5 Ways Calculate Payback

Introduction to Payback Calculation

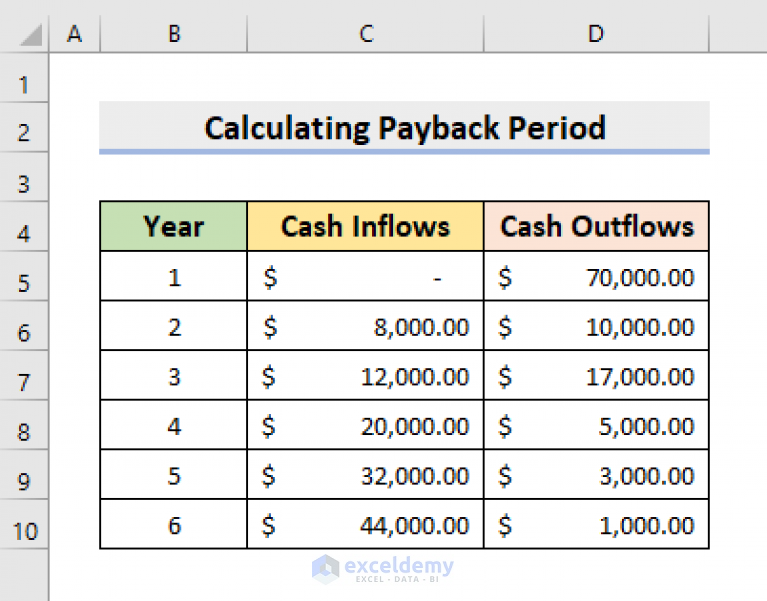

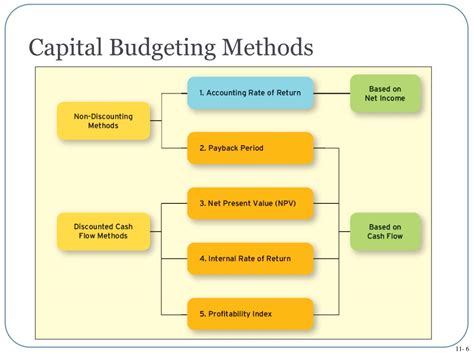

When investing in a new project or venture, one of the key considerations is the payback period, which is the time it takes for the investment to generate returns equal to its initial cost. Calculating the payback period is essential for evaluating the feasibility and potential profitability of an investment. There are several methods to calculate the payback period, each with its own advantages and limitations. In this article, we will explore five ways to calculate payback, providing a comprehensive understanding of the concept and its applications.

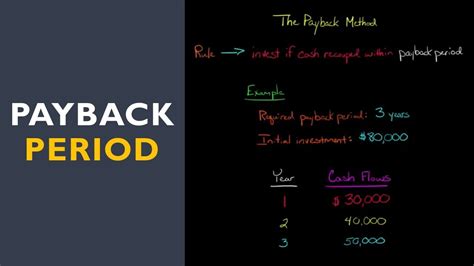

Method 1: Simple Payback Period

The simplest way to calculate the payback period is by dividing the initial investment by the annual cash inflows. This method assumes that the cash inflows are constant over the years and does not take into account the time value of money. The formula for the simple payback period is: Initial Investment / Annual Cash Inflows = Payback Period For example, if an investment of 100,000 generates annual cash inflows of 20,000, the payback period would be 5 years.

