Find Beta in Excel

Introduction to Beta in Finance

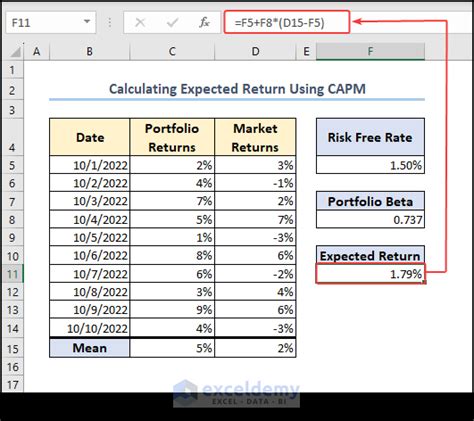

In the realm of finance, beta is a measure used to quantify the volatility of a stock or a portfolio in relation to the overall market. It’s a crucial metric for investors, as it helps them understand the potential risks and returns associated with their investments. In this article, we will delve into the world of beta, exploring its significance, calculation, and how to find it in Excel.

Understanding Beta

Beta is a numerical value that represents the relationship between the price movements of a stock and the overall market. A beta of: - 1 indicates that the stock’s price movements are in line with the market. - Less than 1 suggests that the stock is less volatile than the market. - Greater than 1 implies that the stock is more volatile than the market. For instance, if a stock has a beta of 1.2, it means that for every 1% movement in the market, the stock’s price is expected to move by 1.2%.

Calculating Beta

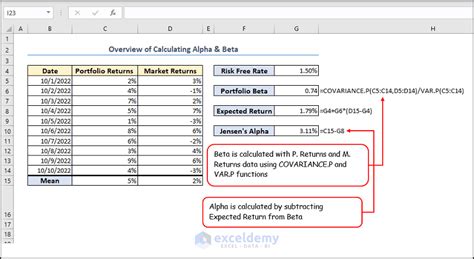

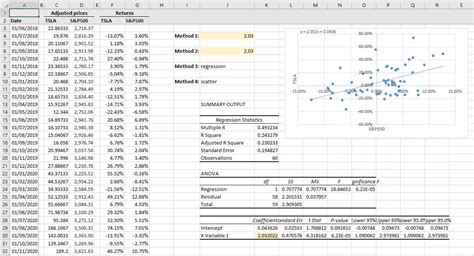

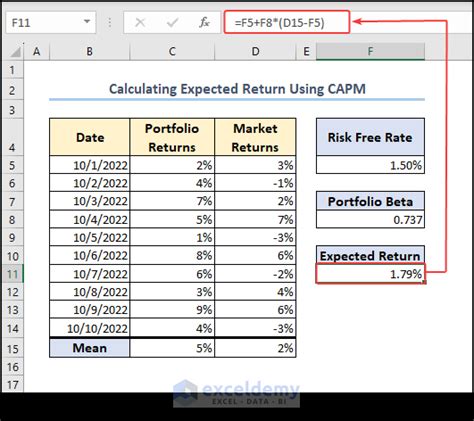

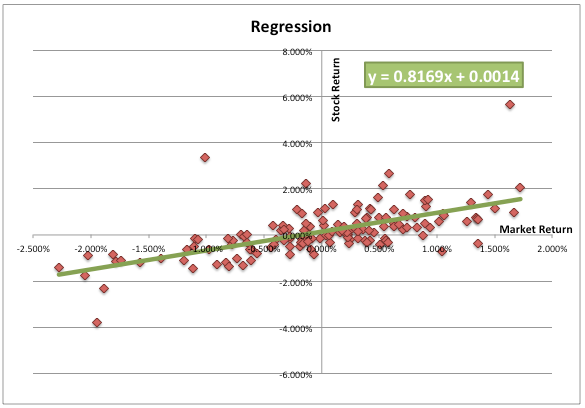

The calculation of beta involves regression analysis, where the historical returns of a stock are plotted against the historical returns of the market. The slope of the regression line represents the beta of the stock. Mathematically, beta can be calculated using the following formula: β = Cov(Ri, Rm) / Var(Rm) where: - β is the beta of the stock - Ri is the return on the stock - Rm is the return on the market - Cov(Ri, Rm) is the covariance between the stock’s returns and the market’s returns - Var(Rm) is the variance of the market’s returns

