Excel

5 Ways Excel Balance Sheet

Understanding the Importance of Excel Balance Sheets

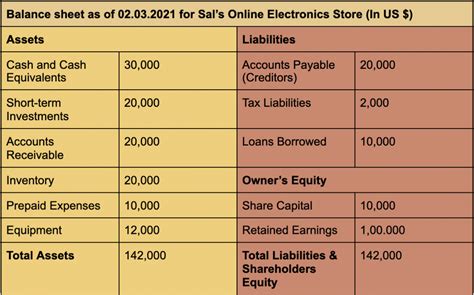

In the realm of financial management and accounting, balance sheets play a crucial role in providing a snapshot of a company’s financial position at a specific point in time. Excel, being a powerful tool for data analysis and visualization, offers an ideal platform for creating, managing, and analyzing balance sheets. An Excel balance sheet is essentially a table that outlines a company’s assets, liabilities, and equity, showcasing its financial health and stability. In this article, we will delve into the world of Excel balance sheets, exploring how to create them, their components, and the benefits they offer to businesses and individuals alike.

Components of an Excel Balance Sheet

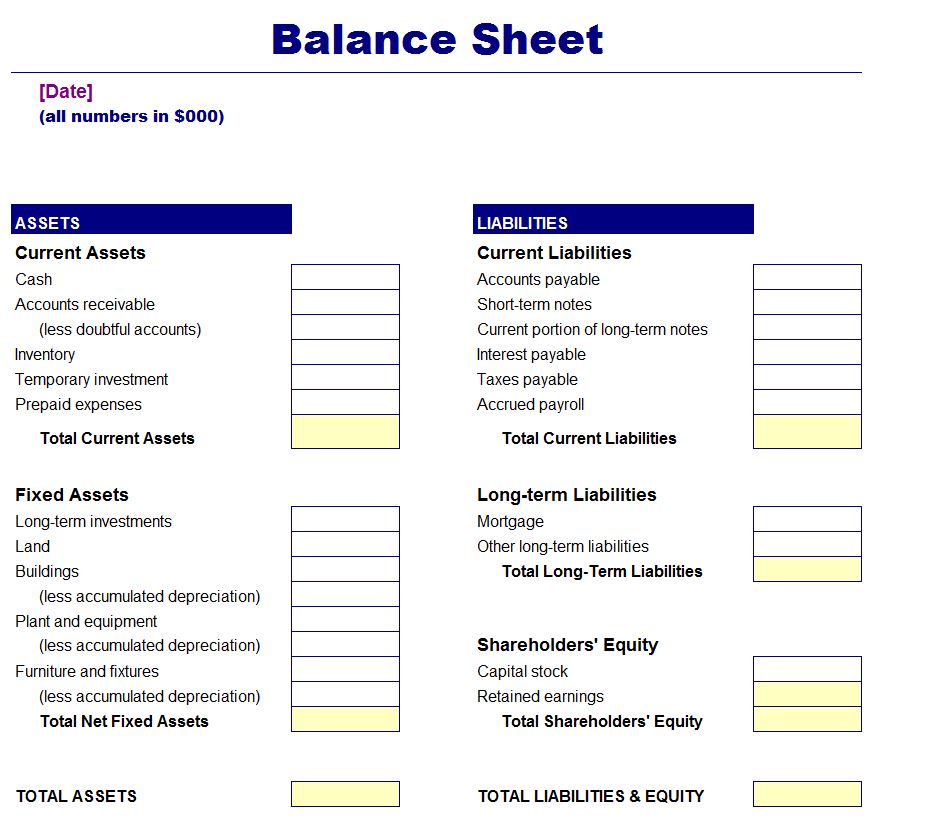

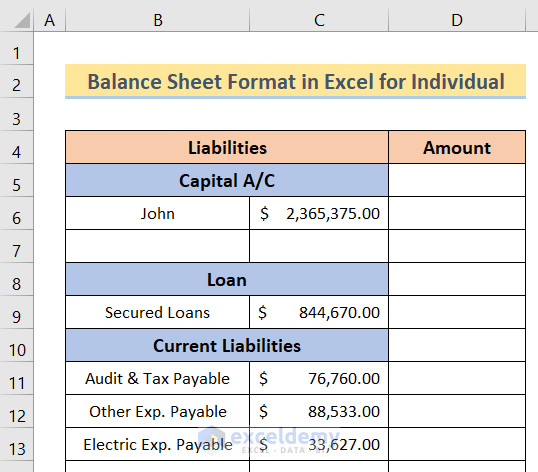

