5 Tips Excel Balance Sheet

Understanding the Basics of a Balance Sheet in Excel

A balance sheet is a crucial financial statement that provides a snapshot of a company’s financial position at a specific point in time. It summarizes the company’s assets, liabilities, and equity, and is a key tool for investors, creditors, and other stakeholders to assess a company’s financial health. In this article, we will explore 5 tips for creating and managing a balance sheet in Excel, with a focus on best practices and common pitfalls to avoid.

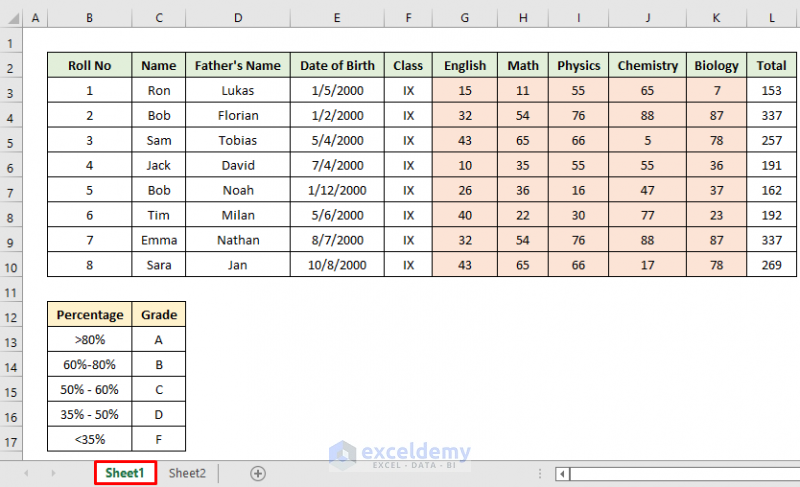

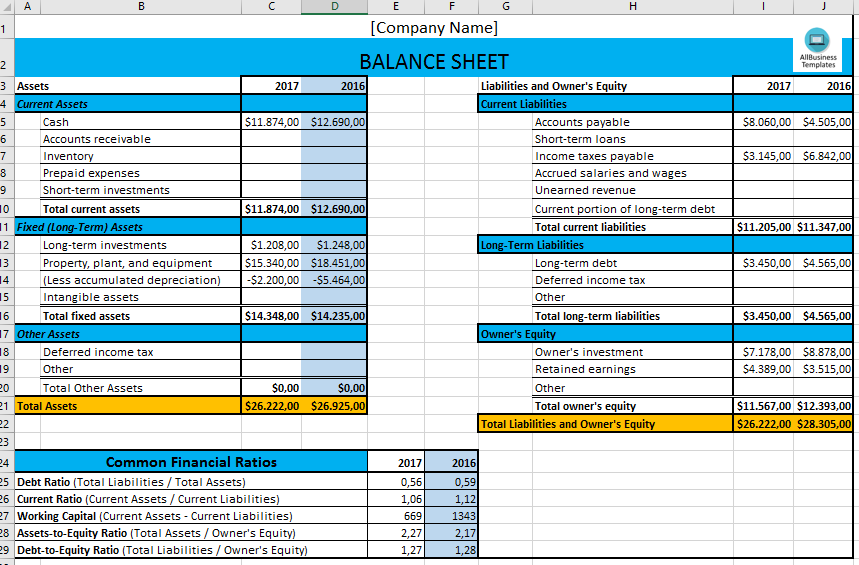

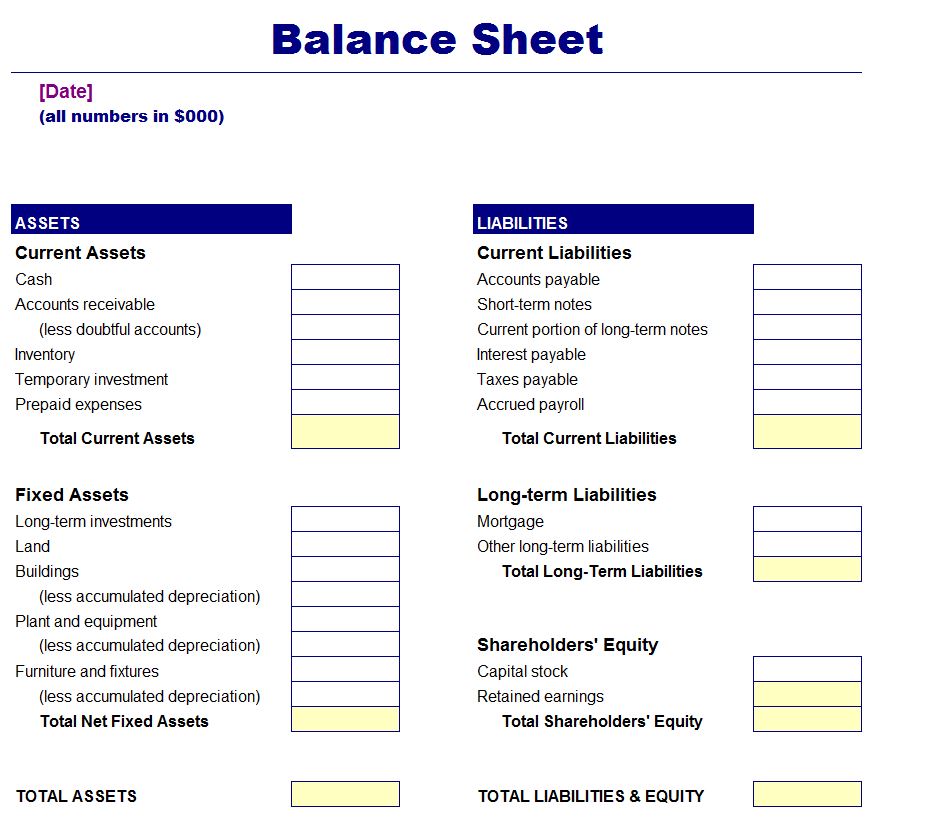

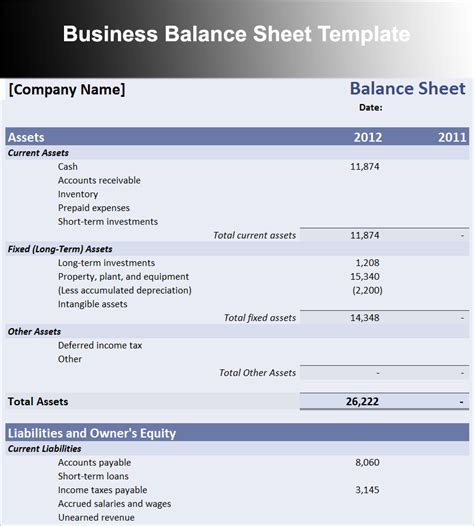

Tip 1: Setting Up the Balance Sheet Template

When creating a balance sheet in Excel, it’s essential to set up a template that is easy to read and understand. This can be achieved by using a consistent formatting style, with clear headings and labels for each section. The balance sheet should be divided into three main sections: Assets, Liabilities, and Equity. Each section should be further subdivided into specific categories, such as Current Assets, Non-Current Assets, Current Liabilities, Non-Current Liabilities, and Shareholder Equity.