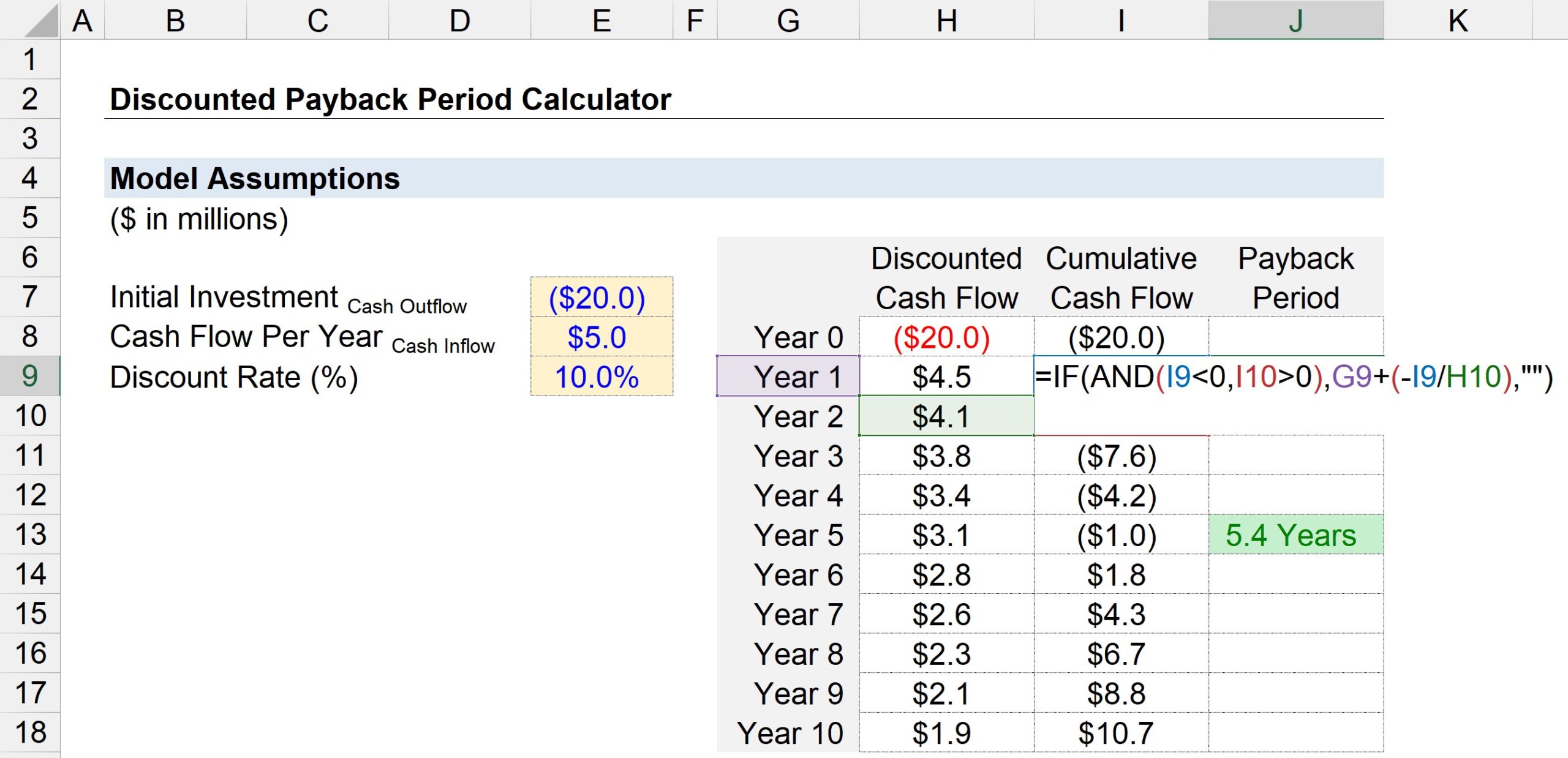

Method 2: Discounted Payback Period

The discounted payback period takes into account the time value of money by discounting the future cash inflows to their present value. This method provides a more accurate calculation of the payback period, as it considers the fact that money received today is worth more than the same amount received in the future. The formula for the discounted payback period is: Present Value of Cash Inflows / Initial Investment = Payback Period Using the same example as above, if the discount rate is 10%, the present value of the annual cash inflows would be $18,181, and the payback period would be approximately 5.5 years.

Method 3: Net Present Value (NPV) Method

The NPV method calculates the present value of all cash inflows and outflows over the life of the project, using a discount rate to determine the time value of money. The NPV is then compared to the initial investment to determine the payback period. The formula for the NPV method is: NPV = Σ (Cash Inflows / (1 + Discount Rate)^Year) - Initial Investment If the NPV is positive, the investment is considered viable, and the payback period can be calculated using the same formula as the simple payback period.

Method 4: Internal Rate of Return (IRR) Method

The IRR method calculates the rate of return at which the NPV of the investment is zero. This method provides a more comprehensive evaluation of the investment, as it considers the time value of money and the risk associated with the project. The formula for the IRR method is: 0 = Initial Investment + Σ (Cash Inflows / (1 + IRR)^Year) Using the same example as above, if the IRR is 15%, the payback period would be approximately 4.5 years.