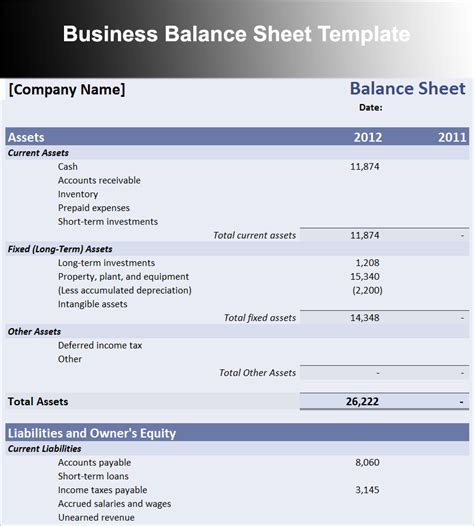

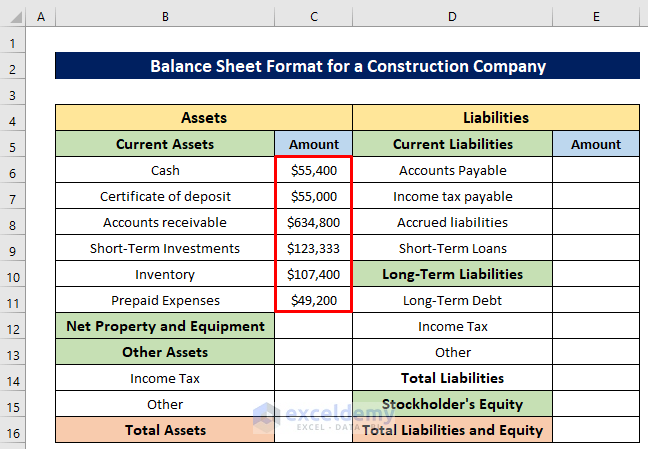

Before diving into the creation and management of Excel balance sheets, it’s essential to understand the core components that make up this financial statement. A balance sheet is divided into three main sections: Assets, Liabilities, and Equity. - Assets: These are the resources owned or controlled by a business, expected to generate future economic benefits. Examples include cash, inventory, equipment, and real estate. - Liabilities: These represent the amounts a business owes to others, which are expected to be settled in the future. Common liabilities include loans, accounts payable, and taxes owed. - Equity: This represents the residual interest in the assets of the entity after deducting liabilities. In simpler terms, it’s the amount that would be left over for shareholders if the company were to liquidate all its assets and pay off all its debts.

