Calculate Wacc In Excel Easily

Introduction to WACC Calculation

The Weighted Average Cost of Capital (WACC) is a crucial concept in finance that represents the average cost of capital for a firm, taking into account the costs of different sources of capital, such as debt and equity. Calculating WACC is essential for evaluating investment opportunities, determining the viability of projects, and assessing the overall financial health of a company. In this article, we will delve into the world of WACC calculation, exploring the concept, its importance, and providing a step-by-step guide on how to calculate WACC in Excel easily.

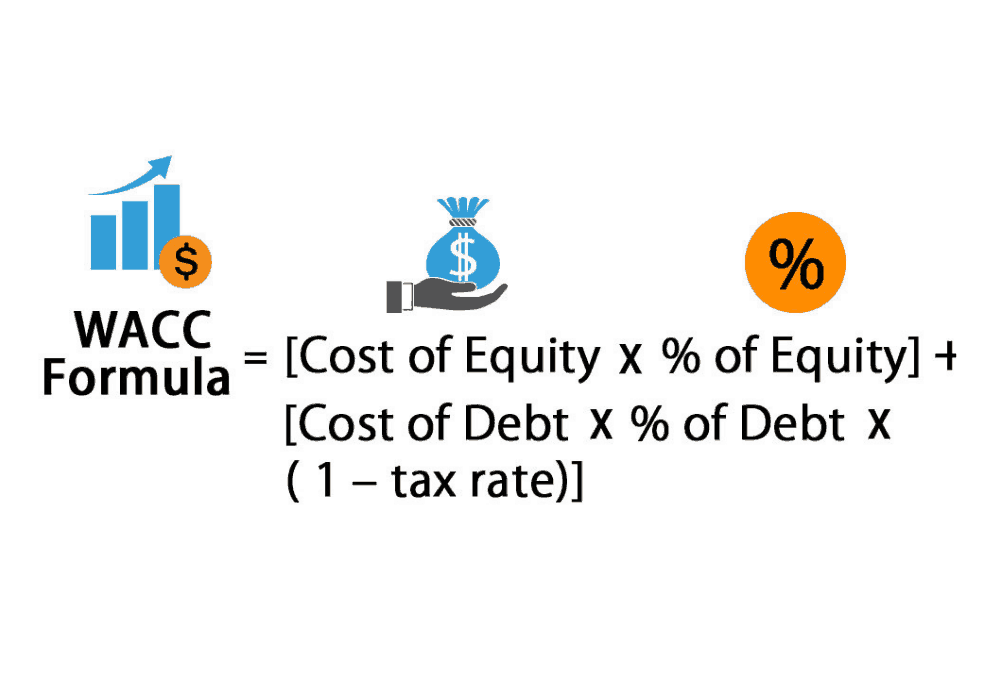

Understanding WACC

Before diving into the calculation process, it’s essential to understand the components of WACC. The formula for calculating WACC is: WACC = (E/V x Re) + (D/V x Rd x (1 - T)) Where: - E = Market value of equity - V = Total market value of the company (E + D) - Re = Cost of equity - D = Market value of debt - Rd = Cost of debt - T = Tax rate

Importance of WACC

WACC is a vital metric for businesses, as it helps them make informed decisions about investments, financing, and growth strategies. A lower WACC indicates that a company can generate more value from its investments, while a higher WACC suggests that the company may struggle to create value. WACC is also used as a hurdle rate for evaluating investment opportunities, ensuring that projects with returns above the WACC are likely to add value to the company.

