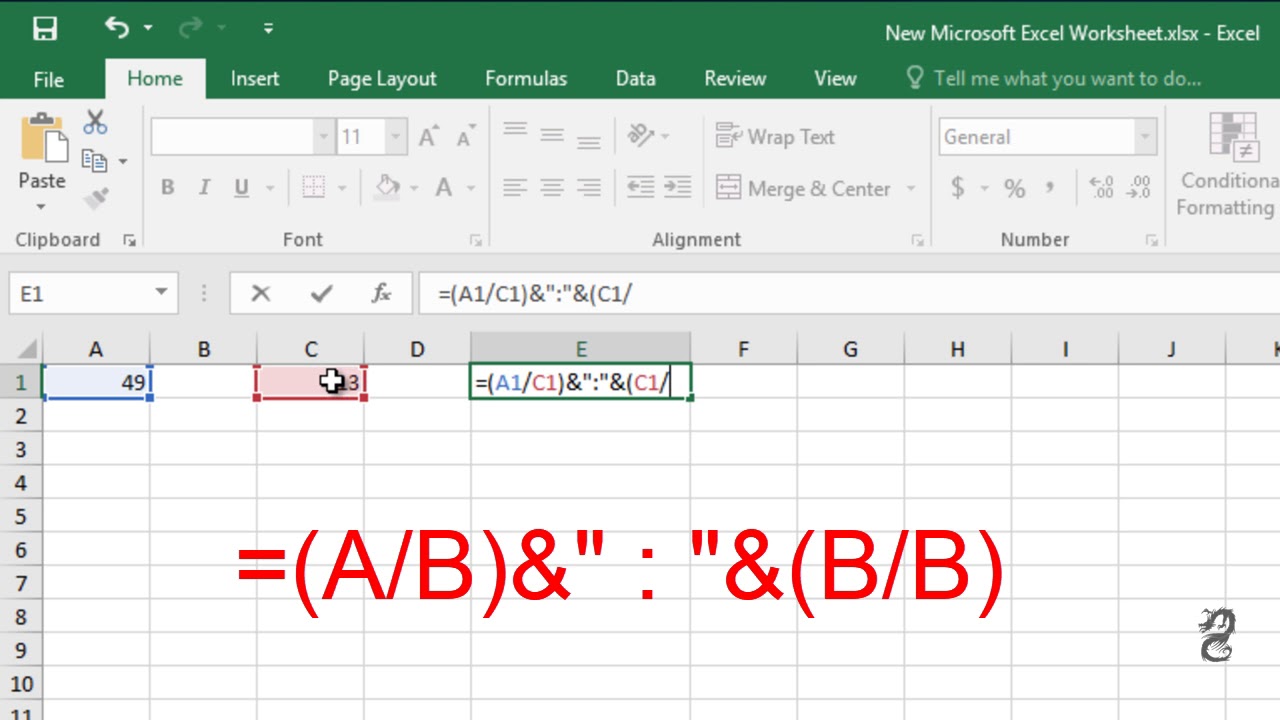

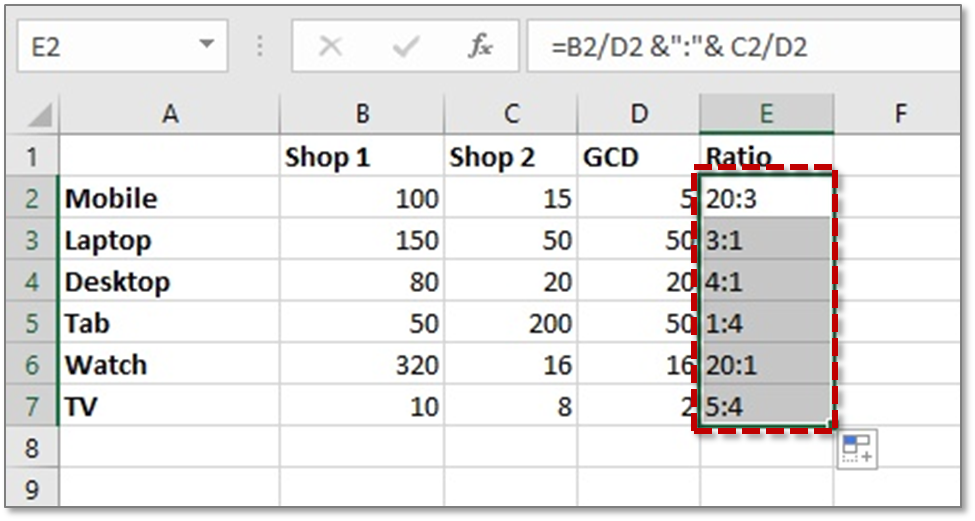

Formulas for Excel Ratios

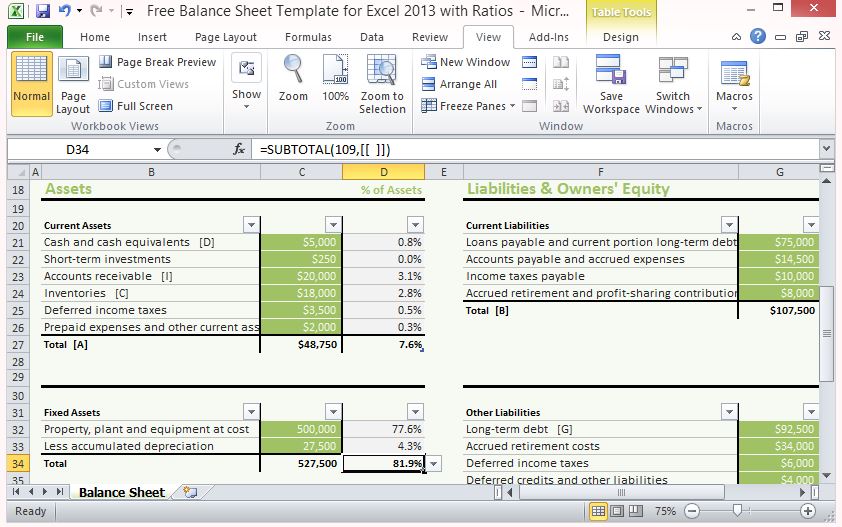

To calculate Excel ratios, you need to use specific formulas. Here are some examples of formulas for common ratios: * Current ratio: Current assets / Current liabilities * Quick ratio: (Current assets - Inventory) / Current liabilities * Gross margin ratio: Gross profit / Sales * Return on equity (ROE) ratio: Net income / Total shareholders’ equity * Asset turnover ratio: Sales / Total assets * Inventory turnover ratio: Cost of goods sold / Average inventory * Debt-to-equity ratio: Total debt / Total shareholders’ equity * Interest coverage ratio: Earnings before interest and taxes (EBIT) / Interest expenses