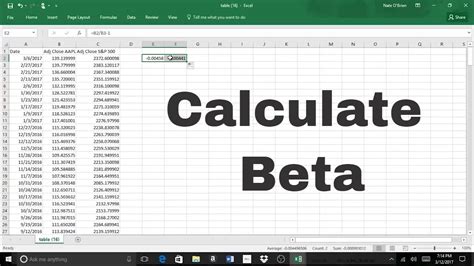

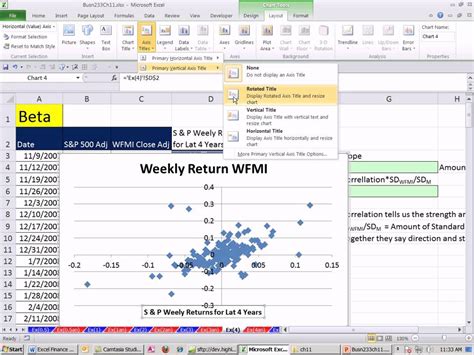

Finding Beta in Excel

Now, let’s move on to finding beta in Excel. We’ll use a simple example to illustrate the steps involved. Assuming we have the following data:

| Stock Returns | Market Returns |

|---|---|

| 0.05 | 0.03 |

| 0.02 | 0.01 |

| 0.08 | 0.05 |

| 0.04 | 0.02 |

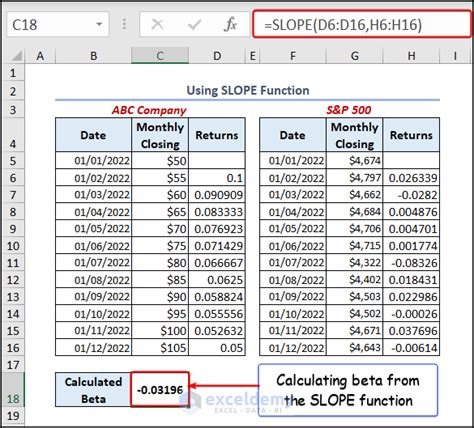

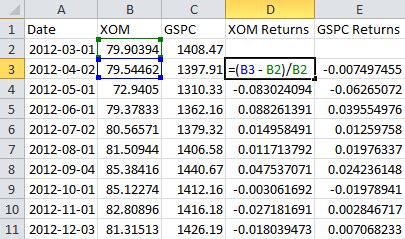

To calculate beta in Excel, follow these steps: 1. Enter the data: Enter the stock returns and market returns in two separate columns. 2. Calculate the covariance: Use the formula

COVAR(array1, array2) to calculate the covariance between the stock’s returns and the market’s returns.

3. Calculate the variance: Use the formula VAR(array) to calculate the variance of the market’s returns.

4. Calculate beta: Use the formula β = COVAR(array1, array2) / VAR(array) to calculate the beta of the stock.

📝 Note: Make sure to select the entire range of data when using the COVAR and VAR functions.

Interpreting Beta

Once you’ve calculated the beta, you can interpret the results as follows: - A high beta indicates that the stock is more volatile than the market. - A low beta suggests that the stock is less volatile than the market. - A negative beta implies that the stock’s price movements are inversely related to the market.

In the world of finance, understanding beta is crucial for making informed investment decisions. By calculating and interpreting beta, investors can better manage their risk and potential returns.

Additional Considerations

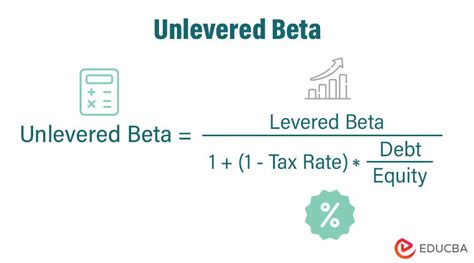

When working with beta, it’s essential to keep in mind the following: * Historical data: Beta is calculated using historical data, which may not reflect future market conditions. * Market conditions: Beta can be affected by changes in market conditions, such as shifts in investor sentiment or economic trends. * Diversification: Beta can be reduced by diversifying a portfolio, as the volatility of individual stocks can be mitigated by holding a range of assets.

In summary, beta is a valuable metric for investors, providing insights into the potential risks and returns associated with their investments. By understanding how to calculate and interpret beta, investors can make more informed decisions and better manage their portfolios.

To further reinforce your understanding of beta, consider the following key points: * Beta is a measure of volatility relative to the market. * A beta of 1 indicates that the stock’s price movements are in line with the market. * Beta can be calculated using regression analysis or the COVAR and VAR functions in Excel. * Interpreting beta requires consideration of the stock’s volatility relative to the market.

What is beta in finance?

+

Beta is a measure of the volatility of a stock or portfolio in relation to the overall market.

How is beta calculated?

+

Beta is calculated using regression analysis or the COVAR and VAR functions in Excel.

What does a high beta indicate?

+

A high beta indicates that the stock is more volatile than the market.