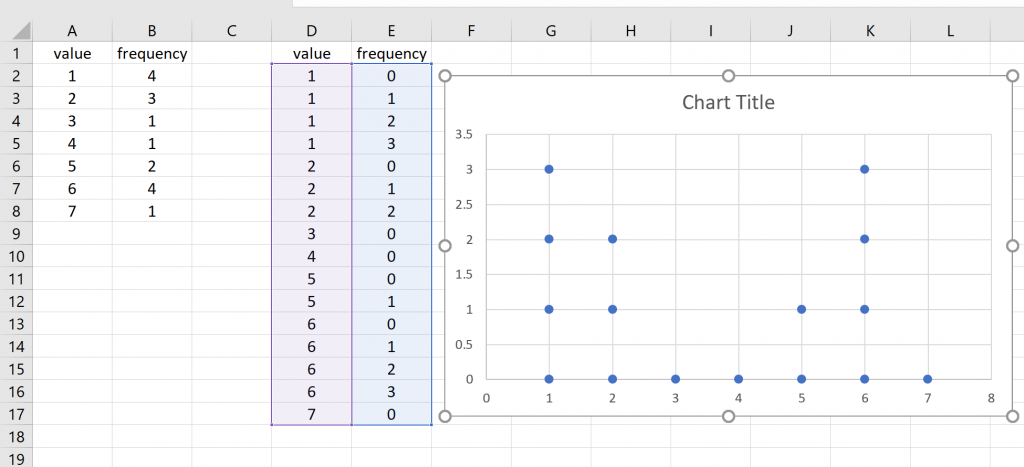

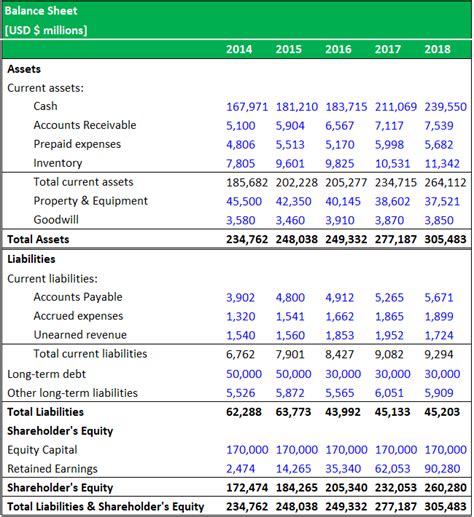

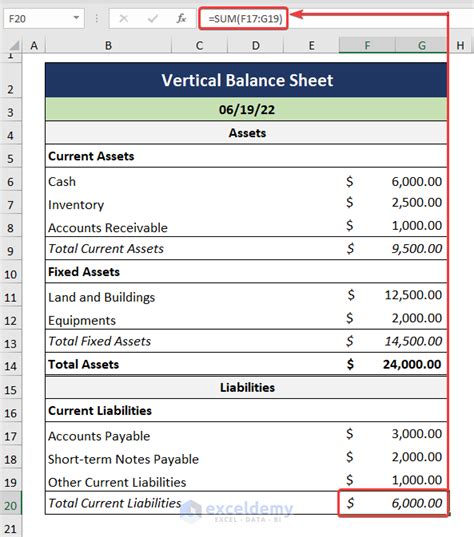

Tip 2: Entering Data and Formulas

Once the template is set up, the next step is to enter the data and formulas. This should be done in a logical and systematic way, with each entry clearly labeled and referenced. It’s essential to use formulas to calculate totals and subtotals, rather than manually entering these values. This will help to reduce errors and ensure that the balance sheet is accurate and up-to-date. Some common formulas used in a balance sheet include SUM, AVERAGE, and IF statements.

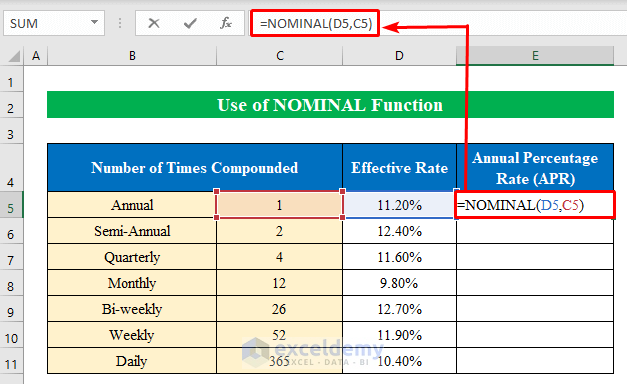

Tip 3: Using Excel Functions for Financial Calculations

Excel provides a range of built-in functions that can be used to perform financial calculations, such as NPV, IRR, and XNPV. These functions can be used to calculate key financial metrics, such as Return on Investment (ROI) and Return on Equity (ROE). By using these functions, you can create a balance sheet that provides a comprehensive picture of a company’s financial performance.

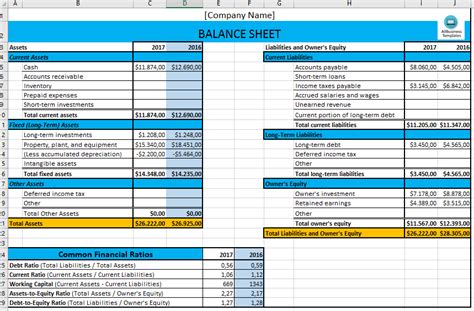

Tip 4: Analyzing and Interpreting the Balance Sheet

A balance sheet is only useful if it is regularly reviewed and analyzed. This involves checking for errors and inconsistencies, and using financial ratios and metrics to assess a company’s financial health. Some common ratios used to analyze a balance sheet include the Current Ratio, Debt-to-Equity Ratio, and Return on Assets (ROA). By using these ratios, you can gain insights into a company’s liquidity, solvency, and profitability.

Tip 5: Best Practices for Managing the Balance Sheet

Finally, it’s essential to follow best practices when managing a balance sheet in Excel. This includes regularly updating the balance sheet to reflect changes in a company’s financial position, and using version control to track changes and revisions. It’s also important to use clear and concise labeling, and to avoid using unnecessary formulas or formatting. By following these best practices, you can create a balance sheet that is accurate, reliable, and easy to understand.

