Kentucky Tobacco Tax Excel Template

Kentucky Tobacco Tax Excel Template: A Comprehensive Guide

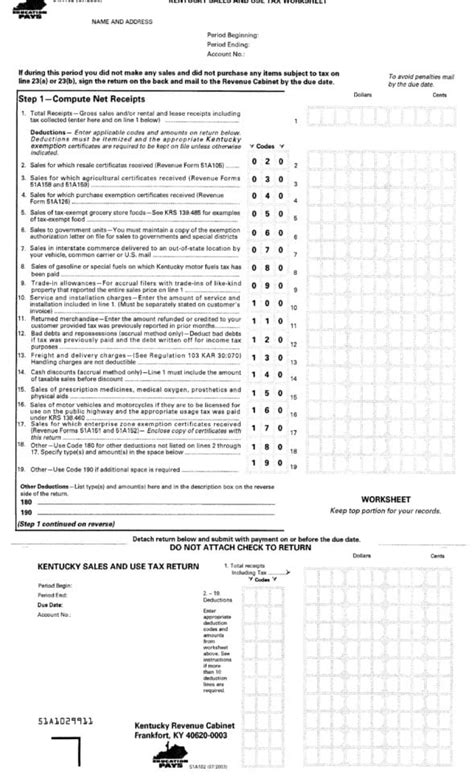

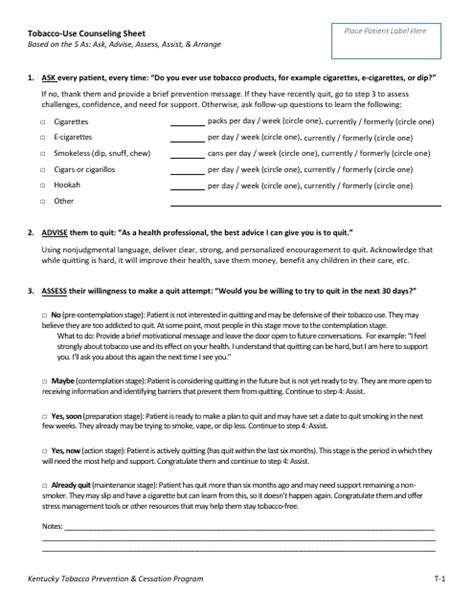

The Kentucky tobacco tax is a significant source of revenue for the state government. The tax is levied on tobacco products, including cigarettes, cigars, and chewing tobacco. In this article, we will discuss the Kentucky tobacco tax Excel template, its features, and how to use it to calculate the tax liability.

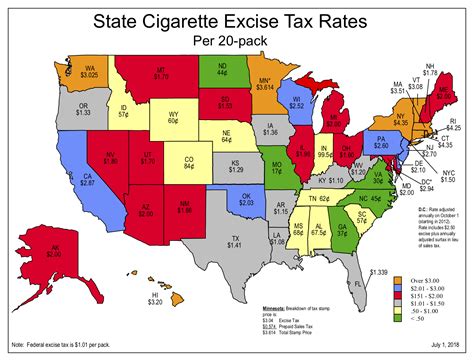

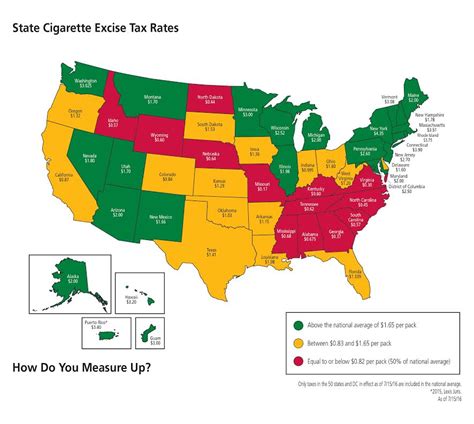

Understanding the Kentucky Tobacco Tax

The Kentucky tobacco tax is imposed on the wholesale price of tobacco products. The tax rate varies depending on the type of tobacco product. For example, the tax rate on cigarettes is $0.60 per pack, while the tax rate on cigars is 15% of the wholesale price. The tax is collected by the Kentucky Department of Revenue and is used to fund various state programs, including healthcare and education.