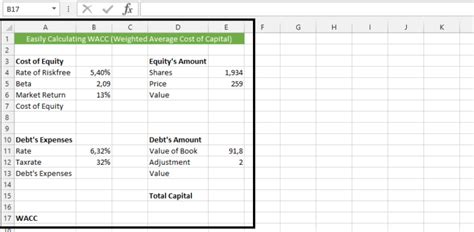

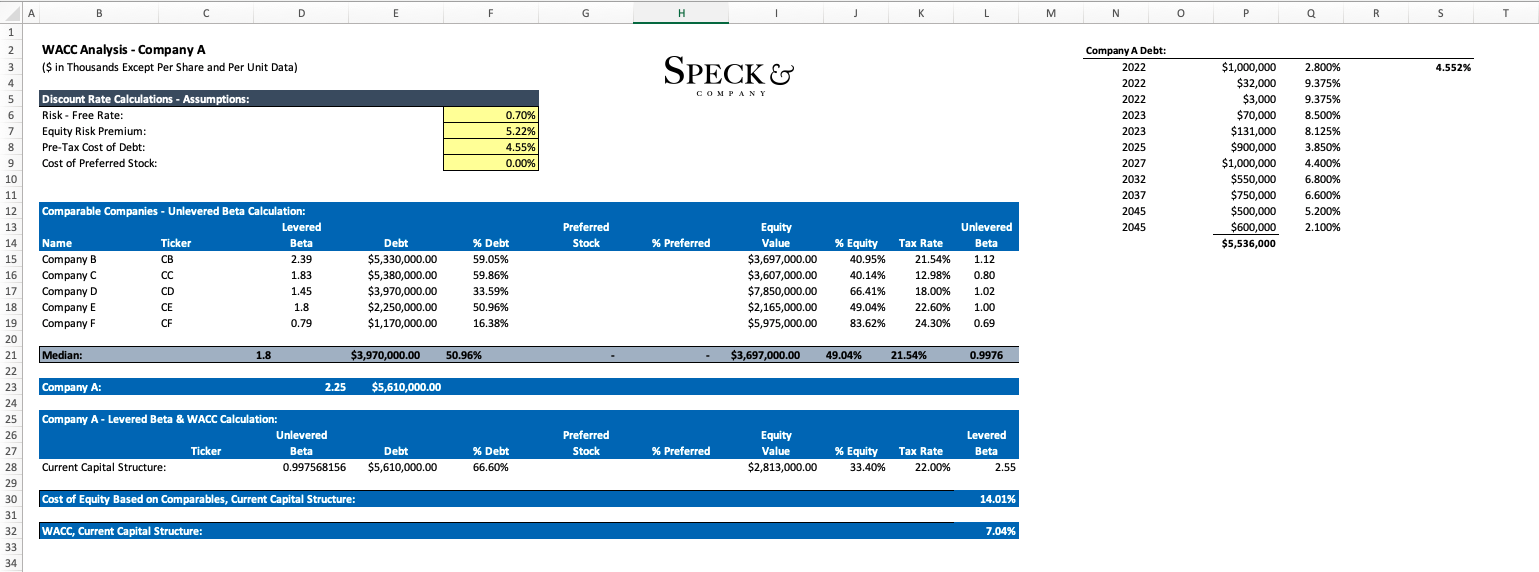

Calculating WACC in Excel

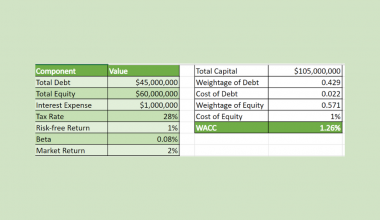

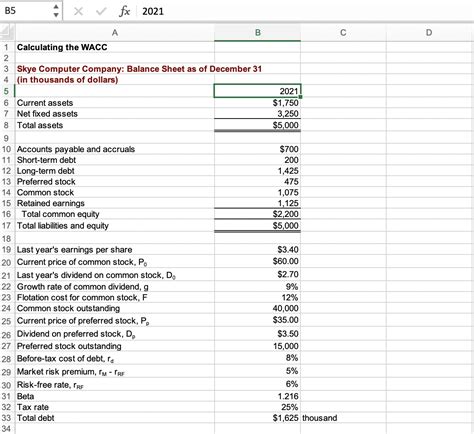

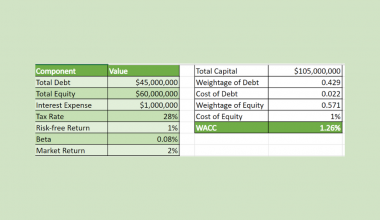

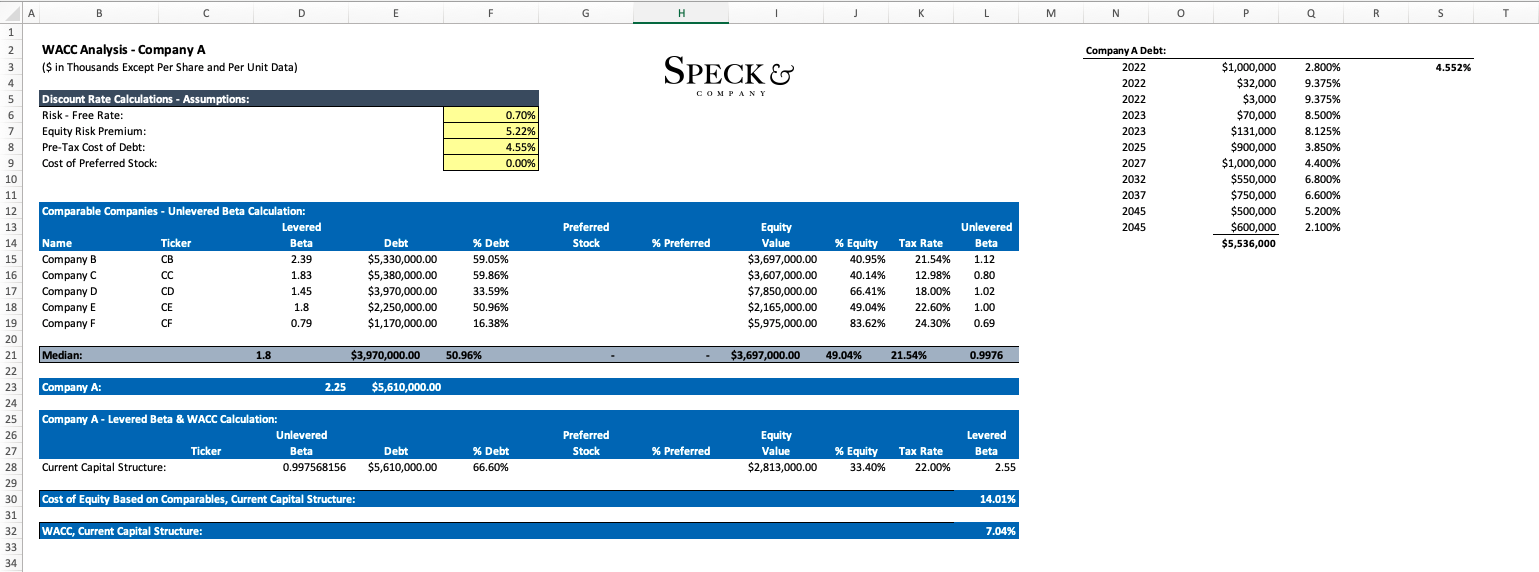

Now, let’s move on to the practical aspect of calculating WACC in Excel. We will use a simple example to illustrate the steps involved in the calculation process.

Assume we have the following data: - Market value of equity (E): 100 million - Market value of debt (D): 50 million - Cost of equity (Re): 12% - Cost of debt (Rd): 8% - Tax rate (T): 25%