📝 Note: When creating a balance sheet in Excel, it's essential to use a consistent formatting style and to regularly review and update the balance sheet to ensure accuracy and reliability.

To illustrate the key components of a balance sheet, the following table provides a summary of the main sections and categories:

| Section | Category | Description |

|---|---|---|

| Assets | Current Assets | Cash, accounts receivable, inventory, etc. |

| Assets | Non-Current Assets | Property, plant, and equipment, etc. |

| Liabilities | Current Liabilities | Accounts payable, short-term debt, etc. |

| Liabilities | Non-Current Liabilities | Long-term debt, etc. |

| Equity | Shareholder Equity | Common stock, retained earnings, etc. |

In summary, creating and managing a balance sheet in Excel requires a combination of technical skills and financial knowledge. By following the 5 tips outlined in this article, you can create a balance sheet that provides a comprehensive picture of a company’s financial position and performance. Whether you’re an accountant, financial analyst, or business owner, a well-designed balance sheet is an essential tool for making informed decisions and driving business success.

What is the main purpose of a balance sheet?

+

The main purpose of a balance sheet is to provide a snapshot of a company’s financial position at a specific point in time, including its assets, liabilities, and equity.

What are the three main sections of a balance sheet?

+

The three main sections of a balance sheet are Assets, Liabilities, and Equity.

What is the difference between current and non-current assets?

+

Current assets are assets that are expected to be converted into cash within one year, such as cash, accounts receivable, and inventory. Non-current assets are assets that are not expected to be converted into cash within one year, such as property, plant, and equipment.