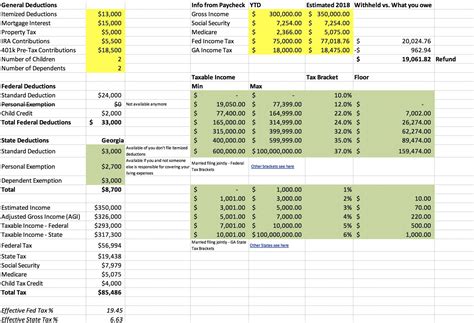

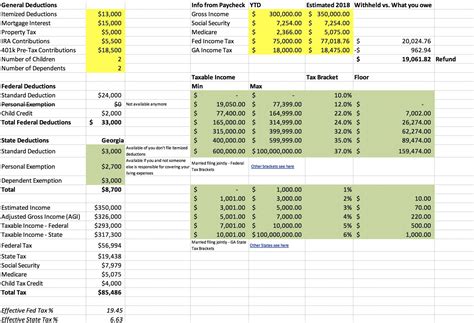

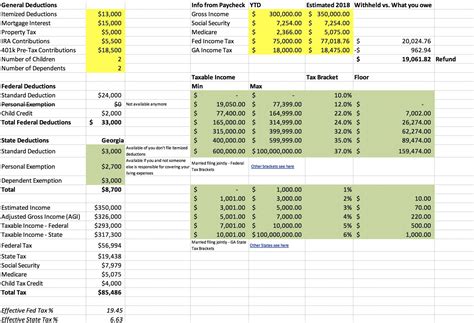

Features of the Kentucky Tobacco Tax Excel Template

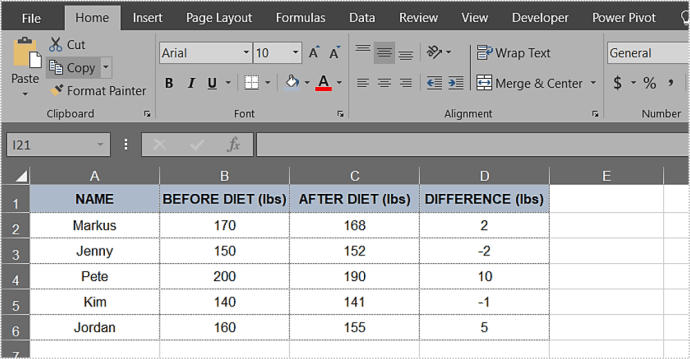

The Kentucky tobacco tax Excel template is a useful tool for calculating the tax liability on tobacco products. The template has the following features: * Tax rates: The template includes the current tax rates for various tobacco products, including cigarettes, cigars, and chewing tobacco. * Wholesale price: The template allows users to enter the wholesale price of the tobacco products. * Tax calculation: The template calculates the tax liability based on the wholesale price and tax rate. * Reporting: The template provides a report of the tax liability, including the total tax due and the amount of tax paid.

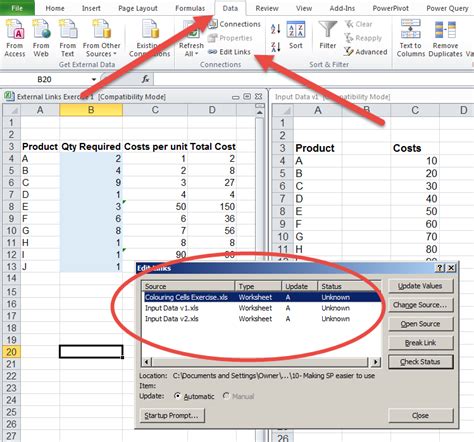

Using the Kentucky Tobacco Tax Excel Template

To use the Kentucky tobacco tax Excel template, follow these steps: * Download the template from a reputable source. * Enter the wholesale price of the tobacco products in the designated cells. * Select the type of tobacco product from the drop-down menu. * The template will calculate the tax liability based on the wholesale price and tax rate. * Review the report to ensure accuracy and completeness.