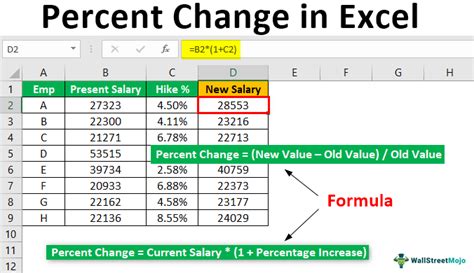

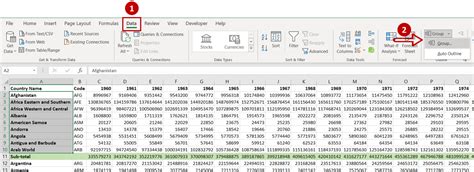

To calculate WACC in Excel, follow these steps:

- Determine the total market value of the company (V): V = E + D = 100 million + 50 million = $150 million

- Calculate the weight of equity (E/V): E/V = 100 million / 150 million = 0.67

- Calculate the weight of debt (D/V): D/V = 50 million / 150 million = 0.33

- Calculate the cost of equity (Re): Re = 12% = 0.12

- Calculate the cost of debt (Rd) after tax: Rd x (1 - T) = 8% x (1 - 0.25) = 6%

- Calculate WACC: WACC = (E/V x Re) + (D/V x Rd x (1 - T)) = (0.67 x 0.12) + (0.33 x 0.06) = 0.084 + 0.02 = 0.104 or 10.4%

