Calculate Payback Period In Excel

Introduction to Payback Period Calculation

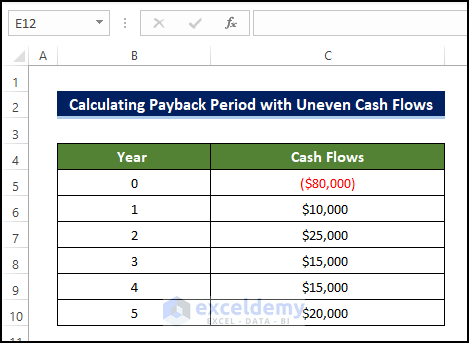

The payback period is a financial metric that calculates the amount of time it takes for an investment to generate cash flows equal to its initial cost. It’s a simple and widely used method for evaluating investment projects. In this blog post, we will learn how to calculate the payback period in Excel.

Understanding the Payback Period Formula

The payback period formula is: Payback Period = Initial Investment / Annual Cash Flow However, this formula assumes that the annual cash flows are constant. If the cash flows vary from year to year, we need to calculate the cumulative cash flows until the initial investment is recovered.

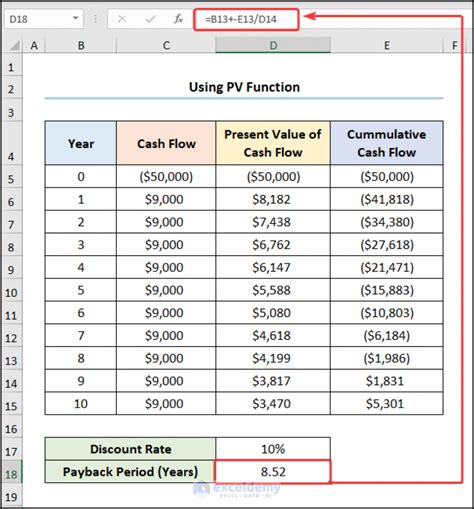

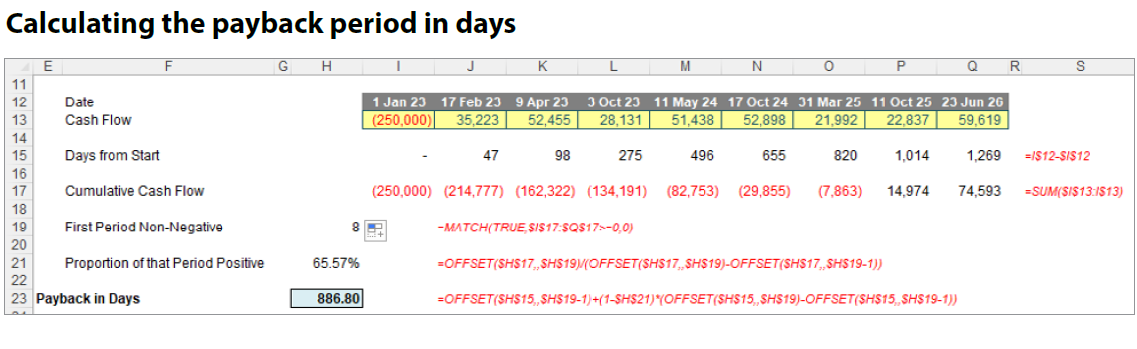

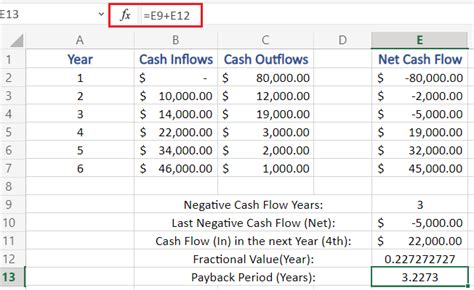

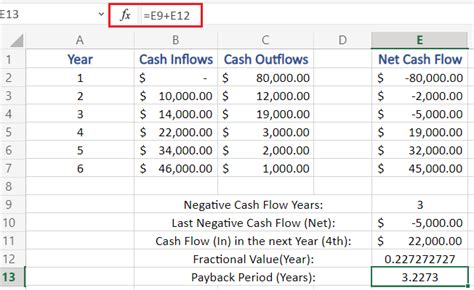

Calculating Payback Period in Excel

To calculate the payback period in Excel, we can follow these steps:

