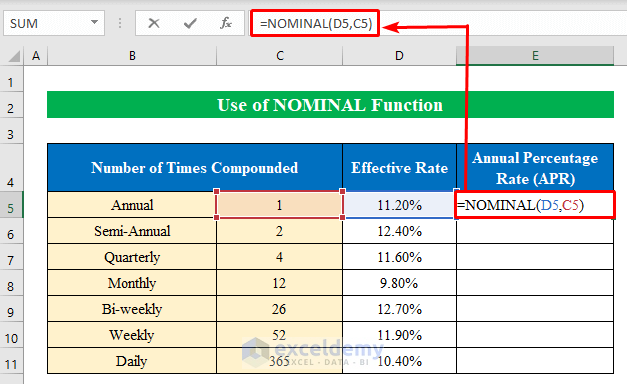

Calculate APR in Excel

Understanding APR and Its Calculation

The Annual Percentage Rate (APR) is the interest rate charged on a loan or credit product over a year, including fees. It’s a crucial factor to consider when borrowing money, as it helps you understand the total cost of the loan. Calculating APR can be complex, but Excel provides a straightforward way to do it. In this article, we’ll explore how to calculate APR in Excel.

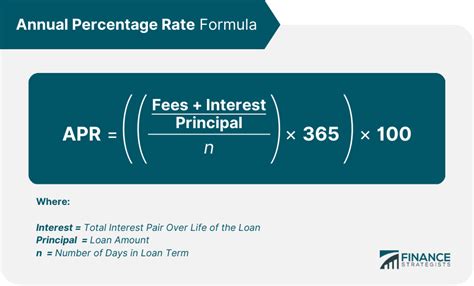

The Formula for Calculating APR

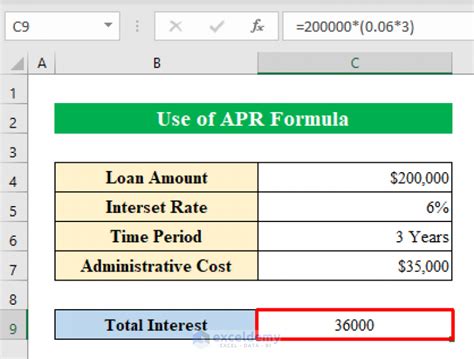

The APR calculation formula is: [ APR = \left( \frac{F + I}{P} \right) \times \frac{1}{T} ] Where: - ( F ) is the fee, - ( I ) is the interest, - ( P ) is the principal amount (the initial amount borrowed), - ( T ) is the time the money is borrowed for, in years.

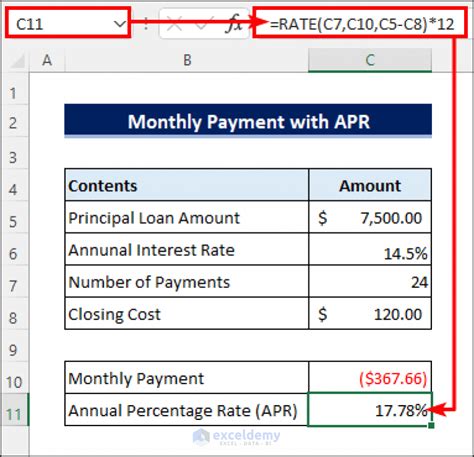

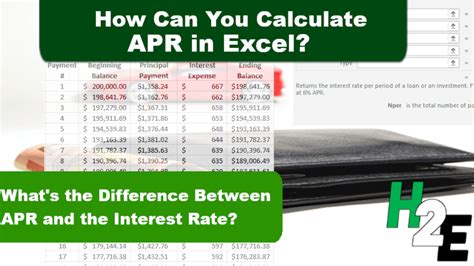

However, this formula simplifies to using the EFFECT function in Excel for more accuracy, especially when dealing with compounds: [ APR = EFFECT(nper, rate) ] Where: - ( nper ) is the total number of payment periods, - ( rate ) is the interest rate per period.

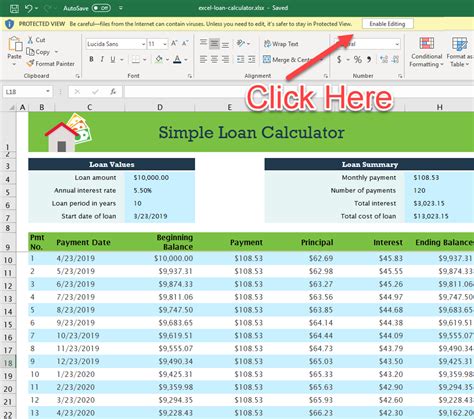

Steps to Calculate APR in Excel

To calculate APR in Excel, follow these steps:

- Determine Your Values: Identify the principal amount (( P )), the interest rate per period (( rate )), and the total number of payment periods (( nper )).

