5 Ways To Calculate Yoy Growth

Understanding Year-Over-Year (YoY) Growth

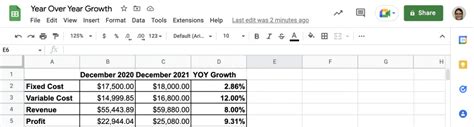

Year-over-year (YoY) growth is a crucial metric used to measure the change in a company’s or economy’s performance over a specific period, typically a year. It helps in understanding the trend and trajectory of growth or decline, enabling better decision-making. Calculating YoY growth involves comparing the same metric or indicator from one period to the same period in the previous year. This can be applied to various aspects such as revenue, profit, website traffic, or any other significant metric. In this article, we will delve into five ways to calculate YoY growth, highlighting the importance of accurate and consistent measurement.

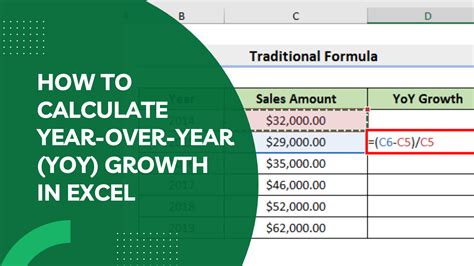

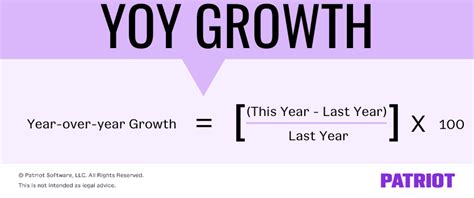

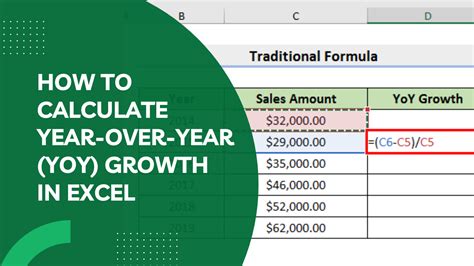

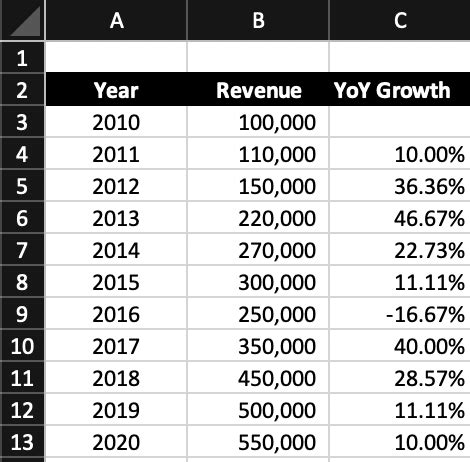

Method 1: Basic Year-Over-Year Growth Calculation

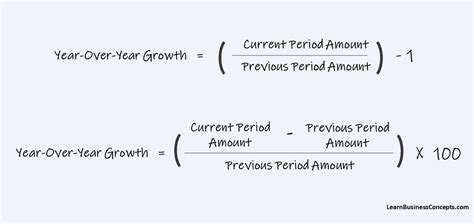

The most straightforward method to calculate YoY growth is by subtracting the previous year’s value from the current year’s value and then dividing by the previous year’s value, finally multiplying by 100 to get the percentage. The formula looks like this: [ \text{YoY Growth} = \left( \frac{\text{Current Year Value} - \text{Previous Year Value}}{\text{Previous Year Value}} \right) \times 100 ] For example, if a company had 100,000 in revenue last year and 120,000 this year, the YoY growth would be: [ \text{YoY Growth} = \left( \frac{120,000 - 100,000}{100,000} \right) \times 100 = 20\% ] This means the company experienced a 20% increase in revenue from last year to this year.

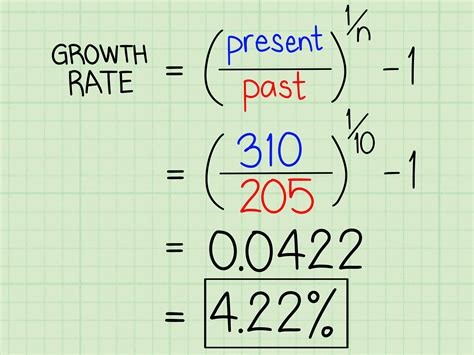

Method 2: Using Average Annual Growth Rate

For multi-year growth analysis, the average annual growth rate (AAGR) can be a more insightful metric. It represents the rate of return of one investment over a specified time period longer than one year. The formula for AAGR is: [ \text{AAGR} = \left( \frac{\text{End Value}}{\text{Start Value}} \right)^{\frac{1}{\text{Number of Years}}} - 1 ] This method is particularly useful for investments or projects that span several years, providing a clearer picture of the consistent growth rate.

Method 3: Quarterly Year-Over-Year Growth

Sometimes, looking at YoY growth on a quarterly basis can offer a more nuanced view of a company’s or economy’s performance. This involves comparing the data from the current quarter to the same quarter in the previous year. The calculation remains similar, but the time frame is shorter: [ \text{Quarterly YoY Growth} = \left( \frac{\text{Current Quarter Value} - \text{Same Quarter Previous Year Value}}{\text{Same Quarter Previous Year Value}} \right) \times 100 ] This method can help identify seasonal trends or fluctuations that might not be apparent in annual data.

Method 4: Adjusted Year-Over-Year Growth for Seasonality

For industries with significant seasonal fluctuations, adjusting the YoY growth calculation to account for seasonality can provide a more accurate picture. This might involve using a moving average or adjusting the comparison periods to match similar points in the seasonal cycle. - Identify the seasonal pattern: Understand how the business or metric typically performs during different times of the year. - Adjust the comparison: Instead of comparing directly to the previous year, compare to the same period in the previous year, taking into account any known seasonal variations.

Method 5: Compound Annual Growth Rate (CAGR) for Multi-Year Analysis

CAGR is a useful metric for understanding the growth of an investment or a company over multiple years. It provides a constant rate of return that would be required to grow the initial value to the final value, assuming the investment is compounded over the time period. The formula for CAGR is: [ \text{CAGR} = \left( \frac{\text{Final Value}}{\text{Initial Value}} \right)^{\frac{1}{\text{Number of Years}}} - 1 ] CAGR gives a clearer picture of the long-term growth trend, smoothing out fluctuations to show the consistent annual rate of return.

📝 Note: Consistency in calculation and consideration of external factors such as economic conditions and industry trends are crucial for accurate YoY growth analysis.

To summarize, calculating YoY growth involves various methods, each suited to different needs and time frames. Whether it’s the basic YoY calculation, AAGR, quarterly analysis, adjusting for seasonality, or using CAGR for long-term growth, understanding and applying these methods can significantly enhance the ability to assess performance and make informed decisions. By focusing on the most relevant metrics and adjusting calculations to fit the specific context, individuals and organizations can gain valuable insights into their growth trajectories.

What does Year-Over-Year growth indicate?

+

Year-Over-Year (YoY) growth indicates the change in the value of a metric from one year to the next. It’s a measure of how much something has grown or declined over a year.

How do I calculate basic Year-Over-Year growth?

+

To calculate basic YoY growth, subtract the previous year’s value from the current year’s value, divide by the previous year’s value, and then multiply by 100 to get the percentage.

What is the difference between AAGR and CAGR?

+

AAGR (Average Annual Growth Rate) and CAGR (Compound Annual Growth Rate) both measure growth over time but differ in how they account for compounding. CAGR is more commonly used for investments as it assumes the reinvestment of earnings, providing a smoothed rate of return.