Excel

Ohio Tobacco Tax Excel Import Guide

Introduction to Ohio Tobacco Tax Excel Import

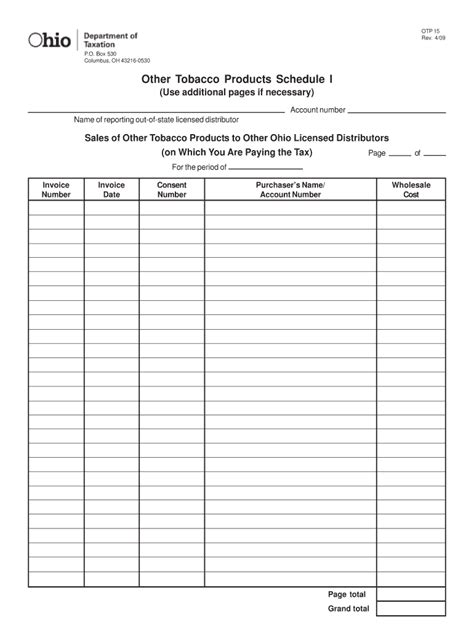

The Ohio tobacco tax is a crucial aspect of the state’s revenue system, and managing it efficiently is essential for both businesses and the government. One of the key tools used in this management is the Excel import feature, which allows for the seamless transfer of data related to tobacco tax. This guide is designed to walk you through the process of using the Excel import feature for Ohio tobacco tax, making it easier to navigate and understand the complexities involved.

Understanding the Ohio Tobacco Tax

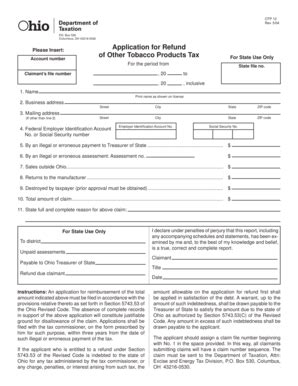

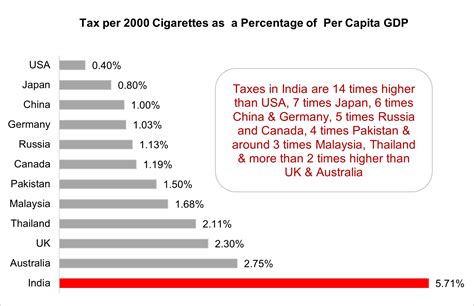

Before diving into the Excel import process, it’s essential to have a basic understanding of the Ohio tobacco tax. The tax is levied on the sale of tobacco products, including cigarettes, cigars, and other tobacco-related items. The tax rate can vary, and it’s crucial to stay updated with the latest rates and regulations. Staying compliant with these regulations is vital for businesses to avoid penalties and ensure smooth operations.