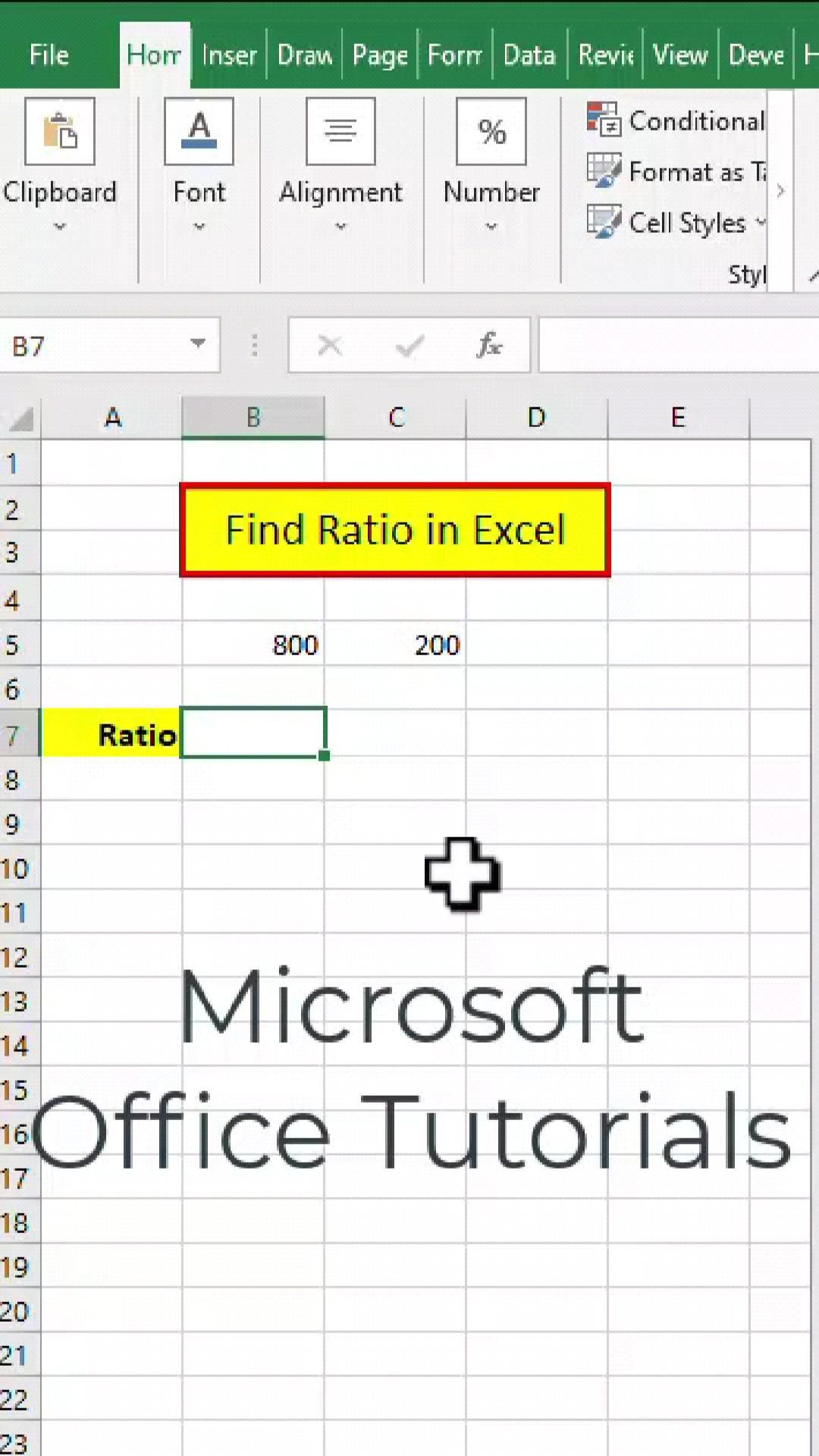

How to Calculate Excel Ratios

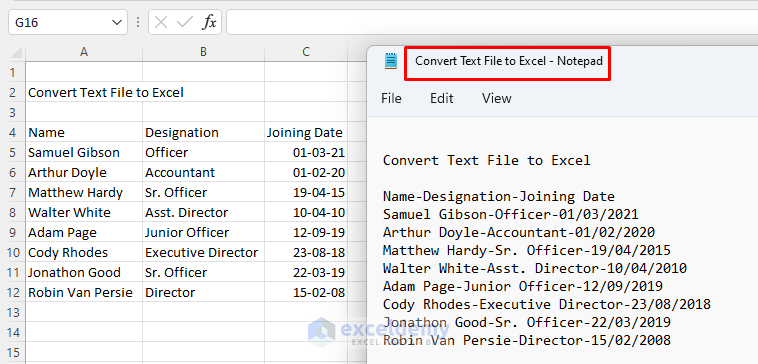

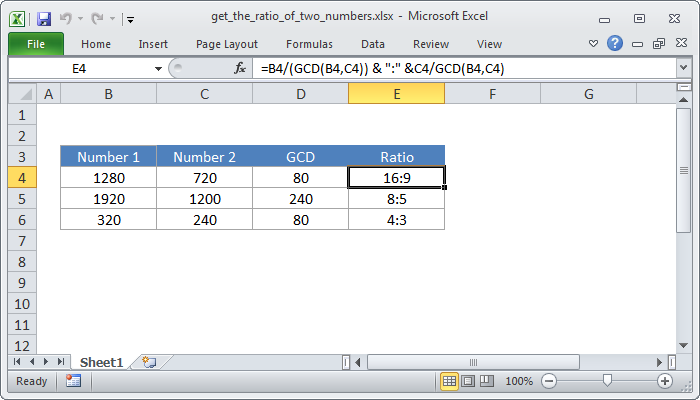

To calculate Excel ratios, you can use a spreadsheet software like Microsoft Excel. Here are the steps to follow: * Enter the data: Enter the relevant data from the financial statements into the spreadsheet. * Create formulas: Create formulas to calculate the ratios using the data. * Calculate the ratios: Calculate the ratios by plugging in the data into the formulas. * Analyze the results: Analyze the results to understand the company’s performance and make informed decisions.

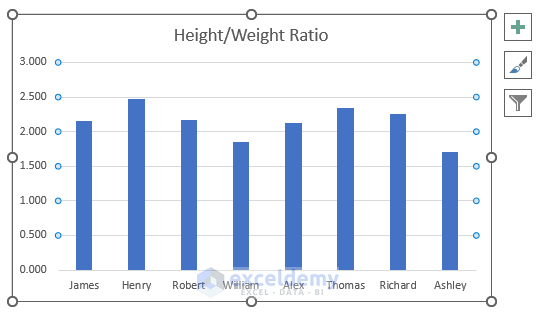

Example of Excel Ratios Calculation

Let’s say we want to calculate the current ratio and the gross margin ratio for a company. The data from the financial statements is as follows:

| Current assets | Current liabilities | Sales | Gross profit |

|---|---|---|---|

| 100,000</td> <td>50,000 | 500,000</td> <td>150,000 |

Using the formulas, we can calculate the ratios as follows: * Current ratio: 100,000 / 50,000 = 2 * Gross margin ratio: 150,000 / 500,000 = 0.3

Interpretation of Excel Ratios

The interpretation of Excel ratios depends on the type of ratio and the industry. Here are some general guidelines: * A high current ratio indicates that the company has sufficient liquidity to pay its short-term debts. * A high gross margin ratio indicates that the company is generating sufficient profits from its sales. * A high asset turnover ratio indicates that the company is using its assets efficiently. * A high debt-to-equity ratio indicates that the company has a high level of debt and may be at risk of default.

