5 Free Excel Bankruptcy Templates

Introduction to Bankruptcy and Excel Templates

Managing finances, especially during challenging times like bankruptcy, requires meticulous planning and organization. Excel, with its versatile spreadsheet capabilities, can be an invaluable tool in tracking expenses, income, and debt repayment plans. For individuals or businesses facing financial difficulties, utilizing Excel bankruptcy templates can simplify the process of financial management and planning. This article explores the benefits and applications of five free Excel bankruptcy templates that can aid in navigating the complexities of bankruptcy.

Understanding Bankruptcy

Before diving into the templates, it’s essential to have a basic understanding of what bankruptcy entails. Bankruptcy is a legal process that allows individuals or businesses to restructure or eliminate debts under the protection of the federal bankruptcy court. The two most common types of personal bankruptcy are Chapter 7 and Chapter 13. Chapter 7 involves liquidating assets to pay off creditors, while Chapter 13 involves creating a repayment plan. For businesses, Chapter 11 is the most common, focusing on reorganizing debts and becoming profitable again.

Benefits of Using Excel Templates for Bankruptcy

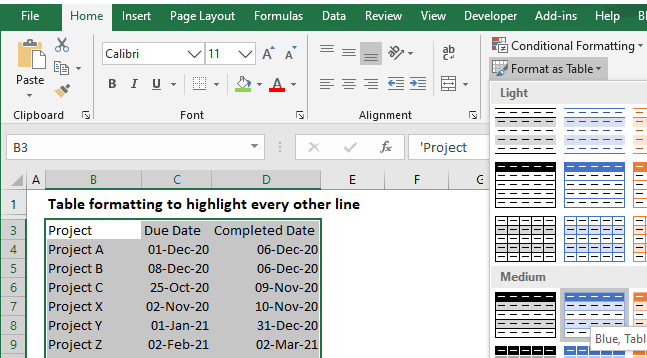

Excel templates offer several benefits for managing bankruptcy, including: - Organization: Keeping all financial information in one place. - Budgeting: Creating detailed budgets and tracking expenses. - Forecasting: Projecting future financial situations based on current data. - Simplicity: Easy to understand and use, even for those without extensive financial knowledge. - Customization: Templates can be adjusted to fit individual or business needs.

5 Free Excel Bankruptcy Templates

Here are descriptions of five free Excel templates designed to help with bankruptcy planning and management:

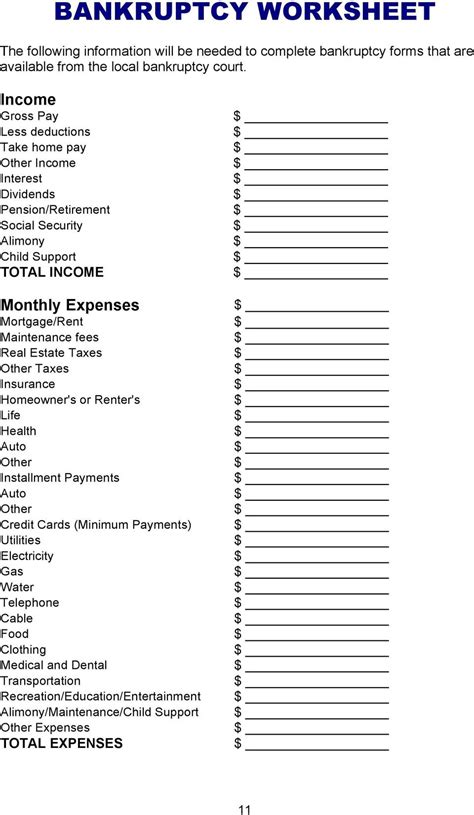

- Personal Budget Template: This template is ideal for creating a monthly budget, which is crucial during bankruptcy. It allows users to input income and expenses, automatically calculating the difference and providing a clear picture of financial health.

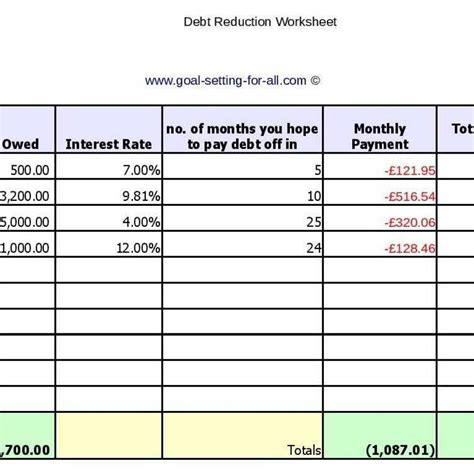

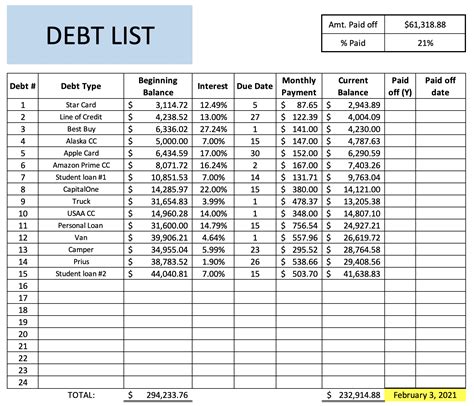

- Debt Repayment Plan Template: Designed for those undergoing Chapter 13 bankruptcy, this template helps in organizing debts, interest rates, and monthly payments. It can calculate how long it will take to pay off debts based on different payment scenarios.