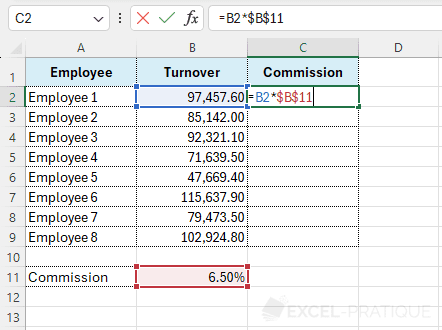

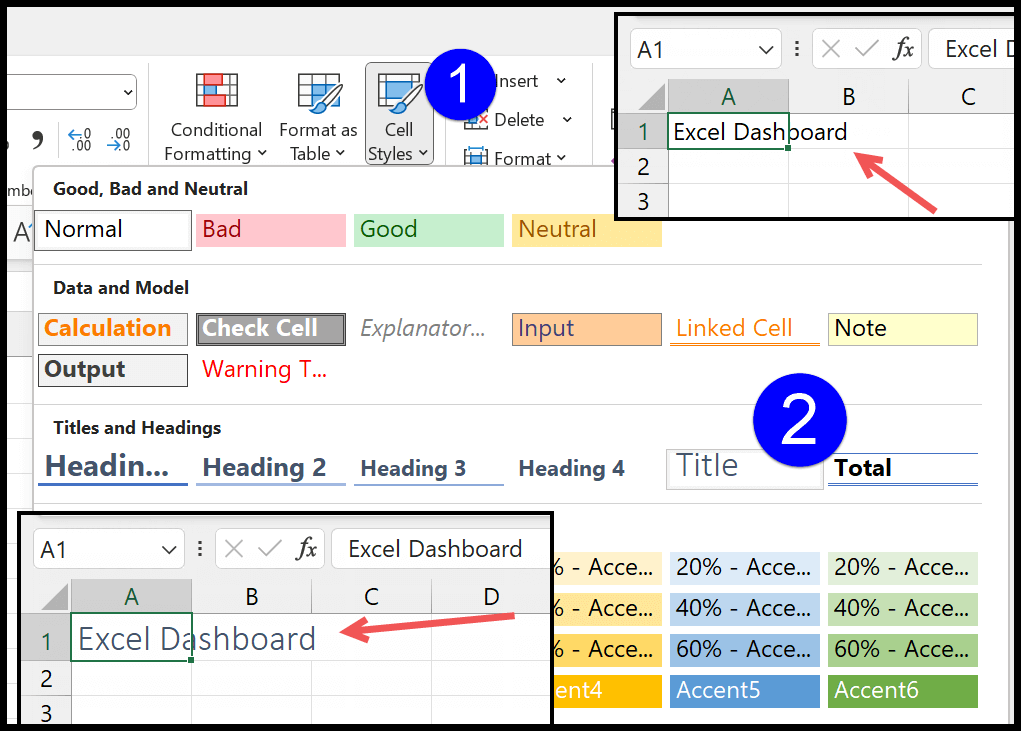

Here’s how you can calculate WACC in Excel:

| Component | Formula | Value |

|---|---|---|

| Market value of equity (E) | =100000000 | $100,000,000 |

| Market value of debt (D) | =50000000 | $50,000,000 |

| Total market value (V) | =E+D | $150,000,000 |

| Weight of equity (E/V) | =E/V | 0.67 |

| Weight of debt (D/V) | =D/V | 0.33 |

| Cost of equity (Re) | =0.12 | 12% |

| Cost of debt (Rd) after tax | =0.08*(1-0.25) | 6% |

| WACC | =(E/V)*Re + (D/V)*Rd*(1-T) | 10.4% |

📝 Note: The formulas and values in the table are examples and may vary depending on the specific company and market conditions.

Using WACC in Decision-Making

Now that we have calculated the WACC, let’s discuss how to use it in decision-making. WACC is commonly used as a hurdle rate for evaluating investment opportunities. If the expected return on an investment is higher than the WACC, it is likely to add value to the company. On the other hand, if the expected return is lower than the WACC, the investment may not be viable.

Here are some key takeaways for using WACC in decision-making: * Evaluate investment opportunities: Use WACC as a hurdle rate to determine whether an investment is likely to add value to the company. * Compare investment options: Use WACC to compare the expected returns of different investment opportunities and choose the one that offers the highest return above the WACC. * Determine the viability of projects: Use WACC to determine whether a project is likely to generate returns above the company’s cost of capital.

In conclusion, calculating WACC is a crucial step in evaluating investment opportunities and determining the viability of projects. By following the steps outlined in this article, you can easily calculate WACC in Excel and use it to make informed decisions about investments and financing. Remember to use WACC as a hurdle rate and compare the expected returns of different investment opportunities to choose the one that offers the highest return above the WACC.

What is the purpose of calculating WACC?

+

The purpose of calculating WACC is to determine the average cost of capital for a company, which can be used to evaluate investment opportunities and determine the viability of projects.

How do I calculate WACC in Excel?

+

To calculate WACC in Excel, follow the steps outlined in this article, which include determining the total market value of the company, calculating the weight of equity and debt, and using the WACC formula.

What is the difference between WACC and cost of equity?

+

WACC is the average cost of capital for a company, while cost of equity is the cost of raising capital through equity financing. WACC takes into account the costs of both debt and equity financing, while cost of equity only considers the cost of equity financing.