Creating an Excel Balance Sheet

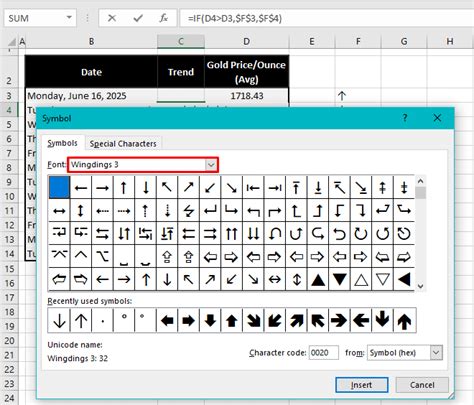

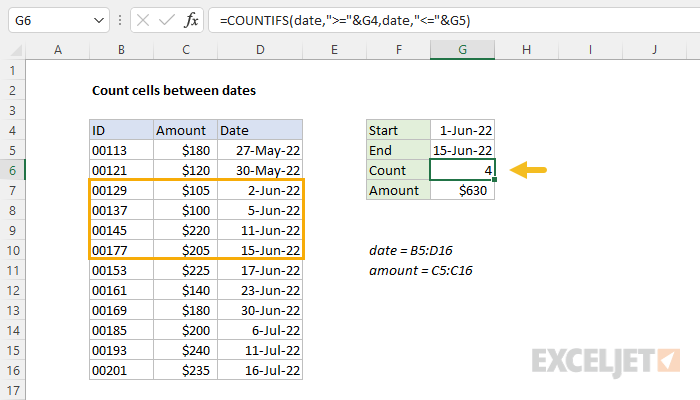

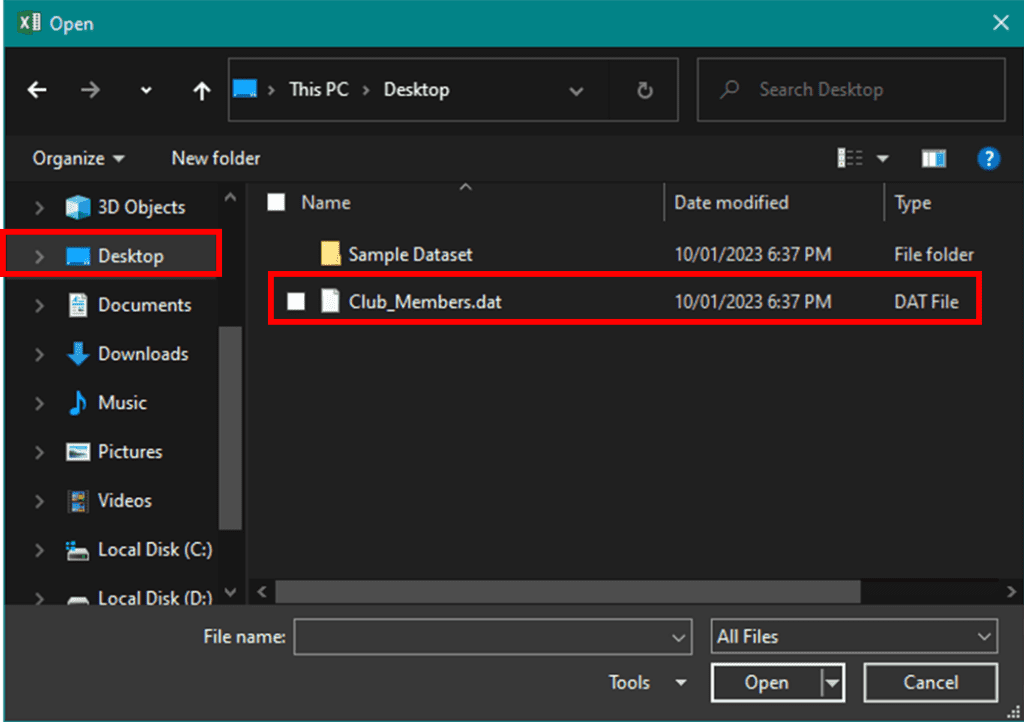

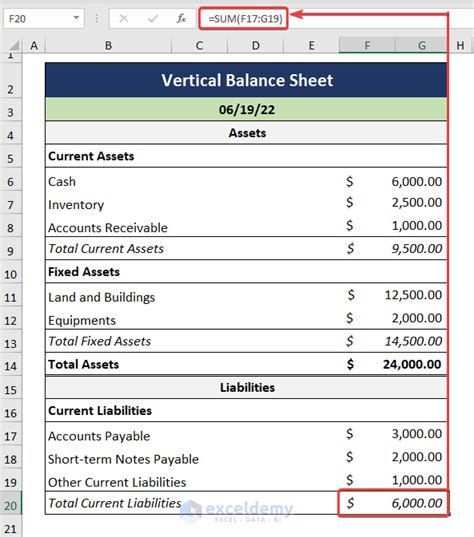

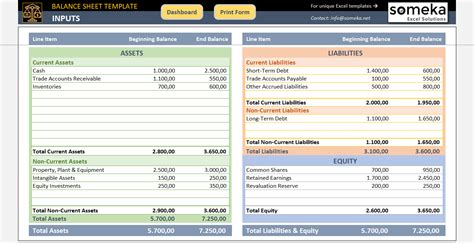

Creating a balance sheet in Excel involves several steps, from setting up the basic structure to inputting financial data. Here’s a simplified approach to get you started: 1. Open Excel: Begin by opening a new Excel spreadsheet. 2. Set Up the Structure: Create columns for the different categories (Assets, Liabilities, Equity) and rows for the specific items within each category (e.g., Cash, Accounts Receivable, Short-term Debt). 3. Input Data: Fill in the financial data for each item. This data should come from your company’s financial records and may include estimated values for certain assets or liabilities. 4. Calculate Totals: Use Excel formulas to calculate the totals for each category and ensure that the balance sheet balances, meaning that Assets = Liabilities + Equity. 5. Format for Readability: Apply appropriate formatting to make the balance sheet easy to read and understand. This can include using headers, adjusting column widths, and applying number formats.