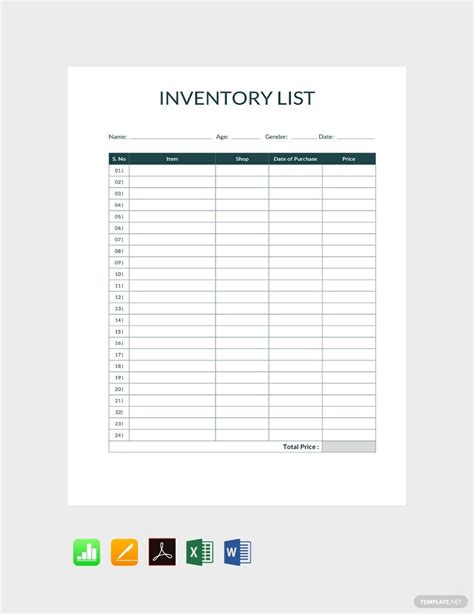

- Expense Tracker Template: For meticulous tracking of daily expenses, this template categorizes spending into necessities, discretionary spending, and debt payments. It’s invaluable for identifying areas where expenses can be reduced.

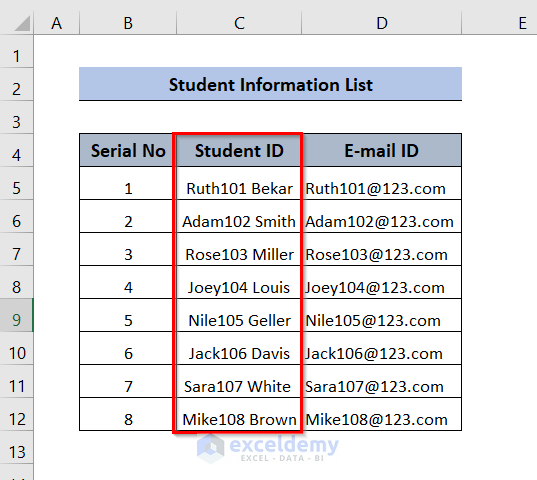

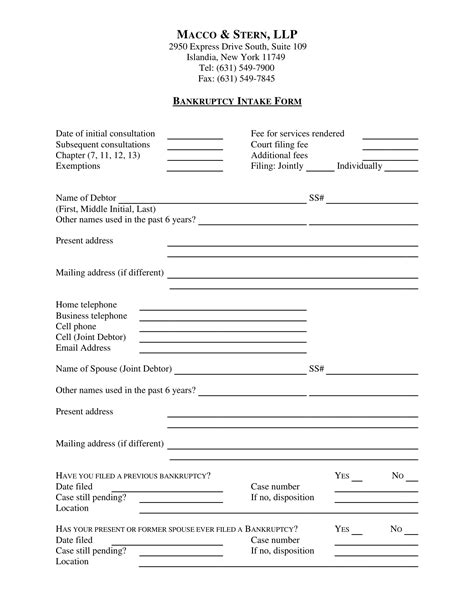

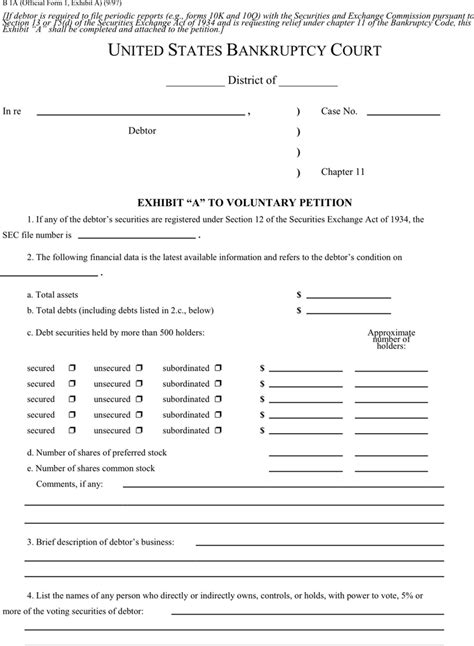

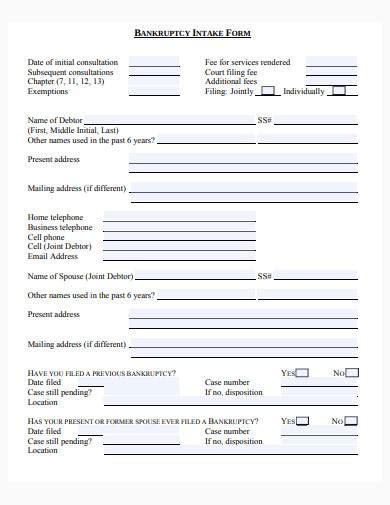

- Financial Statement Template: This template is useful for creating a comprehensive financial statement, including assets, liabilities, income, and expenses. It’s essential for the initial bankruptcy filing and ongoing financial monitoring.