Preparing Your Excel File

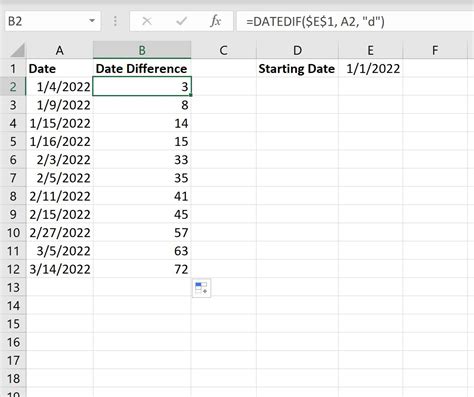

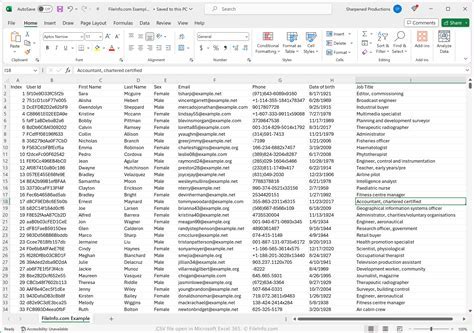

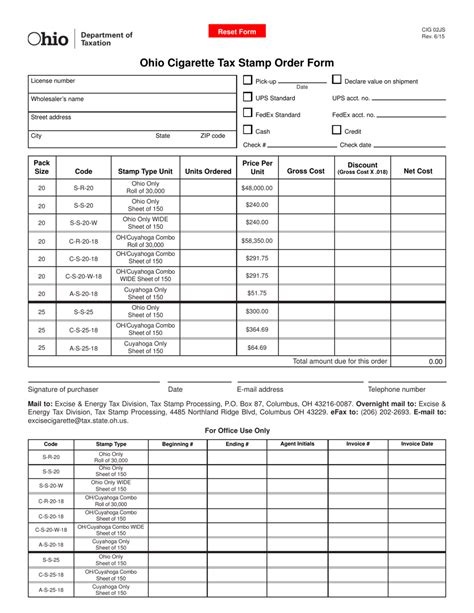

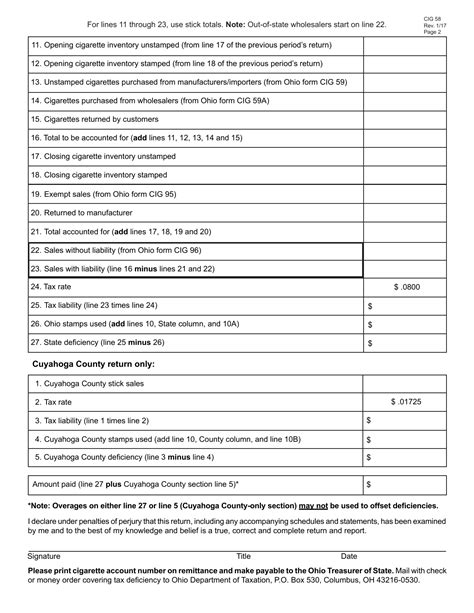

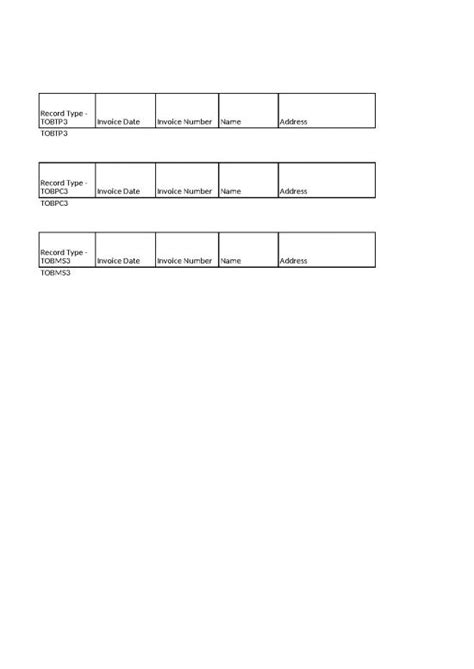

To import data into the Ohio tobacco tax system, you’ll need to prepare your Excel file according to the specified requirements. Here are the steps to follow: - Ensure your Excel file is in the correct format, usually.xlsx or.xls. - Organize your data into columns, with each column representing a specific piece of information, such as the product type, quantity sold, and sale date. - Verify the accuracy of your data, as incorrect information can lead to errors during the import process. - Use the provided template or guidelines from the Ohio tobacco tax authority to ensure your file is structured correctly.

Importing Your Excel File

Once your Excel file is prepared, you can proceed to import it into the system. The steps for this process may vary depending on the specific system you’re using, but generally, you’ll need to: - Log into your account on the Ohio tobacco tax website or platform. - Navigate to the section for filing returns or submitting data. - Look for the option to upload or import a file, usually indicated by a button or link. - Select your prepared Excel file and follow the prompts to complete the upload. - Review the data after upload to ensure everything has been transferred correctly.

Troubleshooting Common Issues

During the import process, you might encounter some common issues, such as: - File format errors: Ensure your file is in the required format. - Data inconsistencies: Check your data for any inconsistencies or errors. - System glitches: Try restarting the process or contacting support if you encounter any technical issues.

📝 Note: Always refer to the official Ohio tobacco tax guidelines for the most current and detailed information on the Excel import process.

Benefits of Using Excel Import for Ohio Tobacco Tax

Using the Excel import feature for managing Ohio tobacco tax offers several benefits, including: - Efficiency: It saves time by allowing for the bulk transfer of data. - Accuracy: By minimizing manual entry, it reduces the chance of human error. - Compliance: It helps ensure businesses are compliant with tax regulations by facilitating the accurate and timely submission of tax data.

Conclusion and Final Thoughts

In conclusion, the Excel import feature is a valuable tool for managing Ohio tobacco tax. By following the guidelines and tips outlined in this guide, businesses can efficiently manage their tax obligations, ensuring compliance and reducing the risk of errors. Remember, staying updated with the latest regulations and using the provided templates can significantly simplify the process.

What is the current tax rate for tobacco products in Ohio?

+

The tax rate can vary, so it’s essential to check the latest information from the Ohio tobacco tax authority for the most current rates.

Can I import data for multiple periods at once?

+

Yes, depending on the system, you might be able to import data for multiple periods. However, it’s best to consult the specific guidelines for the Ohio tobacco tax system you’re using.

How do I correct errors found after importing my Excel file?

+

For errors found after importing, you may need to correct the source Excel file and re-import it, or use the system’s built-in editing features if available. Always refer to the official guidelines for the most appropriate action.