Benefits of Using Excel for Balance Sheets

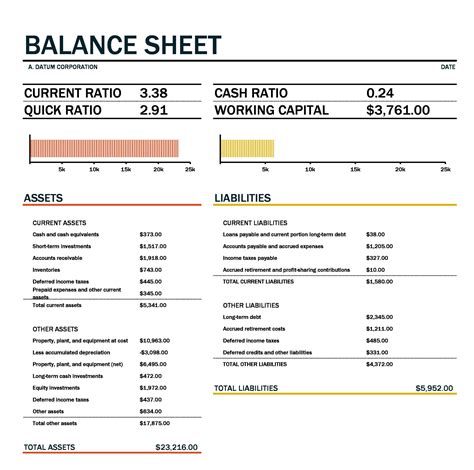

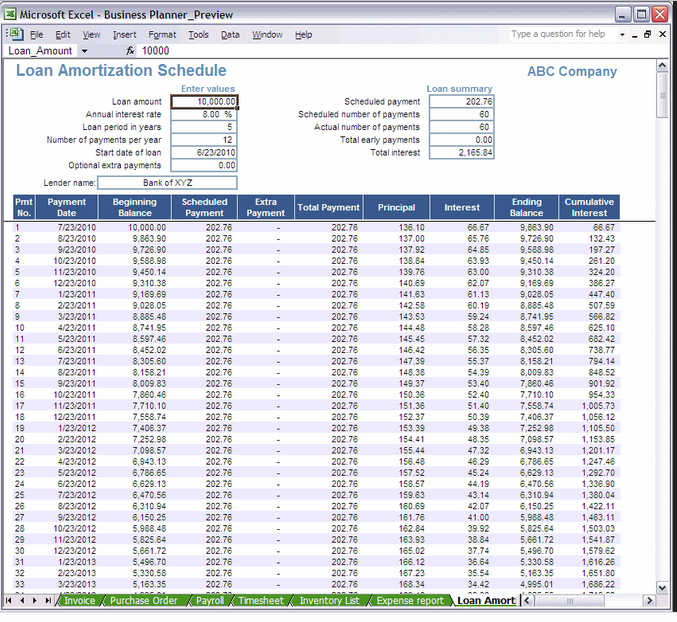

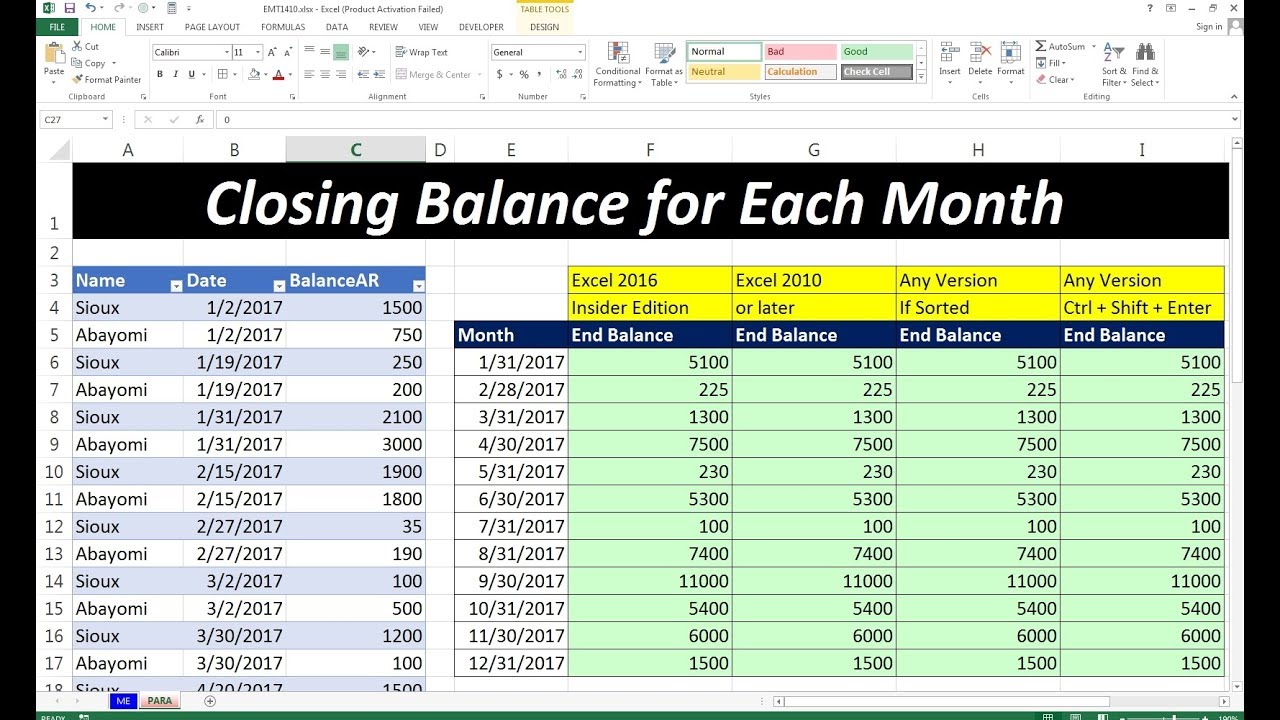

Using Excel for creating and managing balance sheets offers several benefits: - Flexibility and Customization: Excel allows users to customize the balance sheet template according to their specific needs, adding or removing categories and items as necessary. - Automated Calculations: Excel’s formula capabilities enable automatic calculations, reducing the risk of human error and saving time. - Data Analysis: Excel provides various tools and functions for analyzing data, allowing users to draw insights from their balance sheet, such as identifying trends, calculating ratios, and forecasting future financial positions. - Collaboration: Excel files can be easily shared and collaborated on, facilitating teamwork among financial professionals and stakeholders.

5 Ways Excel Enhances Balance Sheet Management

Excel enhances balance sheet management in several key ways: 1. Real-time Updates: With Excel, balance sheets can be updated in real-time, ensuring that financial data is current and reflective of the company’s latest financial position. 2. Scenario Planning: Excel’s “what-if” analysis capabilities enable users to create different scenarios, forecasting how various decisions might impact the company’s financial health. 3. Automated Reporting: Excel can be set up to generate reports automatically, including balance sheets, income statements, and cash flow statements, streamlining the financial reporting process. 4. Error Reduction: By using formulas and functions, Excel reduces the likelihood of errors in financial calculations, providing a more accurate picture of a company’s financial situation. 5. Data Visualization: Excel offers a range of visualization tools, from charts to pivot tables, helping to present complex financial data in a clear and understandable format, which is particularly useful for stakeholders who may not have a financial background.

📝 Note: Regularly reviewing and updating the balance sheet in Excel is crucial for maintaining accurate financial records and making informed business decisions.

Conclusion and Future Directions

In conclusion, Excel balance sheets are a powerful tool for financial management, offering flexibility, automation, and analytical capabilities that enhance financial decision-making. By understanding the components of a balance sheet, learning how to create one in Excel, and leveraging the software’s advanced features, businesses and individuals can gain deeper insights into their financial health and make strategic decisions for future growth and stability. As financial management evolves, the importance of accurate, real-time financial data will only continue to grow, making proficiency in tools like Excel indispensable for anyone involved in financial planning and analysis.

What is the main purpose of a balance sheet?

+

The main purpose of a balance sheet is to provide a snapshot of a company’s financial position at a specific point in time, detailing its assets, liabilities, and equity.

How often should a balance sheet be updated?

+

A balance sheet should be updated regularly, ideally at the end of each accounting period (e.g., monthly, quarterly, annually), to reflect the current financial status of the company.

What are the advantages of using Excel for balance sheet management?

+

The advantages include flexibility, automated calculations, real-time updates, scenario planning, and data visualization, which together enhance financial analysis and decision-making.