📝 Note: It's essential to consider the industry averages and the company's past performance when interpreting the ratios.

Limitations of Excel Ratios

While Excel ratios are a powerful tool for analyzing a company’s performance, they have some limitations. Here are some of the limitations: * Ratio analysis is not a substitute for judgment: Ratio analysis should be used in conjunction with other analytical tools and judgment to make informed decisions. * Ratios can be manipulated: Companies can manipulate their financial statements to improve their ratios. * Ratios are not always comparable: Ratios can vary significantly between industries and companies, making it difficult to compare them.

In summary, Excel ratios are a powerful tool for analyzing a company’s performance and making informed decisions. By understanding the different types of ratios, their formulas, and how to calculate them, you can use ratio analysis to evaluate a company’s liquidity, profitability, efficiency, and solvency. However, it’s essential to consider the limitations of ratio analysis and use it in conjunction with other analytical tools and judgment.

What is the purpose of ratio analysis?

+

The purpose of ratio analysis is to evaluate a company’s performance and make informed decisions about investments, credit, and other business activities.

What are the most common types of ratios?

+

The most common types of ratios include liquidity ratios, profitability ratios, efficiency ratios, and solvency ratios.

How do I calculate the current ratio?

+

The current ratio is calculated by dividing the current assets by the current liabilities.