💡 Note: The Kentucky tobacco tax Excel template is for illustrative purposes only and should not be used for actual tax calculations without consulting a tax professional.

Benefits of Using the Kentucky Tobacco Tax Excel Template

The Kentucky tobacco tax Excel template offers several benefits, including: * Accuracy: The template ensures accuracy in calculating the tax liability, reducing the risk of errors and penalties. * Efficiency: The template saves time and effort in calculating the tax liability, allowing users to focus on other aspects of their business. * Compliance: The template helps users comply with the Kentucky tobacco tax laws and regulations, reducing the risk of non-compliance and penalties.

Common Issues with the Kentucky Tobacco Tax Excel Template

Some common issues with the Kentucky tobacco tax Excel template include: * Outdated tax rates: The template may not reflect the current tax rates, leading to inaccurate calculations. * Incorrect wholesale price: Entering an incorrect wholesale price can result in an incorrect tax calculation. * Formula errors: Errors in the formula can result in incorrect calculations and reports.

Best Practices for Using the Kentucky Tobacco Tax Excel Template

To get the most out of the Kentucky tobacco tax Excel template, follow these best practices: * Regularly update the template: Ensure that the template reflects the current tax rates and laws. * Double-check entries: Verify that the wholesale price and other entries are accurate and complete. * Use the template for reporting: Use the template to generate reports and ensure compliance with the Kentucky tobacco tax laws and regulations.

Alternative Solutions

Alternative solutions to the Kentucky tobacco tax Excel template include: * Tax software: Utilize tax software that is specifically designed for calculating tobacco tax liability. * Consult a tax professional: Consult a tax professional who is familiar with the Kentucky tobacco tax laws and regulations. * Use a different template: Use a different template that is designed for calculating tobacco tax liability.

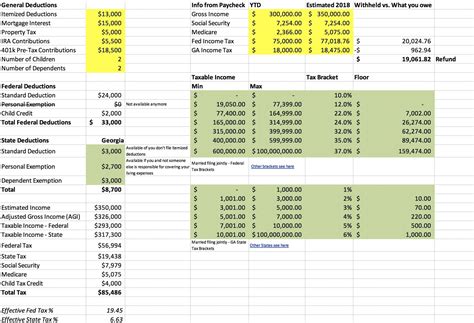

| Tobacco Product | Tax Rate | Wholesale Price | Tax Liability |

|---|---|---|---|

| Cigarettes | $0.60 per pack | $10.00 per pack | $0.60 per pack |

| Cigars | 15% of wholesale price | $5.00 per cigar | $0.75 per cigar |

| Chewing Tobacco | 15% of wholesale price | $3.00 per can | $0.45 per can |

In summary, the Kentucky tobacco tax Excel template is a useful tool for calculating the tax liability on tobacco products. By following the steps outlined in this article and using the template correctly, users can ensure accuracy and compliance with the Kentucky tobacco tax laws and regulations.

To finalize, the key points to consider are the features of the template, the benefits of using it, and the best practices to ensure accurate calculations. By taking these factors into account, users can make the most out of the Kentucky tobacco tax Excel template and ensure compliance with the relevant laws and regulations.

What is the current tax rate on cigarettes in Kentucky?

+

The current tax rate on cigarettes in Kentucky is $0.60 per pack.

How do I calculate the tax liability on chewing tobacco?

+

To calculate the tax liability on chewing tobacco, multiply the wholesale price by the tax rate of 15%.

What is the penalty for non-compliance with the Kentucky tobacco tax laws and regulations?

+

The penalty for non-compliance with the Kentucky tobacco tax laws and regulations varies depending on the severity of the offense, but can include fines and imprisonment.