- Use the EFFECT Function: The EFFECT function calculates the effective annual interest rate from a given periodic interest rate. The syntax is =EFFECT(nper, rate).

- Apply the Values: Insert your values into the EFFECT function. For example, if you have a loan with a monthly interest rate of 1% and the loan is for 12 months, your formula would look like this: =EFFECT(12, 0.01).

Example Calculation

Let’s consider a more detailed example to understand this better: - You borrow $1,000 at an annual interest rate of 12%, compounded monthly. - The loan is for 1 year.

To find the APR: 1. Convert the annual interest rate to a monthly rate: 12%/year / 12 months/year = 1%/month. 2. Use the EFFECT function: =EFFECT(12, 0.01).

This will give you the APR, which you can then use to compare different loan offers or to understand the cost of your loan.

Using Excel for Complex APR Calculations

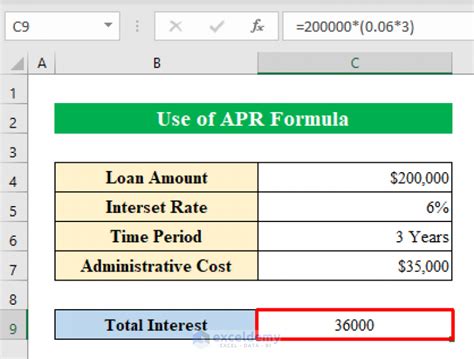

For more complex scenarios, such as when fees are involved or the interest rate changes over time, you might need to use a combination of Excel functions or even create a custom formula.

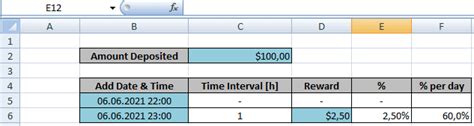

- Fees: If there’s a fee associated with the loan, you can calculate the total cost of the loan and then use this to find an effective APR that includes both interest and fees.

- Changing Interest Rates: If the interest rate changes over the life of the loan, you’ll need to calculate the APR for each period and then find a weighted average based on the time each rate applies.

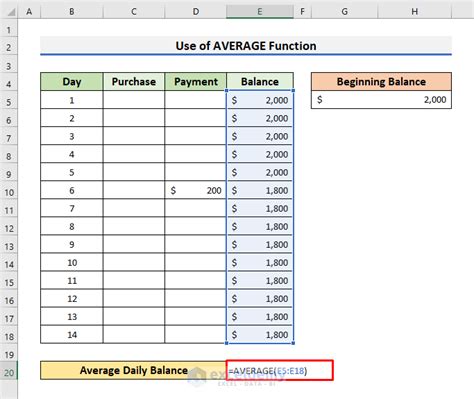

Tables for Comparing APR Offers

| Loan Offer | APR | Loan Term | Monthly Payment |

|---|---|---|---|

| Offer A | 10% | 5 Years | 188.71</td> </tr> <tr> <td>Offer B</td> <td>12%</td> <td>5 Years</td> <td>202.76 |

This table helps you visually compare different loan offers based on their APR, loan term, and monthly payment.

📝 Note: Always ensure that you understand all the terms and conditions of a loan, including any fees and how the APR is calculated, before making a decision.

To sum up the key points: understanding and calculating APR is crucial for making informed decisions about borrowing money. Excel provides powerful tools, like the EFFECT function, to help with these calculations. By following the steps outlined and using the examples provided, you can accurately calculate APR for various loan scenarios and make better financial decisions.

What is APR and why is it important?

+

APR, or Annual Percentage Rate, is the interest rate charged on a loan or credit product over a year, including fees. It’s crucial for understanding the total cost of a loan and for comparing different loan offers.

How do I calculate APR in Excel?

+

You can calculate APR in Excel using the EFFECT function, which calculates the effective annual interest rate from a given periodic interest rate. The syntax is =EFFECT(nper, rate), where nper is the total number of payment periods, and rate is the interest rate per period.

What factors affect APR calculations?

+

Factors that can affect APR calculations include the principal amount, the interest rate per period, the total number of payment periods, and any fees associated with the loan. Compounding interest also plays a significant role in APR calculations.