Excel

Find APR in Excel

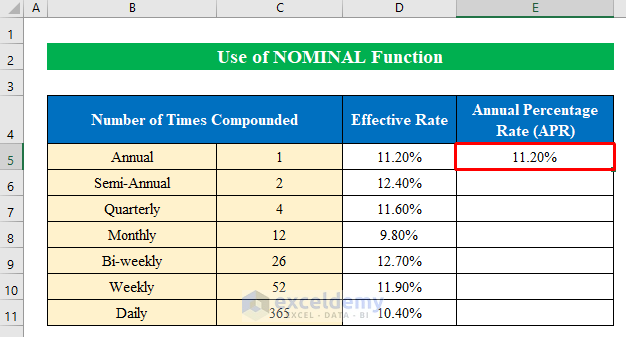

Understanding APR and Its Calculation

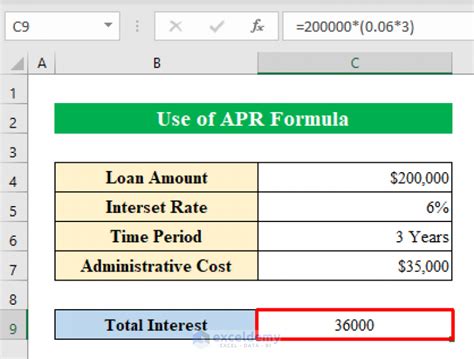

The Annual Percentage Rate (APR) is the interest rate charged on a loan or credit product over a year, including fees. It’s a crucial factor in determining the total cost of borrowing. Calculating APR can be complex, but Excel provides a straightforward way to compute it.

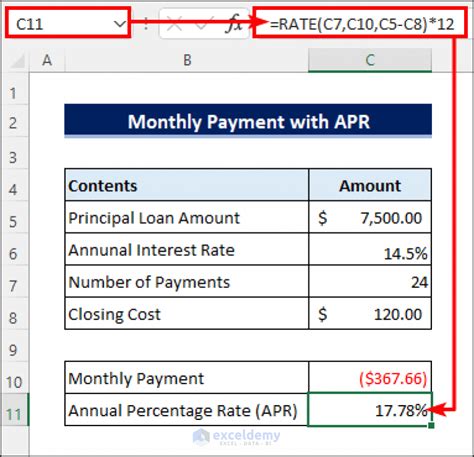

Using the APR Formula in Excel

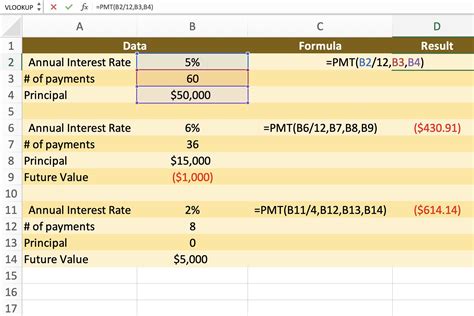

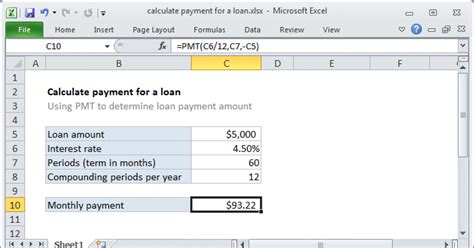

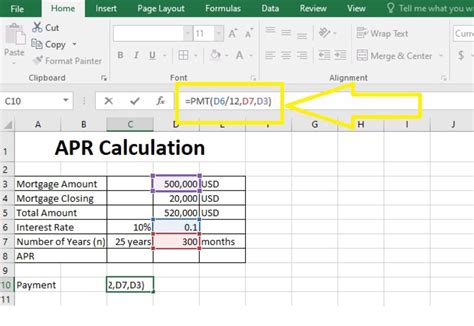

To find the APR in Excel, you can use the RATE function, which is specifically designed for calculating interest rates. The syntax for the RATE function is:

RATE(nper, pmt, pv, [fv], [type], [guess])Where: - nper is the total number of payment periods, - pmt is the payment made each period, - pv is the present value (the initial amount of the loan), - [fv] is the future value (the amount left after the loan is paid off, default is 0), - [type] is when payments are due (0 for end of period, 1 for beginning of period, default is 0), - [guess] is the initial guess for the interest rate (default is 10%).