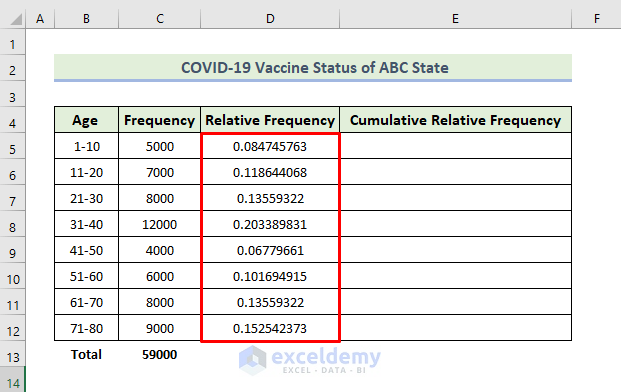

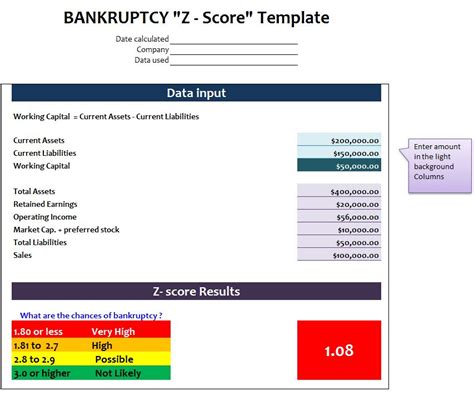

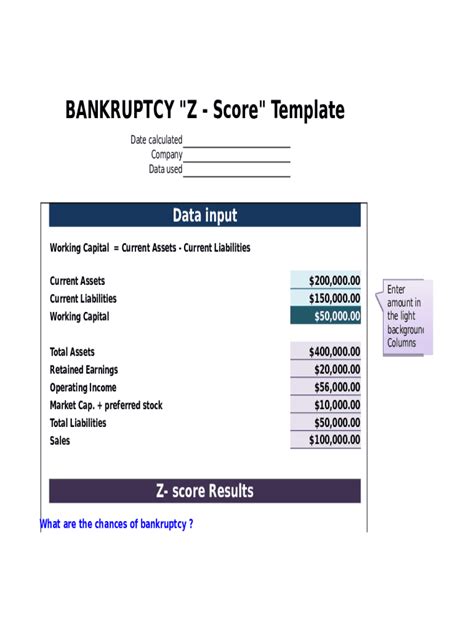

- Bankruptcy Calculator Template: This advanced template can calculate the means test for Chapter 7 eligibility and estimate the repayment plan under Chapter 13. It considers income, expenses, and debt to provide a projection of bankruptcy outcomes.

How to Use These Templates Effectively

To get the most out of these Excel templates: - Start with Accuracy: Input all financial information as accurately as possible. - Regular Updates: Keep the templates updated with the latest financial data. - Analyze Results: Use the data and calculations from the templates to make informed decisions about financial management and debt repayment. - Seek Professional Advice: While templates can provide valuable insights, consulting with a financial advisor or bankruptcy attorney can offer personalized advice tailored to specific situations.

💡 Note: These templates are tools to aid in financial management and should not be considered as legal or financial advice. Always consult with a professional for personalized guidance on bankruptcy and financial planning.

Conclusion and Future Financial Planning

Navigating bankruptcy is a challenging process, but with the right tools, individuals and businesses can better manage their finances and work towards a more stable future. The five free Excel bankruptcy templates discussed here can be invaluable assets in this journey, providing a structured approach to financial planning and debt management. By understanding the basics of bankruptcy, leveraging these templates, and seeking professional advice when needed, individuals can take significant steps towards regaining control of their financial lives.

What is the main difference between Chapter 7 and Chapter 13 bankruptcy?

+

Chapter 7 involves liquidating assets to pay off debts, while Chapter 13 involves creating a repayment plan to pay off debts over time.

Can Excel templates replace the need for a financial advisor during bankruptcy?

+

No, while Excel templates can be very helpful in organizing and understanding financial situations, they cannot replace the personalized advice and legal knowledge that a financial advisor or bankruptcy attorney can provide.

Are these templates suitable for businesses undergoing bankruptcy?

+

Yes, some of the templates, such as the financial statement and debt repayment plan templates, can be adapted for business use. However, businesses may require more complex financial planning and should consider consulting with a financial advisor or accountant experienced in business bankruptcy.