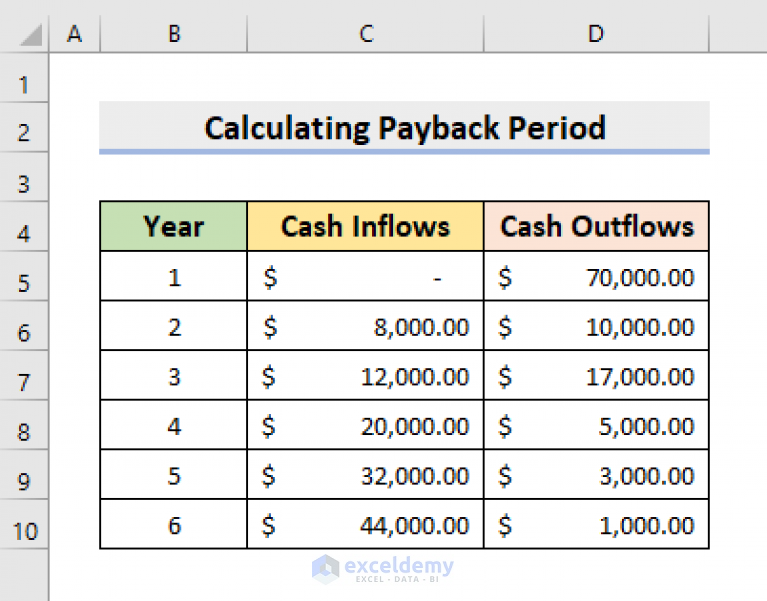

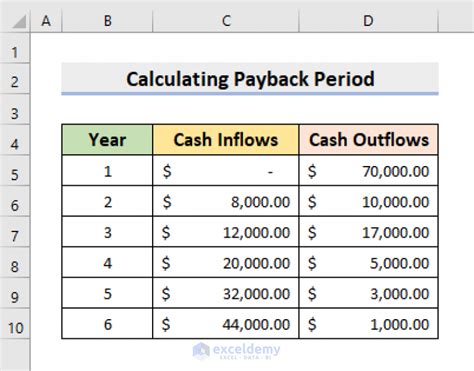

Method 5: Payback Period with Uneven Cash Flows

In some cases, the cash inflows may not be constant over the years. To calculate the payback period with uneven cash flows, we need to calculate the cumulative cash inflows over the years and determine the point at which the cumulative cash inflows equal the initial investment. The formula for the payback period with uneven cash flows is: Payback Period = Year in which Cumulative Cash Inflows ≥ Initial Investment For example, if the cash inflows are 20,000 in year 1, 30,000 in year 2, and 40,000 in year 3, the cumulative cash inflows would be 20,000, 50,000, and 90,000, respectively. The payback period would be approximately 2.5 years.

💡 Note: The choice of method depends on the specific circumstances of the investment and the level of accuracy required. It is essential to consider the time value of money and the risk associated with the project when evaluating the payback period.

To summarize, calculating the payback period is crucial for evaluating the feasibility and potential profitability of an investment. The five methods presented in this article provide a comprehensive understanding of the concept and its applications. By considering the time value of money, risk, and uneven cash flows, investors can make informed decisions about their investments.

What is the payback period, and why is it important?

+

The payback period is the time it takes for an investment to generate returns equal to its initial cost. It is essential for evaluating the feasibility and potential profitability of an investment, as it helps investors determine whether the investment is viable and whether it aligns with their financial goals.

What are the differences between the simple payback period and the discounted payback period?

+

The simple payback period does not take into account the time value of money, whereas the discounted payback period considers the fact that money received today is worth more than the same amount received in the future. The discounted payback period provides a more accurate calculation of the payback period, as it considers the risk associated with the project and the time value of money.

How do I choose the most suitable method for calculating the payback period?

+

The choice of method depends on the specific circumstances of the investment and the level of accuracy required. If the cash inflows are constant and the time value of money is not a significant concern, the simple payback period may be sufficient. However, if the cash inflows are uneven or the time value of money is a significant concern, the discounted payback period or the NPV method may be more suitable.