Example Calculation

Let’s say you borrow 1,000 with a monthly payment of 100 for 12 months. To calculate the APR: - nper = 12 (12 months), - pmt = -100 (negative because it's a payment), - pv = 1,000 (initial loan amount), - [fv] = 0 (assuming the loan is fully paid off), - [type] = 0 ( payments are due at the end of each month), - [guess] = 0.1 (10% initial guess).

The formula would be:

=RATE(12, -100, 1000, 0, 0, 0.1)

Interpreting the Result

The result from the RATE function is a monthly interest rate. To find the APR, you need to multiply this rate by 12. If the result from the formula is 0.008333 (which is approximately 0.8333% monthly), then the APR would be 0.008333 * 12 = 0.1 or 10%.

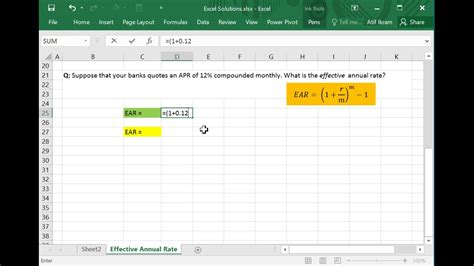

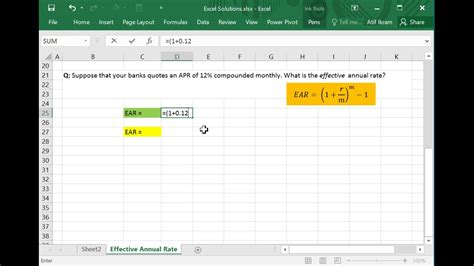

Using the EFFECT Function for APR

Another way to calculate the APR directly is by using the EFFECT function, which calculates the effective annual interest rate from a given nominal annual interest rate. However, since we’re starting with a monthly rate, we can calculate the APR directly using the formula:

=EFFECT(12, -100, 1000)But the EFFECT function doesn’t directly take payments and present value as inputs. It’s more straightforward to calculate the monthly rate with the RATE function and then convert it to APR.

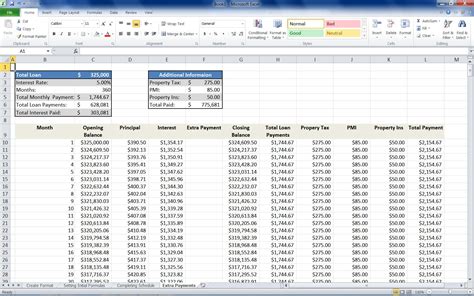

Calculating APR for Credit Cards

When calculating the APR for credit cards, the process can be more complex due to compounding interest. Credit cards often compound interest daily, which means you need to know the daily periodic rate and then calculate the APR based on that. The formula for the daily periodic rate is the APR divided by 365 (days in a year). If you know the monthly payment, balance, and interest charged, you can calculate the APR using the RATE function as described, but you’ll need to adjust the nper and possibly the pmt and pv based on the specifics of the credit card agreement.

Conclusion Without a Heading

Calculating the APR in Excel can be efficiently done using the RATE function. Understanding how to use this function can help in making informed decisions about loans and credit products. Whether you’re comparing different loan offers or trying to understand the total cost of borrowing, knowing the APR is crucial. By following the steps outlined and using the RATE function, you can easily calculate the APR for various financial products directly in Excel.

What does APR stand for?

+

APR stands for Annual Percentage Rate, which is the interest rate charged on a loan or credit product over a year, including fees.

How do I calculate APR in Excel?

+

You can calculate APR in Excel using the RATE function. The syntax is RATE(nper, pmt, pv, [fv], [type], [guess]), where nper is the total number of payment periods, pmt is the payment made each period, pv is the present value, and so on.

What is the difference between APR and interest rate?

+

While both APR and interest rate refer to the cost of borrowing, APR includes fees and compounding interest over a year, providing a more comprehensive view of the loan’s cost.