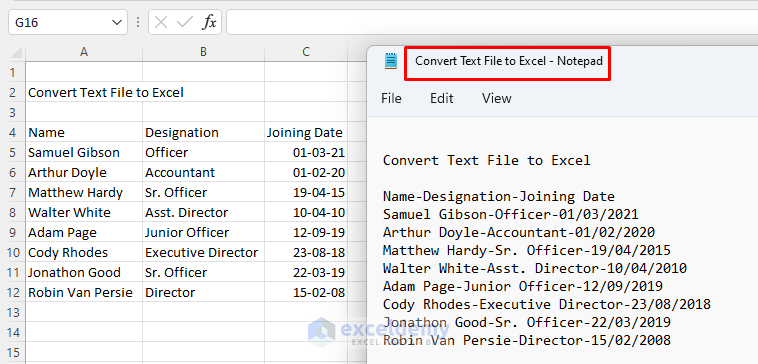

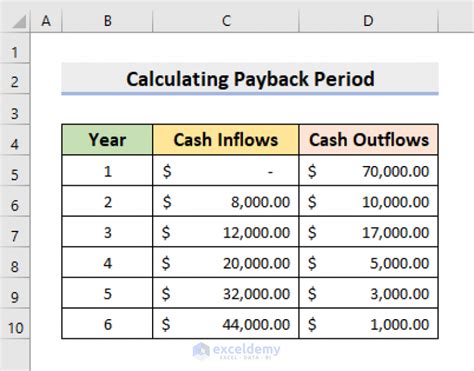

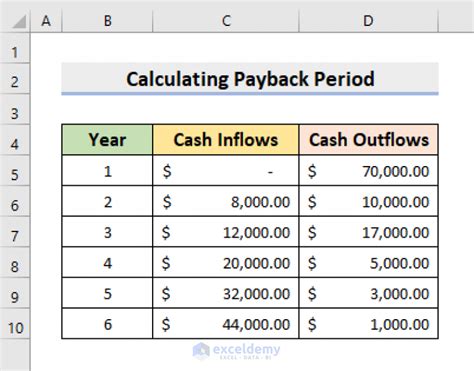

- Enter the initial investment and annual cash flows in a table.

- Calculate the cumulative cash flows by adding the annual cash flows to the previous cumulative cash flow.

- Use the XNPV function or XIRR function to calculate the payback period.

For example, let’s say we have an initial investment of $10,000 and the following annual cash flows:

| Year | Cash Flow |

|---|---|

| 1 | $2,000 |

| 2 | $3,000 |

| 3 | $4,000 |

| 4 | $5,000 |

| 5 | $6,000 |

We can calculate the cumulative cash flows as follows:

| Year | Cash Flow | Cumulative Cash Flow |

|---|---|---|

| 1 | $2,000 | $2,000 |

| 2 | $3,000 | $5,000 |

| 3 | $4,000 | $9,000 |

| 4 | $5,000 | $14,000 |

| 5 | $6,000 | $20,000 |

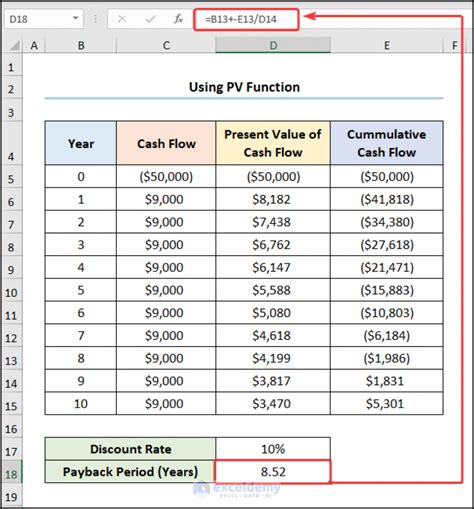

Using the XNPV function, we can calculate the payback period as follows:

=XNPV(0.1, B2:B6, A2:A6)

Where:

- 0.1 is the discount rate

- B2:B6 are the cash flows

- A2:A6 are the years

The result is 3.21 years, which means that the investment will be paid back in approximately 3.21 years.

📝 Note: The payback period calculation assumes that the cash flows occur at the end of each year. If the cash flows occur at different times, we need to adjust the calculation accordingly.

Using the Payback Period to Evaluate Investments

The payback period can be used to evaluate investments by comparing the payback periods of different projects. A shorter payback period indicates a higher return on investment and a lower risk. However, the payback period has some limitations, such as:

- It does not take into account the time value of money

- It does not consider the risk of the investment

- It does not account for the potential for future growth

Therefore, the payback period should be used in conjunction with other evaluation methods, such as the net present value (NPV) and internal rate of return (IRR).

Example of Payback Period Calculation in Excel

Here is an example of how to calculate the payback period in Excel:

| Year | Cash Flow | Cumulative Cash Flow |

|---|---|---|

| 1 | $2,000 | $2,000 |

| 2 | $3,000 | $5,000 |

| 3 | $4,000 | $9,000 |

| 4 | $5,000 | $14,000 |

| 5 | $6,000 | $20,000 |

Using the XNPV function, we can calculate the payback period as follows:

=XNPV(0.1, B2:B6, A2:A6)

The result is 3.21 years, which means that the investment will be paid back in approximately 3.21 years.

📝 Note: The payback period calculation assumes that the cash flows occur at the end of each year. If the cash flows occur at different times, we need to adjust the calculation accordingly.

In summary, the payback period is a simple and widely used method for evaluating investment projects. It calculates the amount of time it takes for an investment to generate cash flows equal to its initial cost. We can calculate the payback period in Excel using the XNPV function or XIRR function. However, the payback period has some limitations, and it should be used in conjunction with other evaluation methods.

To finalize, calculating the payback period is a crucial step in evaluating investment projects, and using Excel can simplify the process. By following the steps outlined above, you can calculate the payback period and make more informed investment decisions.

What is the payback period?

+

The payback period is a financial metric that calculates the amount of time it takes for an investment to generate cash flows equal to its initial cost.

How do I calculate the payback period in Excel?

+

To calculate the payback period in Excel, you can use the XNPV function or XIRR function. Enter the initial investment and annual cash flows in a table, calculate the cumulative cash flows, and then use the XNPV function to calculate the payback period.

What are the limitations of the payback period?

+

The payback period has several limitations, including not taking into account the time value of money, not considering the risk of the investment, and not accounting for the potential for future growth.